-

Is There an Issuance Premium for SRI Bonds?: Evidence from the Periods Before and After the COVID-19 Outbreak

Is There an Issuance Premium for SRI Bonds?: Evidence from the Periods Before and After the COVID-19 Outbreak

- Hak-Kyum Kim, Hee-Joon Ahn

-

Korean J Financ Stud. 2021;50(4):369-409.

-

Article

August 20, 2021

|

-

ESG Fund Labels Matter: Portfolio Holdings, Flows, and Performance

ESG Fund Labels Matter: Portfolio Holdings, Flows, and Performance

- Myounghwa Sim, Hee-Eun Kim

-

Korean J Financ Stud. 2022;51(4):447-470.

-

Article

August 31, 2022

|

-

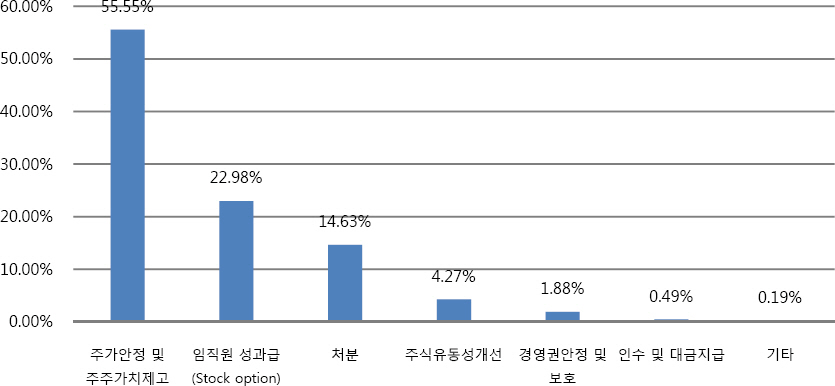

A Study on the Relationship between Insider Trading and Stock Repurchase Firms

A Study on the Relationship between Insider Trading and Stock Repurchase Firms

- Jung Ji Park, Jung Soon Shin

-

Korean J Financ Stud. 2022;51(3):335-358.

-

Article

June 27, 2022

|

-

Competition in the Outsourced Chief Investment Officer Market: A Game Theory Approach

Competition in the Outsourced Chief Investment Officer Market: A Game Theory Approach

- Daehyeon Park, Doojin Ryu

-

Korean J Financ Stud. 2021;50(5):497-520.

-

Article

October 24, 2021

|

-

Changes in Market Response to Stock Repurchases during the COVID-19 Crisis

Changes in Market Response to Stock Repurchases during the COVID-19 Crisis

- Kyung Hee Park

-

Korean J Financ Stud. 2021;50(4):411-437.

-

Article

August 20, 2021

|

-

Building the Korean Sentiment Lexicon for Finance (KOSELF)

Building the Korean Sentiment Lexicon for Finance (KOSELF)

- Su-Ji Cho, Heung-Kyu Kim, Cheol-Won Yang

-

Korean J Financ Stud. 2021;50(2):135-170.

-

Article

April 29, 2021

|

-

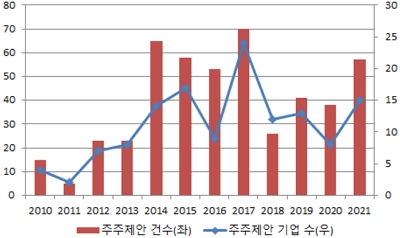

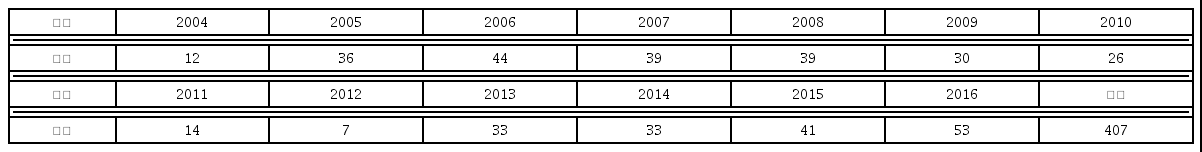

Effects of Shareholder Proposals on Corporate Governance and Firm Value: Focusing on Strengthening Shareholder Rights Following the Introduction of the Stewardship Code

Effects of Shareholder Proposals on Corporate Governance and Firm Value: Focusing on Strengthening Shareholder Rights Following the Introduction of the Stewardship Code

- Junesuh Yi

-

Korean J Financ Stud. 2023;52(3):421-447.

-

Article

June 30, 2023

|

-

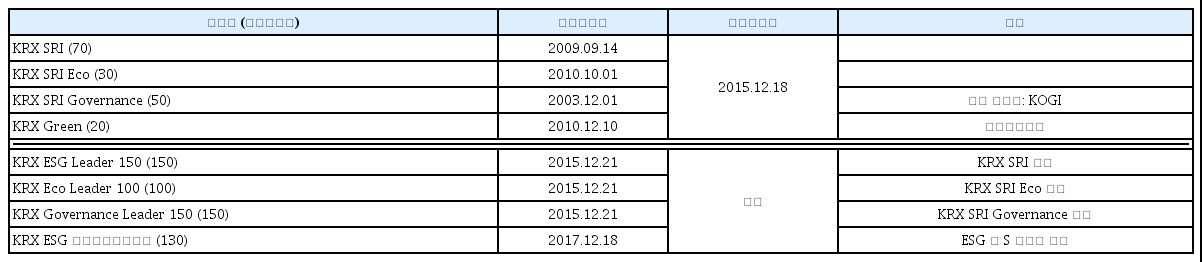

Stock Return Comovement around the ESG Index Revision in Korea

Stock Return Comovement around the ESG Index Revision in Korea

- Soonhong Park, Byungkwon Lim

-

Korean J Financ Stud. 2023;52(1):77-107.

-

February 28, 2023

|

-

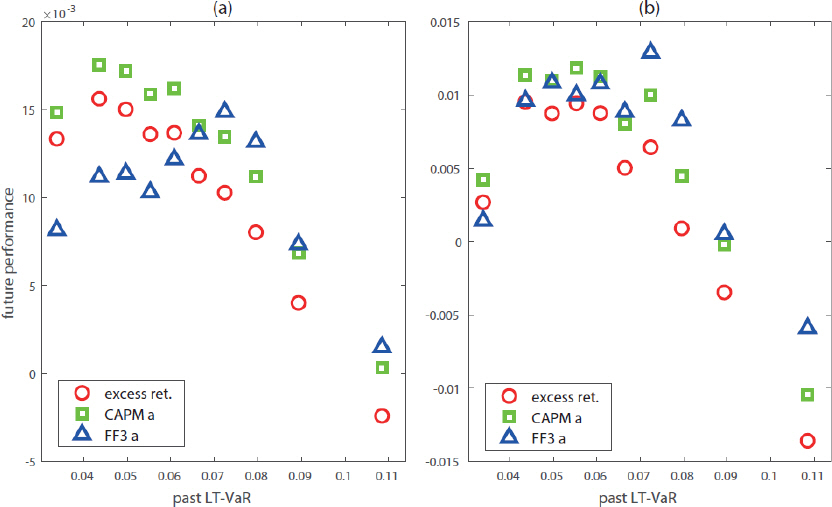

Left-Tail Momentum of Korean Stock Markets

Left-Tail Momentum of Korean Stock Markets

- Cheoljun Eom, Yunsung Eom, Jong Won Park

-

Korean J Financ Stud. 2022;51(6):693-728.

-

Article

December 31, 2022

|

-

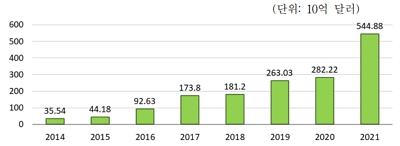

Target Date Funds: Current Status and Issues

Target Date Funds: Current Status and Issues

- Heejin Park

-

Korean J Financ Stud. 2022;51(6):729-754.

-

Article

December 31, 2022

|

-

Effect of Treasury Shares on Firm Value: Evidence from Korea

Effect of Treasury Shares on Firm Value: Evidence from Korea

- Woojin Kim, Jieun Im

-

Korean J Financ Stud. 2022;51(6):787-819.

-

Article

December 31, 2022

|

-

How to Promote ESG in Private Equity

How to Promote ESG in Private Equity

- Jung-Hee Noh

-

Korean J Financ Stud. 2022;51(5):543-569.

-

Article

October 31, 2022

|

-

Is There a Greenium in Korean Bond Markets?: An Empirical Analysis of Bond Secondary-Market Trading Data

Is There a Greenium in Korean Bond Markets?: An Empirical Analysis of Bond Secondary-Market Trading Data

- Hak-Kyum Kim, Hee-Joon Ahn

-

Korean J Financ Stud. 2022;51(4):383-416.

-

Article

August 31, 2022

|

-

ESG and Managerial Agency Problems

ESG and Managerial Agency Problems

- Seong-Jun Jeong, Dong-Beom Choi

-

Korean J Financ Stud. 2022;51(4):417-445.

-

Article

August 31, 2022

|

-

The Interaction Effect of ESG and Innovation on Firm Value

The Interaction Effect of ESG and Innovation on Firm Value

- Mookwon Jung, Young-Lin Kim

-

Korean J Financ Stud. 2022;51(4):471-498.

-

Article

August 31, 2022

|

-

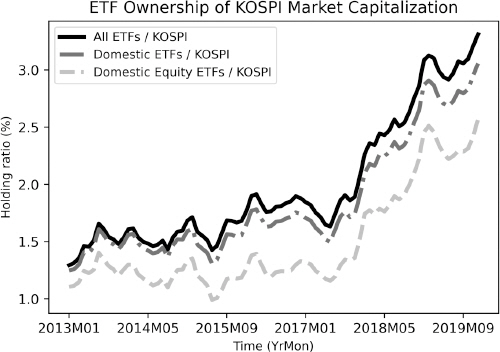

Exchange-Traded Funds Ownership and Stock Volatility

Exchange-Traded Funds Ownership and Stock Volatility

- Byoungho Choi, Shiqing Jin, Jaehoon Hahn

-

Korean J Financ Stud. 2022;51(3):245-280.

-

Article

June 27, 2022

|

-

Empirical Study on Prices, Trading Volumes, and Arbitrages of Listed Subscription Warrants

Empirical Study on Prices, Trading Volumes, and Arbitrages of Listed Subscription Warrants

- Pyung Sig Yoon

-

Korean J Financ Stud. 2022;51(3):281-307.

-

Article

June 27, 2022

|

-

Discount Rates, Subscription Prices, and Subscription Rates in Equity Rights Offerings

Discount Rates, Subscription Prices, and Subscription Rates in Equity Rights Offerings

- Seung-Hyun Jang, Pyung Sig Yoon

-

Korean J Financ Stud. 2022;51(2):177-211.

-

Article

April 22, 2022

|

-

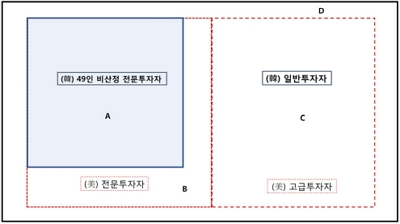

Formulation of Effective Regulations to Protect Financial Consumers from the Sale of High-risk Financial Products

Formulation of Effective Regulations to Protect Financial Consumers from the Sale of High-risk Financial Products

- Sehoon Kwon, Juil Ban

-

Korean J Financ Stud. 2022;51(1):63-95.

-

Article

February 23, 2022

|

-

Why do Fund Managers Increase the Lottery-Like Characteristics of the Fund?

Why do Fund Managers Increase the Lottery-Like Characteristics of the Fund?

- Minyeon Han, Hyoung-goo Kang, Kyoung Hun Bae

-

Korean J Financ Stud. 2021;50(6):557-592.

-

Article

December 21, 2021

|

-

A Study of the Performance of Option Strategy Benchmark Index in Global Option Markets

A Study of the Performance of Option Strategy Benchmark Index in Global Option Markets

- Byung Jin Kang, Cheoljun Eom, Woo Baik Lee, et al.

-

Korean J Financ Stud. 2021;50(4):439-472.

-

Article

August 20, 2021

|

-

Evaluating the Conditional CAPM using Consumption-based State Variables: Evidence from the Korean Stock Market

Evaluating the Conditional CAPM using Consumption-based State Variables: Evidence from the Korean Stock Market

- Dojoon Park, Young Ho Eom, Jaehoon Hahn

-

Korean J Financ Stud. 2021;50(3):339-367.

-

Article

June 30, 2021

|

-

Problems of Private Equity Placements in South Korea and Suggestions for Amendable Measures

Problems of Private Equity Placements in South Korea and Suggestions for Amendable Measures

- Jae Hyun Gwon

-

Korean J Financ Stud. 2021;50(2):171-200.

-

Article

April 29, 2021

|

-

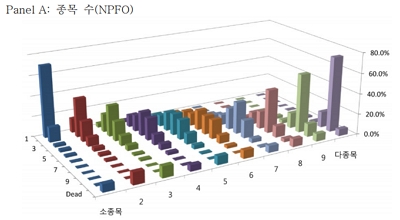

A Study on the Style Investment of Equity Funds

A Study on the Style Investment of Equity Funds

- Eunyoung Cho, Juil Ban

-

Korean J Financ Stud. 2021;50(2):201-245.

-

Article

April 29, 2021

|