|

|

- Search

| Korean J Financ Stud > Volume 48(6); 2019 > Article |

|

Abstract

This study develops an investment strategy that considers both the life cycle and the business cycle by investing in the market index of emerging and global markets (called the Business and Life Cycle Fund (BLCF)). Considering the change in investors’ risk capacity depending on their age, we propose a model similar to the Target Date Fund (TDF), that incorporates the life cycle. We also incorporate the business cycle into the model for excess returns, which leads the model to invest more in emerging markets during economic booms and to shift the portfolio’s weight to the global market during recessions. To mitigate market risk, we include additional assets that move in an opposite direction to business cycles. The resulting model provides higher annual returns and a higher Sharpe ratio than does the model that encompasses only the life cycle model and other market indices individually. In addition, a model that considers risk hedging shows higher annual returns and a higher Sharpe ratio than does the model encompassing only the business and life cycles. These results contribute to future TDF modeling as well as to Korean policymakers’ default option decision issue.

요약

본 연구는 신흥시장 지수와 글로벌시장 지수를 이용하여 생애주기 및 경기순환 주기를 고려한 장기적립식 투자모형(가칭 BLCF) 개발을 목적으로 한다. 먼저 연령대에 따라 불확실성에 대한 수용률이 다르다는 점에 착안하여 신흥시장에서 글로벌시장으로 비중을 서서히 늘리도록 모형을 설계하였다. 다음으로 시장 상황을 고려하여 수익률을 확보하고자 하였다. 경기변동주기를 고려하여 호황기에는 성장성이 높은 신흥시장으로, 침체기에는 안정성이 높은 글로벌시장으로 투자 비중을 변화시킴으로써 모형의 성과를 개선하고자 하였다. 또한 금, 미 국채 등 경기역행적 자산을 추가하여 위험 상황에서 효과적으로 위기를 회피하고자 하였다. 분석결과, 경기변동주기를 고려한 모형은 각각 약 9.06~10.11%, 0.524~0.571의 연수익률과 샤프지수를 가지며 동 기간 단일지수 투자보다 더 높은 성과를 보여주었다. 경기역행적 자산을 추가로 고려한 경우 약 9.68%~13.95%의 연수익률과 0.613~0.849의 샤프지수를 보이며, 기존 모형보다 수익률 및 안정성에서 추가적인 개선이 나타났다. 본 연구는 향후 TDF 설계방식 및 한국의 퇴직연금 디폴트옵션 설정에 있어 실무적, 정책적 시사점을 제시한다.

2017년 대한민국의 평균기대수명은 82.7세로 44년 간 평균수명이 약 20.8세 증가하였으며, 2018년 고령인구는 전체인구의 약 14.3%로 대한민국은 고령사회로 진입하였다(통계청, 2018). 이렇듯 대한민국이 고령사회로 접어들면서 노후대비에 대한 중요성이 대두되고 있다. 국민들의 수명이 길어진 만큼 이전보다 더 많은 액수를 보장해줄 수 있는 연금이 필요해진 것이다. 그러나 국민들에게 가장 기본적인 노후대비 수단이었던 국민연금이 고갈에 대한 우려로 인하여 신뢰도가 악화되고 있다. 이에 따라 투자자들은 국민연금이 아닌 다른 투자 대상을 찾고 있으며 이에 대한 대안으로 Target Date Fund(TDF)가 떠오르고 있다(Jang, 2018). 게다가 2018년 9월 TDF의 비보장성자산 비율이 40%에서 80%로 완화되면서 TDF시장은 더욱 탄력을 받게 되었다(Appell, 2018). 그러나 Spitzer and Singh(2008)에 따르면 생애주기만을 고려한 TDF는 시장상황에 대한 고려가 없어 유효한 투자전략이 되기 어렵다. 이에 본 연구에서는 경기변동주기, 글로벌 리스크를 고려한 TDF를 만들어 유효한 연금펀드 투자전략을 구상한다.

TDF는 투자자의 생애주기에 따라 위험수용률이 변화한다는 모딜리아니의 생애주기 가설을 수용하여 은퇴시점을 Target Date로 설정, 시간이 흐름에 따라 포트폴리오 리스크를 조절해주는 펀드이다. 전술한 이유로 TDF에 대한 국내 수요는 크게 증가하여 2017년 시장규모가 1조원에 달하였으며 미국에서는 이미 2000년대 중반부터 급속도로 성장하여 시장규모가 1,000조원을 넘어섰다(Byun, 2018). 그러나 TDF는 시장 리스크에 온전히 노출된다는 문제점이 있다. 이러한 문제점을 회피하기 위해서는 시장에서 위기상황이 발생하는 때를 미리 파악하여 경기하락국면일 때는 상대적으로 안전한 자산으로 비중을 이전할 필요성이 있다. 이에 본 연구팀은 시장지수를 이용하여 미래의 경기국면을 예측하고 이를 모형 내에서 경기국면변수로 사용한다.

본 연구에서는 TDF의 약점으로 꼽히는 수익률의 문제를 해결하고자 투자 대상을 시장지수로 선정하고 상대적인 위험성에 따라 비중을 조정한다. 그러나 투자 대상인 두 자산이 모두 시장지수일 경우 금융의 전염성으로 인하여 전 세계적으로 위기가 발생하였을 때 두 자산 모두 수익률이 급락할 수 있다는 문제점이 있다. 이를 회피하기 위해서 본 연구에서는 모형에 금, 미 국채, 달러화와 같은 시장과 반대방향으로 변동하는 자산을 이용하여 문제를 해결하고자 하였다.

이러한 이유로 본 연구팀은 생애주기만을 고려한 투자모형(BLCF-Li), 생애주기와 경기변동주기를 모두 고려한 모형(BLCF), 두 주기를 모두 고려하면서 위기상황에 대한 회피까지 고려한 모형(BLCF-H)을 차례로 백데이팅 기법을 이용하여 분석 및 검증하였다. 시뮬레이션 결과 기존의 TDF와 같이 생애주기만을 고려하는 BLCF-Li 모형은 개별 시장지수들과 비교하여 성과의 뚜렷한 개선이 나타나지 않았다. 그러나 BLCF 모형과 BLCF-H 모형의 경우, 개별시장지수들과 비교하여 수익률과 샤프지수 모두에서 더 높은 성과를 보였다. 구체적으로 투자시작 시점을 1975.01.31부터 1988.05.31까지 매월 말일로 두고 30년간 투자하였을 때의 161개의 투자결과를 사용하여 비교하면, 환헤지 상황에서의 MSCI World 지수 수익률은 연평균 약 7.37%인 반면, BLCF 모형은 연평균 약 9.92%의 수익률이 나타난다. BLCF-H(Gold), BLCF-H(Bond), BLCF-H(Ex) 모형은 각각 약 9.68%, 11.13%, 13.95%의 연평균 수익률이 나타난다.

TDF는 일반적으로 연금펀드에서 활용되는 투자전략이며, 생애주기를 고려하여 시간이 지남에 따라 위험자산에서 안전자산으로 비중을 이전하는 방식을 사용한다는 점에서 라이프사이클 펀드라고도 한다. TDF가 연금펀드로 사용되는 가장 주요한 근거는 투자자의 리스크 허용한계가 동태적으로 변화한다는 점이다. 이는 가구주의 연령과 투자자산의 선택 간의 상관관계를 분석함으로써 알 수 있다. Yuh and Joung(2004)의 연구에 의하면, 가구주의 연령과 가계의 주식투자가능성은 음의 상관관계에 있는 반면. Jeong(2008)에 따르면 가구주의 연령과 은행예금 간에는 양의 상관관계가 존재한다.

그러나 단순히 생애주기만을 고려한 전통적인 TDF의 경우, 투자성과가 낮아 유효한 투자전략이라고 보기 어려우며, 최저요구수익률에 도달하지 못할 수 있다는 위험을 가지고 있기 때문에 개선되어야 할 필요가 있다(Arnott et al., 2014; Basu et al., 2011; Booth and Chang, 2011; Branch and Qui, 2011; Forsyth et al., 2017; Pang and Warshawsky, 2009; Pang and Warshawsky, 2011; Spitzer and Singh, 2008, 2011; Yoon, 2010).

이러한 TDF의 투자성과를 개선할 방법론으로 동태적 투자전략의 도입을 고려할 수 있다. Booth and Chang(2011)은 미국시장에서 TDF의 2008년 성과를 분석하여 시장에 반응할 수 있는 동태적 전략의 필요성을 환기하였다. 마찬가지로 Arnott et al.(2014)도 미국시장에서 전통적 글라이드패스 투자의 성과를 분석하여 동적인 투자방식의 필요성을 주장하였다. 이에 Yoon(2010)과 Basu et al.(2011)은 미국시장에서 비중의 동태적 변화를 통하여 TDF 수익률의 개선을 이끌어냈다. Lee(2016) 역시 한국시장에서 경기국면을 고려한 동태적 TDF를 통하여 수익률의 개선과 리스크의 감소를 이끌어 내었고, 특히 하방위험을 뚜렷하게 감소시켰다. 다른 개선방안으로 시장상황을 고려하는 것뿐만 아니라 국내주식과 해외주식을 혼합한 포트폴리오를 사용함으로써 TDF를 개선할 수 있다는 견해가 있다(Kim, 2017).

다만, 본 연구에서와 같이 주가지수만을 이용하여 포트폴리오를 구성할 경우, 글로벌 리스크를 회피하기 어렵다. Kim and Lee(2012)의 연구에 따르면 글로벌 금융위기 이후 금융의 동조화 현상이 강화되면서 금융 전염효과가 심화되었으며, 이러한 점에서 글로벌 리스크에 대한 고려는 필수적인 요소가 되었다. 글로벌 리스크를 회피할 때 사용되는 자산으로 보통 경기변동과 반대로 움직이는 자산이 사용된다. 이러한 자산으로는 전통적으로 금 및 채권이 있으며 수차례의 연구로 인하여 유효성이 증명되었다(Ciner et al., 2012; Bredin et al., 2015). 또한 최근의 연구에 의하면 한국과 미국의 주식시장의 경우 금을 활용한 리스크 헤지는 효과적인 것으로 나타났다(Choi, 2018).

본 연구는 1975.01.31~2018.05.31 기간 동안의 KOSPI, MSCI World 지수, 원/달러 환율, 금, 미국 10년 채권 데이터를 사용한다. 데이터는 FnGuide(http://www.fnguide.com)에서 수집하였다. 환율의 영향을 고려하기 위하여 환율 리스크에 노출시킬 경우, 결과값 뒤에 “Ex”를 추가하여 나타낸다.

<표 1>에서 KOSPI의 경우, 수익률의 표준편차가 다른 자산들과 비교하여 가장 크고, 평균수익률 역시 가장 높다는 점에서, 성장성과 변동성이 높은 신흥시장을 대표하기에 충분하다고 할 수 있다. 반면 MSCI World 지수의 경우, KOSPI 지수에 비해 낮은 표준편차를 가진다는 점에서 상대적으로 안정적인 시장이라고 할 수 있다.

가장 먼저 생애주기 가설에 따른 투자의 유효성을 검증하기 위하여 생애주기만을 고려한 투자를 진행한다. 생애주기에 따라 투자자의 위험수용률이 달라진다는 점에 착안하여 투자 초반에는 수익성과 변동성이 모두 높은 신흥시장 지수에 투자를 진행하다가 시간의 흐름에 따라 변동성이 상대적으로 낮은 글로벌시장 지수로 투자대상을 전환하여 투자를 진행한다.

BLCF-Li 모형은 총 투자기간동안 매월 동일금액을 적립하는 적립식 펀드 형태를 가지며, 매월 말에 리밸런싱된다. 투자대상은 KOSPI를 신흥시장지수로(EM: KOSPI) MSCI World 지수를 글로벌시장 지수로(GM: MSCI World Index) 사용한다. 글로벌시장 지수의 경우 해외지수에 해당하므로 환율의 영향을 받는 경우와 받지 않는 경우로 나누어 투자결과를 분석하며 환율에 노출된 지수의 경우 지수에 Ex를 붙여 나타낸다. 수집된 데이터는 1975.01.31~2018.05.31 매월 종가로 표시한 KOSPI지수와 MSCI World 지수이다.

먼저 총 투자기간을 전환기간(P1)과 전환 후 투자기간(P2)으로 나눈다. 초기에는 신흥시장 지수에 전액 투자하되, 전환기간 동안 글로벌시장 지수로 투자비중을 이전한다. 전환기간 동안의 투자비중 이전은 동일비중 이전을 원칙으로 한다. 전환 후 투자기간 동안에는 글로벌시장 지수에 전액 투자한다. 본 연구에서는 전환기간과 전환 후 보유기간의 선택지를 120, 180 240개월로 한정하며, 따라서 가능한 총 투자기간을 20~40년으로 설정한다. 또한 투자금액은 매월 10단위로 가정한다.

시간(t)의 변화에 따른 투자비중(W) 변화는 다음과 같이 진행된다.

투자 결과를 보면 먼저 환율의 반영 유무에 따라 수익률에 약 1~2%p의 차이가 발생함을 알 수 있다. 이는 투자기간동안 환율이 상승하였고, 이러한 요인이 데이터에 반영된 결과라고 볼 수 있다. BLCF-Li 모형과 시장지수 간의 성과를 비교해보면 투자기간에 따라 우열이 갈리는 등 BLCF-Li 모형이 절대우위에 있다고 보기 어렵기 때문에 수익률의 개선이 발생하였다고 보기 어려우며, 이러한 점에서 초과수익률을 확보하지 못하고 있다고 볼 수 있다.

다음으로 샤프지수를 비교해보면 BLCF-Li 모형은 환노출이 존재할 경우 0.531~0.611, 존재하지 않을 경우 0.466~0.531의 샤프지수를 가지며 0.255~0.313의 샤프지수를 보이는 KOSPI 지수에 대한 단일지수투자와 비교하여 샤프지수의 명백한 개선이 발생하였다. 이를 통해 신흥국 지수에 대한 단일투자보다 신흥국 지수와 글로벌 지수를 이용하여 포트폴리오를 구성하는 것이 변동성을 줄이는 데에 효과적임을 알 수 있다. 그러나 환헤지를 가정하였을 때는 0.498~0.514, 환노출을 가정하였을 때는 0.595~0.638의 샤프지수를 보이는 MSCI World 지수에 대한 단일지수투자와 비교하였을 때는 샤프지수가 충분히 개선되지 못하였음을 알 수 있다. 수익률의 측면에서 BLCF-Li 모형과 MSCI World 지수 간의 차이가 적었다는 것을 감안하였을 때 BLCF-Li 모형이 변동성을 충분히 감소시키지 못한 것을 알 수 있다.

BLCF-Li 모형의 기간별 수익률을 비교하면, 30년 동안의 투자기간을 가질 때, 연 8.19%~8.34%로 평균 수익률이 가장 높았고, 샤프지수 역시 0.496~0.531로 다른 투자시기들보다 높은 수치를 보이고 있다. 구체적으로 환노출의 상황에서 투자기간이 (P1, P2)=(10,20)일 때, 수익률과 샤프지수가 각각 연 8.30%와 0.525로 매우 높은 수치를 보임을 알 수 있다.

생애주기만을 고려한 모형에 더하여 초과 수익을 달성하기 위하여 경기변동주기를 추가로 고려하였다. 금융 세계화로 인해 신흥시장 지수와 글로벌 시장 지수가 유사한 경기순환 흐름을 보이는 경향이 생겼다는 점, 글로벌 시장에 비해 신흥시장의 변동성이 상대적으로 높다는 점을 근거로 호황기에는 신흥시장의 투자 비중을 증가시켜 수익률을 높이고, 침체기에는 글로벌시장의 투자 비중을 증가시켜 변동성을 낮추고자 하였다.

BLCF 모형의 생성에 앞서 경기변동주기에 따른 투자의 근거에 대한 실증분석을 실시하였다.

BLCF 모형은 금융 세계화가 진행됨에 따라 신흥시장과 글로벌 시장이 유사한 경기변동을 보인다는 것을 가정한다. <표 3>을 보면 KOSPI와 MSCI World 지수는 지수 수익률 간 상관관계가 0.4332로 높은 상관관계를 보인다. 이를 통해 두 지수가 실제로 유사한 경기순환 흐름을 가진다는 것을 확인할 수 있다.

또한 BLCF 모형은 신흥시장이 글로벌시장에 비해 더 높은 변동성을 가지고 있다는 것을 전제하고 있다. 본 연구에서 신흥시장지수로 설정된 KOSPI의 변동성은 글로벌시장을 대표하는 MSCI World 지수의 변동성보다 크다. 따라서, KOSPI 지수와 MSCI World 지수는 강한 양의 상관관계를 보이며 동조성을 보이고 있고, 신흥시장이 글로벌시장에 비해 더 높은 변동성을 가지고 있으므로, 경기변동 주기를 고려함으로써 투자전략을 개선할 수 있다.

금융 세계화로 인하여 신흥시장 지수와 글로벌 시장 지수가 유사한 경기순환 흐름을 보이고, 신흥시장 지수의 변동성이 글로벌 시장 지수와 비교하여 더 높다면, 경기변동에 따라 호황일 경우 신흥시장의 지수 수익률이 글로벌시장보다 더 가파르게 상승할 것이다. 반면, 불황일 경우 신흥시장 지수 수익률이 글로벌시장보다 더 가파르게 하락할 것이다. 경기순환 흐름은 연속적이며, 따라서 신흥시장 지수와 글로벌시장 지수와의 수익률 갭을 통해 경기국면을 읽을 수 있다. 실제로 금융위기 당시인 2008년 10월 한 달 동안 KOSPI 지수는 약 23%하락하였으나, S&P 500 지수의 하락폭은 약 7%이었으며, 반대로 회복기인 2009년 3, 4월동안 KOSPI 지수는 각각 약 13%, 14% 상승한 반면, S&P 500지수는 약 9%, 5% 상승하였다.

이러한 아이디어에 착안하여 신흥시장 지수와 글로벌시장 지수와의 수익률 갭을 이용하여 경기국면 변수(Gap)를 구성한다. 일정기간동안 신흥시장 지수의 누적수익률이 글로벌시장 누적수익률에 비해 1%p높을 때마다 신흥시장으로 투자비중을 1%p1)이전한다. 반대로 글로벌시장 지수의 누적수익률이 신흥시장에 비해 1%p높을 때마다 글로벌시장으로 투자비중을 1%p 이전한다. 이 방식은 투자기간 전체에 걸쳐 진행한다. 비중 조정에서 공매는 수반하지 않는다. 따라서 경기국면변수에 의해 신흥시장 혹은 글로벌시장 비중이 0 미만으로 떨어질 경우에는 비중을 0으로, 1을 초과할 경우에는 비중을 1로 고정한다. 비중 이외의 모든 조건은 BLCF-Li 모형과 동일하게 적용하였다. 경기국면변수의 시차에 대해서는 다음 장에서 논의한다.

경기국면변수

시간(t)의 변화에 따른 투자비중(W) 변화는 다음과 같이 진행된다.

단, WEM(or WGM) < 0이면, WEM(or WGM) = 0,

WEM(or WGM) > 1이면, WEM(or WGM) = 1

BLCF 모형에서 경기국면변수는 글로벌시장과 신흥시장의 수익률 갭을 통해 만들어진다. 본 장에서는 경기국면을 파악하는데 있어서, 수익률 갭의 최적시차에 대해 분석하였다.

<표 4>에서 투자기간에 관계없이 9~10개월 동안의 수익률 갭을 기준으로 투자하였을 때, 수익률은 연 11.68%~12.90%의 수치를 샤프지수는 0.658~0.719의 수치를 보이며 극대화됨을 알 수 있다. 이는 키친순환 주기(단기 경기변동 주기, 40개월 주기)의 경기국면이 약 10개월마다 전환된다는 이론적 배경과 일치한다는 점에서도 그 근거를 얻을 수 있다(Kitchin, 1923).

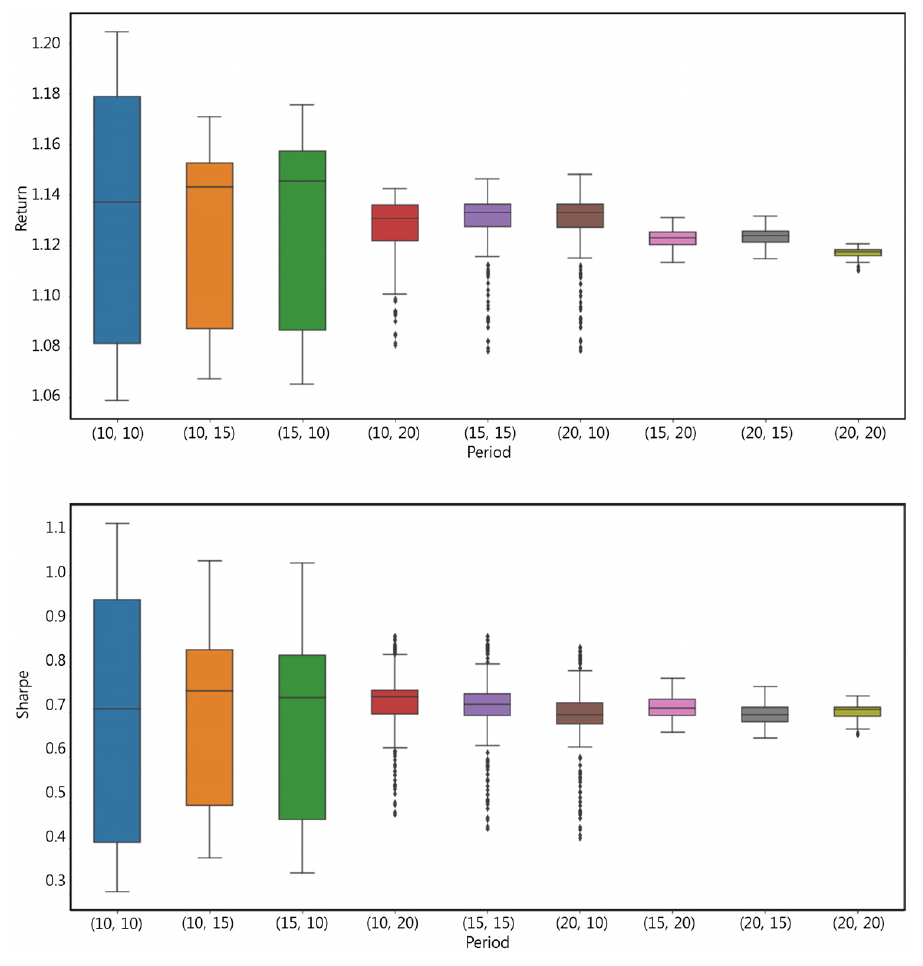

<그림 1>, <표 6>은 세 가지 시사점을 가진다. 먼저 총 투자기간이 짧을수록 투자 시작시점에 따른 수익률 변화가 크게 발생한다. (P1, P2) = (10, 10)의 투자기간을 가지는 BLCF의 경우 투자 시작시점에 따라 5.88~20.43%의 연평균수익률을 가지는 반면, (P1, P2) = (20, 20)의 투자기간을 가지는 BLCF는 11.04~12.08%의 연평균수익률을 가진다.

다음으로 총 투자기간이 동일할 때 전환기간이 길수록 평균수익률이 약간 개선되나, 투자시점에 따른 수익률 변화가 크게 발생하며 투자기간동안 변동성이 커지면서 샤프지수가 악화되는 경향이 있다. 이러한 사실은 다음의 두 가지 근거에 기인한다. 첫째, 전환 후 투자기간의 비중이 길어질수록 BLCF는 글로벌시장 비중을 늘려 안정성을 강하게 확보할 수 있고 이에 대한 결과는 샤프지수의 개선으로 나타난다. 둘째, 전환기간의 비중이 늘어날수록 신흥시장의 비중을 늘려 성장성을 확보할 수 있으며, 이는 수익률의 개선으로 나타난다.

마지막으로 수익률과 샤프지수를 고려할 때, BLCF는 투자기간이 30년일 때 가장 높은 성과를 달성한다. 최대성과만을 고려할 경우, 투자기간이 가장 짧은 (P1, P2) = (10, 10)의 투자기간을 가지는 BLCF가 가장 바람직하다 그러나 본 연구는 연금펀드의 구상을 목적으로 하는 만큼, 성과를 극대화하면서도 가입시점에 따른 불안요인을 최소화하는 것이 바람직하다. 따라서 최대성과보다는 평균적인 성과가 극대화되는 투자기간을 선택하는 것이 바람직하다.

<표 6>에서 수익률과 샤프지수가 모두 총 투자기간이 30년일 때 극대화된다. 구체적으로 수익률은 (P1, P2) = (20, 10), 샤프지수는 (P1, P2) = (10, 20)일 경우 극대화된다는 것을 알 수 있다. 샤프지수는 위험 대비 수익률의 성과를 측정한다는 점에서 단순하게 수익률만으로 투자기간을 설정하는 것보다 바람직할 수 있다. 따라서 이하의 연구에서는 투자기간을 (P1, P2) = (10,20)으로 설정하여 BLCF의 성과를 분석한다.

BLCF는 환율에 관계없이 KOSPI, MSCI World에 대한 단일지수 투자보다 수익률 및 샤프지수에서 명백한 개선을 보인다. 구체적으로 MSCI World 지수를 비교대상으로 할 때, BLCF는 World 지수에 비해 약 2~3%p만큼의 연간 수익률 개선을 보인다. 또한 샤프지수 역시 BLCF는 World 지수에 비해 모든 기간에서 개선되었음을 볼 수 있다.

다음으로 BLCF 모형의 환율효과는 약 2~3%로 BLCF Li에 비해 뚜렷한 개선효과가 나타난다. 이는 침체기에 KOSPI 지수에서 MSCI World 지수로의 비중 이전에 기인하는 것으로 보인다. 구체적으로 KOSPI 지수의 악화가 환율을 상승시키는 압력으로 작용하면서, World 지수의 투자수익률을 증가시키고 이러한 상황이 BLCF의 환율효과를 극대화하는 것으로 분석된다.

종합하면, BLCF는 단일지수 투자에 비해 높은 수익률과 샤프지수를 이끌어내며, BLCF의 성과를 극대화하기 위해서는 환율의 영향을 제거하지 않는 것이 바람직하다.

투자 결과 BLCF 투자모형은 단일지수투자의 경우보다 모든 기간에서 더 높은 수익률을 확보할 수 있다. 이는 BLCF 투자모형을 사용할 경우, 시장수익률을 초과하는 알파수익률을 얻을 수 있음을 의미한다.

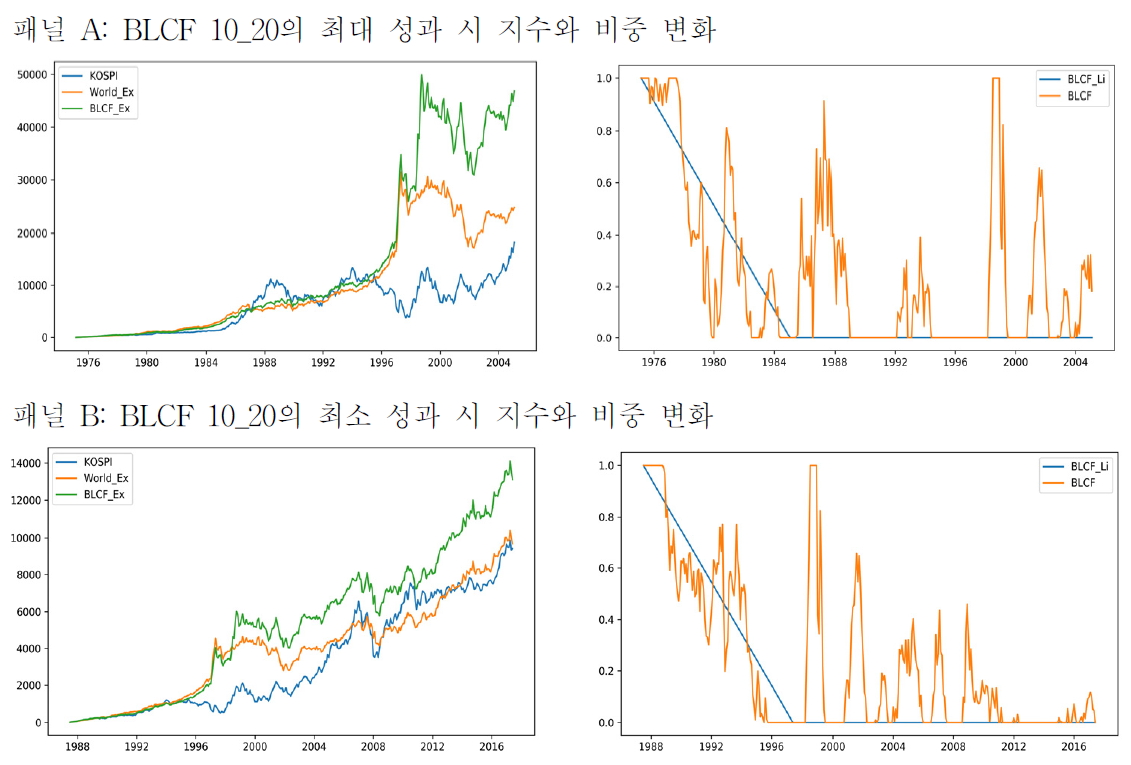

투자수익금의 변화를 보면, <그림 3> 패널 A에서 BLCF는 신흥시장과 글로벌시장 중 수익률이 개선되는 시장을 추종하며, 그 결과 투자수익금이 두 시장에 비해 높게 나타난다. 이는 시장상황이 정체되어 있는 <그림 3> 패널 B의 경우에도 동일하게 성립한다.

다음으로 투자비중의 변화를 보면, 경기국면 변수에 따라 BLCF가 수익률이 높은 시장을 추종하면서 글로벌 시장과 신흥시장 간의 투자비중을 지속적으로 변화시키고 있음을 보여준다. 또한 일시적으로 KOSPI지수와 MSCI World 지수가 음의 상관성을 보이는 구간에서 지수가 KOSPI에 100% 투자하는 경우가 발생한다. 그러나 생애주기 투자방식에 따라 전환 후 투자기간 동안(MSCI World 지수에 100% 투자)에는 음의 상관성을 보이더라도 KOSPI로의 비중이전은 전환기간에 비해 작아지며, 지수는 MSCI World의 움직임과 유사하게 변화한다. 요약하자면, BLCF는 경기국면을 고려함에 따라 시장수익률을 초과하는 수익률을 얻을 수 있으며, 생애주기에 따라 시간이 지날수록 안전자산의 성격을 강화한다.

BLCF 모형은 경기변동에 대한 두 가지 가정 하에서 단일지수투자보다 높은 수익률을 얻을 수 있다. 그러나 BLCF 모형은 글로벌 리스크에 취약하다는 단점이 있다. 금융의 세계화로 인해 주가지수는 글로벌 경기에 순행적인 성격이 강하며, 주가지수를 투자 대상으로 하는 BLCF 모형은 2008년 금융위기와 같은 글로벌 경기침체에 대해 여전히 취약하다. 따라서 본 연구에서는 경기침체 판별변수(RS: Recession Sign)를 설정하여 글로벌 경기침체에 대한 취약점을 보완하고자 하였다.

(P1, P2) = (10, 20)으로 고정하였으며 경기국면변수의 최적시차는 9개월로 설정하였다. 안전자산에 달러화가 포함됨에 따라 왜곡을 피하기 위하여 본 분석에서는 환율의 영향력을 제외하고 결과를 도출하였다.

금융시장과 무관하여 금융시장 리스크로부터 안전하거나 혹은 시장이 불안정할 때, 오히려 수익률이 개선되는 경기역행적인 자산인 금, 미 국채, 미국 달러화를 안전자산으로 선정하였다. 미 국채의 경우, 미국 달러화와의 비교를 위하여 환헤지의 상황을 가정하였다. BLCF-H 모형에서의 비중 변화는 다음과 같다.

경기침체 판별변수

경기국면변수

시간(t)의 변화에 따른 투자비중(W) 변화는 다음과 같다.

이 때, 호황은 경기가 지속적이고 완만하게 개선되는 반면, 불황은 급격하게 발생할 수 있다는 점에 의거하여 경기침체판별변수(RS)는 경기국면변수(Gap)보다 더 짧은 기간을 반영하였다.2)

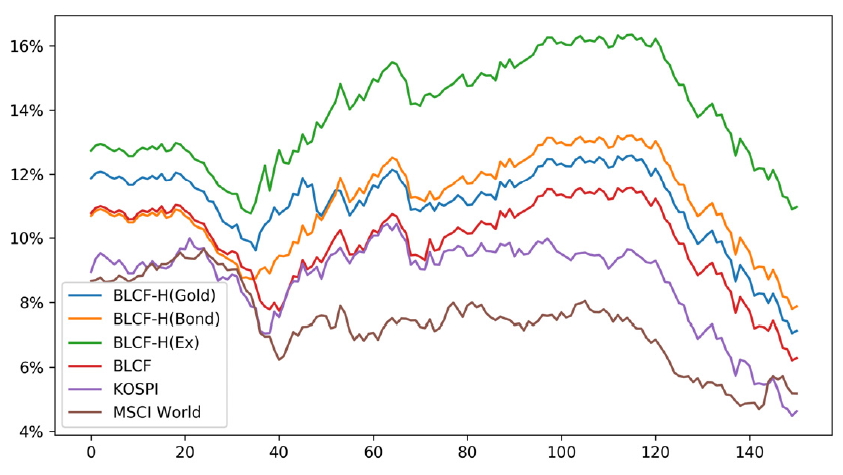

<표 8>에서 금을 이용하여 시장리스크를 회피한 경우 BLCF 모형보다 낮은 평균 수익률을 보였으나, 미 국채나 미 달러를 이용하여 시장리스크를 회피한 경우에는 일반 BLCF 모형보다 높은 수익률을 얻을 수 있었다. KOSPI와 MSCI World 단일지수에 대한 투자보다는 세 경우 모두 높은 성과를 보였다. 다음으로 샤프지수를 보면 BLCF-H 모형이 BLCF 모형이나 단일 지수에 대한 투자보다 항상 높은 성과를 보이는 것을 알 수 있다. 이를 통해 경기역행적인 안전자산을 섞는 것이 금융리스크를 회피하는데 있어 효과적임을 알 수 있다.

투자수익금의 변화를 보면, 패널 A에서 BLCF-H는 BLCF 모형과 같이 신흥시장과 글로벌 시장 중 수익률이 개선되는 시장을 추종한다. 또한 두 시장 모두 위험을 겪을 경우 BLCF-H는 경기역행성 자산으로의 비중이전을 통하여 안정성을 확보하고 있다. 그 결과 BLCF-H의 최종 투자수익금은 BLCF 모형 및 시장지수들에 비하여 높다. 이를 통해 BLCF-H 모형의 위험회피전략이 유효함을 알 수 있다. 이는 시장상황이 정체되어 있는 패널 B의 경우에도 동일하게 성립한다. 회피자산별 결과는 두 시기 모두 달러화를 이용한 결과가 가장 좋은 성과를 보였으며 채권, 금이 그 뒤를 이었다.

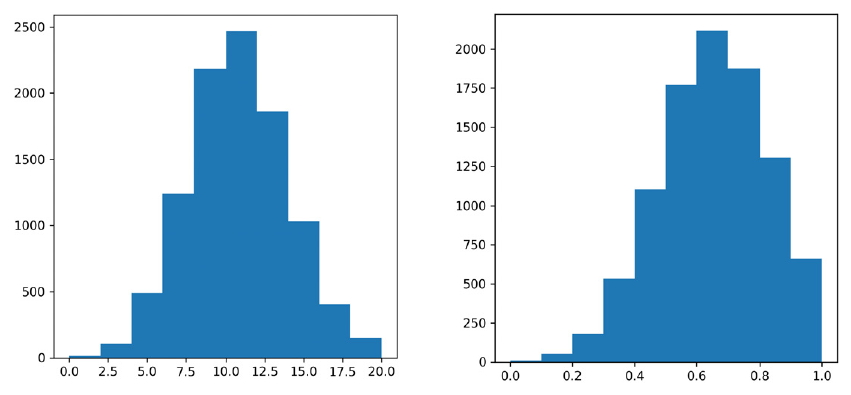

본 장에서는 Bootstrap 방식을 이용하여 BLCF 모형의 Robustness를 검증한다. 일반적으로 Bootstrap 방식은 실제 데이터에서 무작위 복원추출방식으로 재표본 추출하는 방식이다. 그러나 본 논문의 전략은 주가지수의 모멘텀을 이용하는 방식으로 무작위 복원추출방식을 사용할 경우 데이터에서 모멘텀 효과를 모두 제거한다는 문제점이 있다. 이에 본 장에서는 데이터를 10개월 단위로 무작위 복원추출하여, 재표본이 실제 데이터의 모멘텀을 일정부분 유지하도록 한다.

따라서 Bootstrap 방식은 다음과 같다. 먼저 1975.01.31~2018.05.31 기간 동안의 KOSPI, MSCI World 지수를 수익률로 변환한 후 10개월 단위로 무작위 추출하여 재표본을 생성한다. 이 때 MSCI World 지수는 환노출의 가정하에서 수익률을 산출하였으며, 재표본의 길이는 본 데이터의 길이와 같도록 재표본을 생성한다. 다음으로 재표본을 이용하여 BLCF 전략을 이용, 수익률, 샤프지수, 확실성등가를 추출하여 전략의 유효성을 검증한다. BLCF 전략은 전환기간, 전환 후 투자기간을 각각 10년, 20년으로 잡고, 9개월 동안의 수익률 갭을 이용하여 경기국면변수를 만드는 방식으로 구성한다. 확실성등가의 경우, negative exponential utiliy function을 이용한다. 이러한 효용함수 하에서 확실성등가는 다음의 식으로 산출할 수 있다. 만큼의 위험 성향을 가지고 있는 소비자에게 있어, N(μ, σ2)을 따르는 수익률의 확실성등가(CE)는 다음과 같다.

마지막으로 재표본 추출 및 모형 검증 과정을 10,000회 반복하여 전략의 Robustness를 검증한다.

<그림 6>은 Bootstrap결과로 추출된 평균수익률과 샤프지수의 분포를, <표 9>는 Bootstrap과로 추출된 평균 수익률과 샤프지수, 확실성 등가를 보여준다. Bootstrap 결과 평균수익률과 샤프지수의 평균값은 각각 10.85%, 0.66으로 나타났으며, Bootstrap 결과를 이용하여 확실성 등가를 추출하였을 때, 위험회피성향이 낮은 투자자(=1)의 경우 10.80%의 수익률을, 위험회피성향이 극단적으로 높은 투자자(=100)의 경우 5.53%의 수익률을 확실성등가로 가지는 것으로 나타났다.

KOSPI를 벤치마크로 Bootstrap결과와 비교할 때, Bootstrap 평균수익률 및 샤프지수는 KOSPI보다 각각 약 2.11%, 0.36만큼 높다는 점에서 수익률은 높이고 변동성은 크게 낮추는 전략으로 여전히 유의함을 알 수 있다.

MSCI World 지수를 벤치마크로 Bootstrap 결과와 비교할 때, Bootstrap 평균수익률 및 샤프지수는 MSCI World_Ex보다 각각 약 1.62%, 0.08만큼 더 높다는 점에서 벤치마크 대비 매우 유의한 전략임을 알 수 있다.

TDF는 생애주기에 따라 투자자의 위험수용률이 변화한다는 점을 고려한 펀드로 미국 근로자의 약 80%가 은퇴를 대비하여 활용하는 상품이다. 최근 한국에서도 국민연금의 고갈에 대한 우려, 고령화로 인한 노후자산의 관리 문제가 대두되면서 TDF가 주목받고 있다. 실제로 한국의 TDF시장은 2017년 초 2천억 원 이하였으나, 2019년 현재 약 1조 5천억 원까지 성장하였으며 현재 퇴직연금에 대한 디폴트옵션으로서 TDF를 고려하고 있다. 그러나 단순히 생애주기만을 이용한 TDF는 시장상황에 탄력적으로 대응하지 못하며, 효과적인 노후자산 관리수단으로써 작용하기 어렵다. 이에 본 연구팀은 생애주기를 고려하여 투자를 진행하는 TDF를 바탕으로 시장상황을 고려하는 변수들을 추가하여 투자모형의 수익률을 개선하고 안정성을 확보하고자 하였다. 이는 한국의 퇴직연금 정책에서 디폴트옵션을 설정하는 데 있어 정책적 시사점을 제시하고 있다.

먼저 생애주기만을 고려한 BLCF-Li 모형을 만들어 분석을 진행하였다. BLCF-Li 모형은 수익률과 샤프지수 측면에서 투자대상 지수인 KOSPI, MSCI World와 유의미한 차이를 만들어 내지 못하였다. 이는 생애주기만을 고려하였을 때 효과적인 수익률이 발생하지 않는다는 선행연구들의 결과와 일치한다.

다음으로 생애주기에 더하여 시장 상황, 즉 경기순환주기를 투자모형에 고려하여 BLCF 모형을 만들고 이에 대한 분석을 진행하였다. 투자모형의 분석을 진행하기 이전에 본 연구는 모형의 정당성 및 최적시차에 관한 분석을 실시하였다. 정당성 분석을 통해 본 연구의 투자대상지수인 KOSPI, MSCI World 지수는 서로 유사한 경기순환 주기를 가지며, 변동성의 차이가 존재함을 알 수 있었다. 다음으로 최적시차 분석을 통해 경기국면을 9~10개월로 파악할 때, 수익률을 극대화할 수 있음을 알 수 있었다. 투자결과, BLCF는 BLCF-Li, KOSPI, MSCI World와 비교하여 수익률 및 샤프지수가 명백하게 개선되었다. 그러나 투자 대상 자산이 모두 시장지수일 경우 전 세계적인 금융위기가 발생할 때 수익률의 하락을 피할 수 없다는 한계점이 있었다.

BLCF 모형의 한계점을 개선하기 위하여 생애주기와 경기순환주기에 경기침체판별변수를 추가적으로 고려하여 BLCF-H 모형을 만들고, 이를 분석하였다. 그 결과 생애주기만 혹은 생애주기와 경기순환만을 고려하여 투자를 진행했을 때보다 글로벌리스크 헤지를 모형에 포함하였을 때 수익률과 샤프지수가 개선되었다. 따라서 생애주기, 경기순환주기, 경기침체리스크를 모두 고려한 BLCF-H 모형이 가장 좋은 투자결과를 얻을 수 있는 모형인 것으로 보이며 국민연금이나 기존 TDF를 충분히 개선할 수 있을 것으로 보인다.

그러나 다른 자산에 대해서도 본 모형이 적용가능한지에 대한 추가적인 검토가 필요하다. 또한, 본 연구에서는 각 시장 지수 간의 수익률 차이가 1%일 때 비중을 1%p 이전하였는데 최적 민감도에 대한 추가 연구 역시 필요할 것으로 보인다.

Notes

1) 경기 국면에 따라 투자비중을 조정하는 경우, 경기국면변수의 경기예측력이 높을수록 투자비중을 크게 변화시킬 때, 수익률이 증가한다(<Appendix Ⅱ>). 그러나 이는 동시에 월간 투자비중의 변화율을 크게 가져간다는 의미이기도 하다. 일반적으로 연금펀드는 자금규모가 커서 분석되는 것보다 실제 거래비용이 훨씬 크게 작용할 수 있으며, 시장을 왜곡시킬 수 있다. 이러한 점을 고려하여 경기국면변수에 따른 투자비중 변화율을 1%로 고정, 투자비중의 변화를 보수적으로 설정하였다.

<그림 1>

Vintage 수익률 및 샤프지수

BLCF Ex 모델의 거래방식을 기반으로 1975.01.31~2018.05.31 기간 동안 투자하였을 때의 투자기간별 Vintage 수익률 및 샤프지수를 나타낸다. Vintage란 투자시작시점에 따라 수익률이 달라질 수 있다는 점에 착안하여 펀드의 조성 시점을 일컫는 용어이다. 본문에서는 Vintage 수익률을 투자시작시점을 변화시켰을 때의 BLCF Ex 모델의 연평균 수익률 집합으로 정의한다. BLCF Ex란 환노출의 가정 하에서 BLCF 모델의 투자전략을 진행한 모델을 의미한다. 환노출의 가정이므로 MSCI World 지수의 수익률은 지수변화율에 환율 변화율을 더하여 산출하였다. BLCF 모델의 투자전략은 두 가지로 구분된다. 첫 번째는 시간에 따라 신흥시장에서 글로벌 시장 지수로 투자비중을 이전하는 전략이다. 이 전략은 전환기간(P1)과 전환 후 투자기간(P2)에 의하여 투자비중의 이전속도가 변화한다는 특징이 있다. 전환기간이란 시간에 따라 투자비중을 신흥시장에서 글로벌시장으로 전환하는 기간을 의미하며, 초기에는 신흥시장 지수에 전액 투자하되, 전환기간 동안 글로벌시장 지수로 투자비중을 동일비중 이전한다. 모멘텀에 변화가 없는 한, 전환기간의 종료시점에는 글로벌시장 지수로 투자비중이 전액 투자된다. 전환 후 투자기간은 모멘텀에 변화가 없는 한, 글로벌시장 지수로 전액 투자한 상태로 투자를 유지하는 기간을 의미한다. BLCF 모델의 두 번째 전략은 수익률 모멘텀에 따라 투자비중을 이전하는 방식이다. 이 전략은 신흥시장이 글로벌 시장보다 n개월 동안의 누적수익률이 1%p 증가할 때마다 신흥시장으로 비중을 1%p 이전하며, 반대로 글로벌시장의 n개월 누적수익률이 1%p 증가할 때마다 글로벌시장으로 비중을 1%p 이전한다. 아래의 두 그래프 중 상단의 그래프는 Vintage 연평균 수익률, 하단의 그래프는 샤프지수를 나타낸다.

<그림 2>

투자기간이 (P1, P2)=(10, 20)인 BLCF의 투자 시작시점에 따른 수익률 변화

1975.01.31~2018.05.31 기간 동안 투자시작시점을 달리하여 (P1, P2) = (10, 20)의 투자기간을 가지는 BLCF와 KOSPI 지수, MSCI World 지수에 각각 30년 동안 투자했을 때, 투자결과를 연평균수익률 (시간가중)로 산출하여 나타낸 데이터이다. X축은 투자시작년도를 나타내며, BLCF 모형 및 MSCI World 지수에 대한 투자는 환노출의 가정 하에서 진행하였다.

<그림 3>

특정시점의 투자결과 분석

(P1, P2) = (10, 20)의 투자기간을 가지는 BLCF가 투자수익률이 가장 높을 때와 가장 낮을 때의 투자수익금의 궤적과, 이때의 투자비중 변화를 나타낸 그래프이다. 패널 A의 투자기간은 1975.12 ~2005.12이며, 패널 B의 투자기간은 1988.05~2018.05이다. 투자수익금을 비교하기 위하여 동일기간 동안 단일지수 투자의 결과를 그래프에 같이 첨부하였다. 또한 경기국면 변수가 투자비중을 얼마나 변화시키는지 확인하기 위해 단순한 생애주기 가설만을 고려했을 경우의 그래프를 투자비중 그래프에 같이 첨부하였다. BLCF 및 MSCI World 지수의 결과물은 환노출의 가정 하에서 진행하였다.

<그림 4>

투자시작시기에 따른 수익률 변화 (BLCF-H)

1975.01.31~2018.05.31 기간 동안 투자시작시점을 다르게 하여 (P1, P2) = (10, 20)의 투자기간을 가지는 BLCF, BLCF-H와 KOSPI 지수, MSCI World 지수에 각각 30년 동안 투자했을 때의 투자결과를 연평균수익률(시간가중)로 산출하여 나타낸 데이터이다. X축은 투자시작년도를 나타내며 달러화를 이용한 환율 헤지의 성과를 나타내기 위해 달러화에 대한 투자 이외에는 환헤지를 가정하였다.

<그림 5>

특정시점의 투자결과 분석

(P1, P2) = (10, 20)의 투자기간을 가지는 BLCF-H 및 BLCF가 투자수익률이 가장 높을 때와 가장 낮을 때의 투자수익금의 궤적과, 이때의 투자비중 변화를 나타낸 그래프이다. 패널 A의 투자기간은 1985.07~2015.07이며, 패널 B의 투자기간은 1988.05~2018.05이다. 투자수익금을 비교하기 위하여 동일기간 동안 단일지수 투자의 결과를 그래프에 같이 첨부하였다. 또한 경기국면 변수 및 경기침체판별변수가 투자비중을 얼마나 변화시키는지 확인하기 위해 단순한 생애주기 가설만을 고려했을 경우의 그래프를 투자비중 그래프에 같이 첨부하였다. 모든 투자 결과는 환헤지의 가정 하에서 도출되었다.

<그림 6>

Bootstrap을 이용한 BLCF의 평균수익률(좌)과 샤프지수(우)의 분포

1975.01.31~2018.05.31 기간 동안의 KOSPI, MSCI World 지수 수익률을 10개월 단위로 무작위 추출하여 생성된 재표본을 바탕으로 BLCF 전략을 사용하여 도출된 수익률과 샤프지수의 히스토그램이다. 이 때, MSCI World 지수는 환노출의 가정하에서 수익률을 산출하였으며, 재표본의 길이는 본 데이터의 길이와 같도록 재표본을 생성하였다. BLCF 전략은 전환기간, 전환 후 투자기간을 각각 10년, 20년으로 잡고 9개월 동안의 수익률 갭을 이용하여 경기국면변수를 만드는 방식으로 구성하였다. 이 때 경기국면변수의 계수는 본문과 같이 1로 설정하였다. 재표본 추출 및 모형 검증과정은 총 10,000회 반복하여 진행하였다.

<표 1>

투자자산의 요약 통계량

1975.01.31~2018.05.31 기간 동안의 KOSPI, MSCI World 지수, 원/달러 환율, 금, 미국 10년 채권 데이터의 월간 수익률 요약 통계량이다. KP는 KOSPI 지수, World는 MSCI World 지수를 나타내며, Ex, gold, bond는 각각 원/달러 환율, 금의 온스 당 달러 가격(미국 기준), 미국 10년 채권 데이터를 수익률로 변환하여 사용하였다. KOSPI와 MSCI World 지수는 각각 신흥시장(Emerging Market, 이하 EM)과 글로벌 시장(Global Market, 이하 GM)을 상징하므로, 각각 EM, GM으로 나타내었다.

<표 2>

BLCF-Li 모형을 포함한 각각의 지수에 대한 투자수익률 및 샤프지수의 평균치

1975.01.31~2018.05.31 기간 동안 각각의 지수에 대한 투자수익률 및 샤프지수의 평균치 자료를 전환기간 (P1)과 전환 후 투자기간(P2)에 따라 나열해놓은 데이터이다. 전환기간이란 시간에 따라 투자비중을 신흥시장에서 글로벌시장으로 전환하는 기간을 의미하며, 초기에는 신흥시장 지수에 전액 투자하되, 전환기간 동안 글로벌시장 지수로 투자비중을 이전한다. 전환기간 동안의 투자비중 이전은 동일비중 이전을 원칙으로 한다. 전환 후 투자기간은 글로벌시장 지수로 전액 투자한 상태로 투자를 유지하는 기간을 의미한다. 투자시작시점에 따라 투자결과가 다르게 도출될 수 있다는 점을 감안하여 총 투자기간이 20년, 25년, 30년, 35년, 40년일 때 각각 1975.01.31~1998.05.31, 1975.01.31~1993.05.31, 1975.01.31~ 1988.05.31, 1975.01.31~1983.05.31, 1975.01.31~1978.05.31를 투자시작시점으로 하여 결과를 도출하고 이 결과들의 평균치를 기록하였다. 투자수익률의 경우 수익률을 연율화하였다. 괄호 밖의 데이터는 연 평균 투자수익률, 괄호 안의 데이터는 샤프지수를 나타낸다.

<표 3>

KOSPI와 World 지수의 상관관계 및 변동성

1975.01.31~2018.05.31 기간 동안의 KOSPI와 MSCI World 지수 간의 상관관계 및 변동성이다. KP 는 KOSPI, MSCI World는 World로 나타내었으며, 원/달러 환율의 영향을 MSCI World 지수에 포함시킬 경우(+Ex)로 나타내었다. 지수간 상관관계 분석에는 Index를, 수익률 간 상관관계 분석에는 Return을 사용하여 나타내었다.

| Type | Correlation | Type | Volatility |

|---|---|---|---|

| KP-World Index | 0.9007 | KP Return | 0.2513 |

| KP-World Return | 0.4332 | World Return | 0.1540 |

| KP-World(+Ex) Return | 0.2511 | World(+Ex) Return | 0.1298 |

<표 4>

투자기간 및 모멘텀 기간에 따른 BLCF Ex의 수익률 및 샤프지수

1975.01.31~2018.05.31 기간 동안 투자기간 및 모멘텀 기간에 따른 BLCF Ex의 수익률 및 샤프지수을 도출한 데이터이다. BLCF Ex란 환노출의 가정 하에서 BLCF 모델의 투자전략을 진행한 모델을 의미한다. 환노출의 가정이므로 MSCI World 지수의 수익률은 지수변화율에 환율 변화율을 더하여 산출하였다. BLCF 모델의 투자전략은 두 가지로 구분된다. 첫 번째는 시간에 따라 신흥시장에서 글로벌 시장 지수로 투자비중을 이전하는 전략이다. 이 전략은 전환기간(P1)과 전환 후 투자기간(P2)에 의하여 투자비중의 이전속도가 변화한다는 특징이 있다. 전환기간이란 시간에 따라 투자비중을 신흥시장에서 글로벌시장으로 전환하는 기간을 의미하며, 초기에는 신흥시장 지수에 전액 투자하되, 전환기간 동안 글로벌시장 지수로 투자비중을 동일비중 이전한다. 모멘텀에 변화가 없는 한, 전환기간의 종료시점에는 글로벌시장 지수로 투자비중이 전액 투자된다. 전환 후 투자기간은 모멘텀에 변화가 없는 한, 글로벌시장 지수로 전액 투자한 상태로 투자를 유지하는 기간을 의미한다. <표 4>의 세로축은 전환기간 (P1)과 전환 후 투자기간(P2)을 나타낸다. BLCF 모델의 두 번째 전략은 수익률 모멘텀에 따라 투자비중을 이전하는 방식이다. 이 전략은 신흥시장이 글로벌 시장보다 n개월 동안의 누적수익률이 1%p 증가할 때마다 신흥시장으로 비중을 1%p 이전하며, 반대로 글로벌시장의 n개월 누적수익률이 1%p 증가할 때마다 글로벌시장으로 비중을 1%p 이전한다. 투자시작시점에 따라 투자결과가 다르게 도출될 수 있다는 점을 감안하여 총 투자기간이 20년, 25년, 30년, 35년, 40년일 때 각각 1975.01.31~1998.05.31, 1975.01.31~1993.05.31, 1975.01.31~1988.05.31, 1975.01.31~1983.05.31, 1975.01.31~1978.05.31를 투자시작시점으로 하여 결과를 도출하고 이 결과들의 평균치를 기록하였다. 투자수익률의 경우 수익률을 연율화 하였다. <표 4>의 가로축은 모멘텀 산출 기간(n, 단위 : 월)을 나타낸다. 괄호 밖의 데이터는 연 평균 투자수익률, 괄호 안의 데이터는 샤프지수를 나타낸다.

<표 5>

투자기간 및 모멘텀 기간에 따른 BLCF의 수익률 및 샤프지수

1975.01.31~2018.05.31 기간 동안 환헤지의 가정 하에서 투자기간 및 모멘텀 기간에 따른 BLCF의 수익률 및 샤프지수를 도출한 데이터이다. 환헤지의 가정이므로 MSCI World 지수의 수익률은 지수변화율만을 고려하여 산출하였다. BLCF 모델의 투자전략은 두 가지로 구분된다. 첫 번째는 시간에 따라 신흥시장에서 글로벌 시장 지수로 투자비중을 이전하는 전략이다. 이 전략은 전환기간(P1)과 전환 후 투자기간(P2)에 의하여 투자비중의 이전속도가 변화한다는 특징이 있다. 전환기간이란 시간에 따라 투자비중을 신흥시장에서 글로벌시장으로 전환하는 기간을 의미하며, 초기에는 신흥시장 지수에 전액 투자하되, 전환기간 동안 글로벌시장 지수로 투자비중을 동일비중 이전한다. 모멘텀에 변화가 없는 한, 전환기간의 종료시점에는 글로벌시장 지수로 투자비중이 전액 투자된다. 전환 후 투자기간은 모멘텀에 변화가 없는 한, 글로벌시장 지수로 전액 투자한 상태로 투자를 유지하는 기간을 의미한다. <표 5>의 세로축은 전환기간 (P1)과 전환 후 투자기간(P2)을 나타낸다. BLCF 모델의 두 번째 전략은 수익률 모멘텀에 따라 투자비중을 이전하는 방식이다. 이 전략은 신흥시장이 글로벌 시장보다 n개월 동안의 누적수익률이 1%p 증가할 때마다 신흥시장으로 비중을 1%p 이전하며, 반대로 글로벌시장의 n개월 누적수익률이 1%p 증가할 때마다 글로벌시장으로 비중을 1%p 이전한다. 투자시작시점에 따라 투자결과가 다르게 도출될 수 있다는 점을 감안하여 총 투자기간이 20년, 25년, 30년, 35년, 40년일 때 각각 1975.01.31~1998.05.31, 1975.01.31~ 1993.05.31, 1975.01.31~1988.05.31, 1975.01.31~1983.05.31, 1975.01.31~1978.05.31를 투자시작시점 으로 하여 결과를 도출하고 이 결과들의 평균치를 기록하였다. 투자수익률의 경우 수익률을 연율화 하였다. <표 5>의 가로축은 모멘텀 산출 기간(n, 단위: 월)을 나타낸다. 괄호 밖의 데이터는 연 평균 투자수익률, 괄호 안의 데이터는 샤프지수를 나타낸다.

<표 6>

Vintage 수익률 및 샤프지수의 요약 통계량

BLCF Ex 모델의 거래방식을 기반으로 1975.01.31~2018.05.31 기간 동안 투자하였을 때의 Vintage 수익률 및 샤프지수의 요약 통계량을 나타낸다. Vintage란 투자시작시점에 따라 수익률이 달라질 수 있다는 점에 착안하여 펀드의 조성 시점을 일컫는 용어이다. 본문에서는 Vintage 수익률을 투자시작 시점을 변화시켰을 때의 BLCF Ex 모델의 연평균 수익률 집합으로 정의한다. BLCF Ex란 환노출의 가정 하에서 BLCF 모델의 투자전략을 진행한 모델을 의미한다. 환노출의 가정이므로 MSCI World 지수의 수익률은 지수변화율에 환율 변화율을 더하여 산출하였다. BLCF 모델의 투자전략은 두 가지로 구분된다. 첫 번째는 시간에 따라 신흥시장에서 글로벌 시장 지수로 투자비중을 이전하는 전략이다. 이 전략은 전환기간(P1)과 전환 후 투자기간(P2)에 의하여 투자비중의 이전속도가 변화한다는 특징이 있다. 전환기간이란 시간에 따라 투자비중을 신흥시장에서 글로벌시장으로 전환하는 기간을 의미하며, 초기에는 신흥시장 지수에 전액 투자하되, 전환기간 동안 글로벌시장 지수로 투자비중을 동일비중 이전한다. 모멘텀에 변화가 없는 한, 전환기간의 종료시점에는 글로벌시장 지수로 투자비중이 전액 투자된다. 전환 후 투자기간은 모멘텀에 변화가 없는 한, 글로벌시장 지수로 전액 투자한 상태로 투자를 유지하는 기간을 의미한다. BLCF 모델의 두 번째 전략은 수익률 모멘텀에 따라 투자비중을 이전하는 방식이다. 이 전략은 신흥시장이 글로벌 시장보다 n개월 동안의 누적수익률이 1%p 증가할 때마다 신흥시장으로 비중을 1%p 이전하며, 반대로 글로벌시장의 n개월 누적수익률이 1%p 증가할 때마다 글로벌시장으로 비중을 1%p 이전한다. 투자시작시점에 따라 투자결과가 다르게 도출될 수 있다는 점을 감안하여 총 투자기간이 20년, 25년, 30년, 35년, 40년일 때 각각 1975.01.31~1998.05.31, 1975.01.31~1993.05.31, 1975.01.31~1988.05.31, 1975.01.31~1983.05.31, 1975.01.31~1978.05.31을 투자시작시점으로 하여 결과를 도출하고 이 결과들의 평균치를 기록하였다. 투자수익률의 경우 수익률을 연율화 하였다. <표 6>의 가로축은 Vintage 수익률의 요약 통계량을, 세로축은 전환기간 (P1)과 전환 후 투자기간(P2)을 나타낸다.

<표 7>

각각의 지수에 대한 투자수익률 및 샤프지수의 요약통계량

각각의 지수에 대한 연평균 투자수익률 및 샤프지수의 요약통계량이다. 환노출의 상황에서 투자결과를 도출한 경우 Ex를 붙여 나타내었다. 요약통계량은 투자시작시점을 1975.01.31부터 1988.05.31까지 매월 말일로 두고 30년간 투자하였을 때의 161개의 투자결과를 사용하였다. BLCF, BLCF Ex, BLCF Li, BLCF Li Ex의 경우 30년간의 투자기간 중 10년을 전환기간, 20년을 전환 후 투자기간으로 두고 모델을 구상하였다.

<표 8>

각각의 지수에 대한 투자수익률 및 샤프지수의 요약통계량

각각의 지수에 대한 연평균 투자수익률 및 샤프지수의 요약통계량이다. 미 달러의 헤지효과를 다른 자산들과 비교하기 위하여 미 달러에 투자하는 전략을 제외한 모든 투자에 있어서 환율 변동을 전혀 고려하지 않았다. 요약통계량은 투자시작시점을 1975.01.31부터 1988.05.31까지 매월 말일로 두고 30년간 투자하였을 때의 161개의 투자결과를 사용하였다. BLCF-H(Gold), BLCF-H(Bond), BLCF-H(Ex), BLCF의 경우 30년간의 투자기간 중 10년을 전환기간, 20년을 전환 후 투자기간으로 두고 모델을 구상하였다.

<표 9>

Bootstrap을 이용한 BLCF의 평균수익률과 샤프지수의 분포 및 확실성 등가

패널 A는 1975.01.31~2018.05.31 기간 동안의 KOSPI, MSCI World 지수 수익률을 10개월 단위로 무작위 추출하여 생성된 재표본을 바탕으로 BLCF 전략을 사용하여 도출된 수익률과 샤프지수의 평균, 표준편차, 신뢰구간을 나타낸다. 이 때, MSCI World 지수는 환노출의 가정하에서 수익률을 산출하였으며, 재표본의 길이는 본 데이터의 길이와 같도록 재표본을 생성하였다. BLCF 전략은 전환기간, 전환 후 투자기간을 각각 10년, 20년으로 잡고 9개월 동안의 수익률 갭을 이용하여 경기국면변수를 만드는 방식으로 구성하였다. 이 때 경기국면변수의 계수는 본문과 같이 1로 설정하였다. 재표본 추출 및 모형 검증과정은 총 10,000회 반복하여 진행하였다. 패널 B는 10,000회 반복하여 추출된 수익률과 샤프지수를 바탕으로 위험 성향에 따라 소비자가 가지는 확실성 등가를 나타낸다. 이 때, 소비자의 효용함수는 negative exponential utiliy function을 사용한다.

References

Arnott, RD, KF Sherrerd, L Wu, and G Goyal, 2014, Practical Applications of The Glidepath Illusion... and Potential Solutions, The Journal of Portfolio Management, Practical Applications, Vol. 1 (4), pp. 6-9.

Appell, D, 2018, S. Korea’s Target-Date Funds Get a Little Regulatory Help, Pensions & Investments, Vol. 46 (19), pp. 1.

Basu, AK, A Byrne, and ME Drew, 2011, Dynamic Lifecycle Strategies for Target Date Retirement Funds, Journal of Portfolio Management, Vol. 37 (2), pp. 83-96.

Booth, L, and B Chang, 2011, The Global Financial Crisis and the Performance of Target-Date Funds in the United States, Rotman International Journal of Pension Management, Vol. 4 (2), pp. 46-52.

Branch, B, and L Qui, 2011, Exploring the Pros and Cons of Target Date Funds, Financial Services Review, Vol. 20 (2), pp. 95-111.

Bredin, D, T Conlon, and V Potì, 2015, Does Gold Glitter in the Long-Run? Gold as a Hedge and Safe Haven Across Time and Investment Horizon, International Review of Financial Analysis, Vol. 41, pp. 320-328.

Byun, H, 2018, “Is National Pension Safe?” Rising Interest in TDF of 20s and 30s, (2018 September 8), Money Today,

Choi, WS, 2018, Safe Haven Role of Gold on Stock: Mainly USA and Korea, The Korean Finance Association, 1998-2018,

Ciner, C, C Gurdgiev, and BM Lucey, 2012, Hedges and Safe Havens: An Examination of Stocks, Bonds, Gold, Oil and Exchange Rates, International Review of Financial Analysis, Vol. 29, pp. 202-211.

Forsyth, PA, Y Li, and KR Vetzal, 2017, Are Target Date Funds Dinosaurs?, Failure to Adapt can Led to Extinction, eprint arXiv:1705.00543,

Jang, IH, 2018, Rising Concerns on National Pension Raising Interest to TDF, (2018. September 5), Asia Today,

Jeong, WY, 2008, Determinants of Portfolio Composition Choice: The Case of Korean Household, Financial Planning Review, Vol. 1 (1), pp. 81-108.

Kim, KS, and KH Lee, 2012, A Study on the Contagion Effects among Stock Markets between Developed Countries and ASEAN, Korean Corporation Management Review, Vol. 19 (4), pp. 65-85.

Kim, BD, 2017, Usage of Default Option in Pension Fund Management and Financial Enterprises, Weekley Financial Brief, Vol. 26 (5), pp. 3-7.

Kitchin, J, 1923, Cycles and Trends in Economic Factors, Review of Economics and Statistics, Vol. 5 (1), pp. 10-16.

Lee, JH, 2016, A Study on the Performance of Dynamic Strategic Asset Allocation Under the Regime Shifts, Journal of Finance & Knowledge Studies, Vol. 14 (2), pp. 145-170.

Pang, , and Warshawsky, 2011, Target-Date and Balanced Funds: Latest Market Offerings and Risk-Return Analysis, Financial Services Review, Vol. 20 (1), pp. 21-24.

Spitzer, , and Singh, 2008, Shortfall Risk of Target-date Funds During Retirement, Business- Economics Faculty Publications, Vol. 17 (2), pp. 143-153.

Spitzer, , and Singh, 2011, Assessing the Effectiveness of Lifecycle(Target-Date) Funds during the Accumulation Phase, Financial Services Review, Vol. 20 (4), pp. 327-341.

Yoon, Y, 2010, Glide Path and Dynamic Asset Allocation of Target Date Funds, Journal of Asset Management, Vol. 11 (5), pp. 346-360.

Yuh, YK, and SH Joung, 2004, Determinants of Households’ Stock Investments, Journal of Korean Management Association, Vol. 22 (3), pp. 11-21.

- TOOLS

-

METRICS

-

- 1 Crossref

- 3,670 View

- 83 Download

- Related articles in Korean J Financ Stud

-

Investment Strategy Based on Past Stock Returns and Trading Volume2004 ;33(1)

A Value Investment Strategy: Its Performance and Sources2003 ;32(2)

Time-led Interaction between Bond Yields and Business Cycles1993 ;15(1)