1. ņä£ļĪĀ

2. ļ╣äņāüņןņŻ╝ņŗØĻ▒░ļל Ēöīļ×½ĒÅ╝

2.1 ĻĄŁļé┤ņÖĖ ļ╣äņāüņןņŻ╝ņŗØĻ▒░ļל Ēöīļ×½ĒÅ╝ ļÅäņ×ģ ĒśäĒÖ®

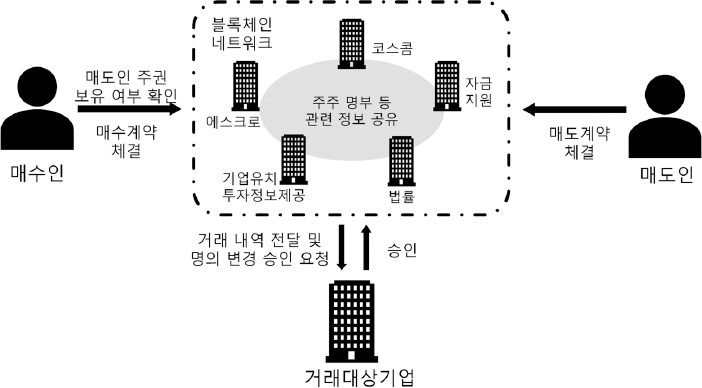

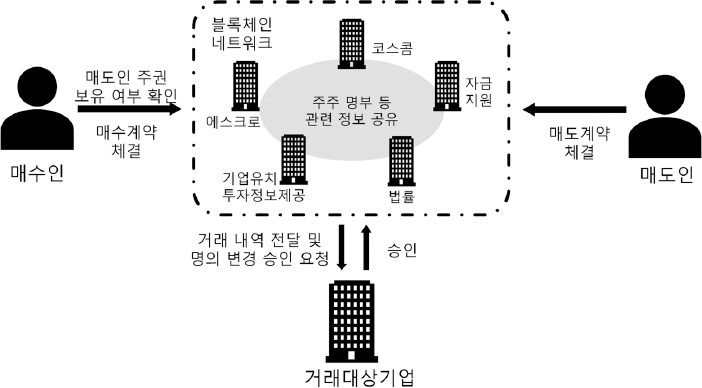

<Ēæ£┬Ā1>

<ĻĘĖļ”╝┬Ā1>

| Korean J Financ Stud > Volume 49(4); 2020 > Article |

|

1) ŌĆ£ŌĆśļéśļÅä ņ£ĀļŗłņĮśņŚÉ Ēł¼ņ×ÉĒĢ┤ļ│╝Ļ╣ī?ŌĆÖŌĆ” ļ╣äņāüņן ņŖżĒāĆĒŖĖņŚģ ņŻ╝ņŗØĻ▒░ļל Ļ┤Ćņŗ¼ŌĆØ, ņĪ░ņäĀļ╣äņ”ł, 2020ļģä 1ņøö.

2) ĻĖłņ£Ąņ£äņøÉĒÜī, ŌĆ£ņ×Éļ│Ėņŗ£ņןņØä ĒåĄĒĢ£ ĒśüņŗĀĻĖ░ņŚģņØś ņ×ÉĻĖłņĪ░ļŗ¼ņ▓┤Ļ│ä Ļ░£ņäĀļ░®ņĢłŌĆØ, 2019ļģä 10ņøö ļ│┤ļÅäņ×ÉļŻī.

3) ŌĆ£ļĖöļĪØņ▓┤ņØĖņØä ĒÖ£ņÜ®ĒĢ£ ļ╣äņāüņןĻĖ░ņŚģ ņŻ╝ņŗØ Ļ▒░ļלņØś ļ│ĆĒÖöŌĆØ, ņĮöņŖżņĮż ļ”¼ĒżĒŖĖ Vol. 5, 2019ļģä.

4) ņĢłņ£Āļ»Ė, ŌĆ£ļ»ĖĻĄŁ ņןņÖĖņ£ĀĒåĄĒöīļ×½ĒÅ╝ ĒśäĒÖ® ļ░Å ņŗ£ņé¼ņĀÉŌĆØ, ņ×Éļ│Ėņŗ£ņןĒżņ╗żņŖż, ņ×Éļ│Ėņŗ£ņןņŚ░ĻĄ¼ņøÉ, 2018-17ĒśĖ, (2018), pp. 1-3.

5) ĻĖłņ£Ąņ£äņøÉĒÜī, ŌĆ£ļ╣äņāüņן ņżæņåī┬Ęļ▓żņ▓śĻĖ░ņŚģņØś ņżæĻ░äĒÜīņłś ĒÖ£ņä▒ĒÖöļź╝ ņ£äĒĢ£ ņĀ£ļÅä Ļ░£ņäĀļ░®ņĢłŌĆØ, 2017ļģä 11ņøö ļ│┤ļÅäņ×ÉļŻī.

6) ŌĆ£ņןņÖĖņŻ╝ņŗØļÅä ļ£©Ļ▓üļäżŌĆ” K-OTC ĒĢśļŻ© Ļ▒░ļלļīĆĻĖł 236ņ¢Ą ŌĆśņŚŁļīĆ ņĄ£ļīĆŌĆÖŌĆØ, ĒĢ£ĻĄŁĻ▓ĮņĀ£, 2019ļģä 12ņøö.

7) ŌĆ£ŌĆśļéĪņØĆŌĆÖ ļ╣äņāüņןņé¼ ņŻ╝ņŻ╝ļ¬ģļČĆ, ļĖöļĪØņ▓┤ņØĖņ£╝ļĪ£ ŌĆśņāłļĪ£Ļ│Āņ╣©ŌĆÖŌĆØ, ļ©ĖļŗłĒł¼ļŹ░ņØ┤, 2019ļģä 5ņøö.

8) ŌĆ£ļĖöļĪØņ▓┤ņØĖ ņןņÖĖņŗ£ņן ļé┤ļŗ¼ ļ¼Ė ņŚ┤ņ¢┤ŌĆ” ŌĆśņŖżĒāĆĒŖĖņŚģ ņŻ╝ņŗØ Ēł¼ļ¬ģĒĢśĻ▓ī Ļ▒░ļלŌĆÖŌĆØ, ĒĢ£ĻĄŁĻ▓ĮņĀ£, 2019ļģä 10ņøö.

9) ŌĆ£ņĮöņŖżņĮż vs. ļæÉļéśļ¼┤ ŌĆśļ╣äņāüņן ņŻ╝ņŗØ, ļĖöļĪØņ▓┤ņØĖņ£╝ļĪ£ ņĢłņĀäĻ▒░ļלŌĆÖŌĆØ, ĒīŹņŖżļäĘļē┤ņŖż, 2020ļģä 1ņøö.

10) ļ│Ė ļģ╝ļ¼ĖņŚÉņä£ņØś Ļ░ĆņĪ▒ĻĖ░ņŚģņØĆ ņ░ĮņŚģņŻ╝ņÖĆ ņ¦Ćļ░░ļīĆņŻ╝ņŻ╝, ĻĘĖļ”¼Ļ│Ā Ļ▓Įņśüņ×ÉĻ░Ć ņØ╝ņ╣śĒĢśļŖö ĒśĢĒā£ņØś ĻĖ░ņŚģņØä ļ¦ÉĒĢ£ļŗż. Ļ░ĆņĪ▒ĻĖ░ņŚģņØĆ ņØ╝ļ░śņĀüņ£╝ļĪ£ ņ░ĮņŚģņŻ╝ ņØ╝Ļ░ĆĻ░Ć Ļ▓Įņśü ņĀäļ░śņŚÉ Ļ░£ņ×ģĒĢśļŖö ĒśĢĒā£ļź╝ ņØśļ»ĖĒĢśļŖöļŹ░, ļ│Ė ļģ╝ļ¼ĖņŚÉņä£ļŖö ņØ┤ ņżæ ļīĆņŻ╝ņŻ╝ņÖĆ Ļ▓Įņśüņ×ÉĻ░Ć ņØ╝ņ╣śĒĢ£ļŗżļŖö ĒŖ╣ņ¦ĢņŚÉ ņ┤łņĀÉņØä ļ¦×ņČśļŗż. ņØ┤ļ¤¼ĒĢ£ ņĀĢņØśļŖö ļ╣äņāüņןĻĖ░ņŚģ ļīĆļČĆļČäņØ┤ ņ┤łĻĖ░ĒÜīņé¼ņØ┤ĻĖ░ ļĢīļ¼ĖņŚÉ ņ░ĮņŚģņŻ╝, ņ¦Ćļ░░ļīĆņŻ╝ņŻ╝, Ļ▓Įņśüņ×ÉĻ░Ć ņØ╝ņ╣śĒĢ£ļŗżļŖö ņĀÉņŚÉņä£ ļ│Ė ļģ╝ļ¼ĖņØ┤ ļČäņäØĒĢśĻ│Āņ×É ĒĢśļŖö ņāüĒÖ®ņŚÉ ļČĆĒĢ®ĒĢ£ļŗż.

11) ŌĆ£ņżæĻĖ░ ņĀäļ¼Ė Ēł¼ņ×ÉĒÜīņé¼, ņ£ĀļŗłņĮś ĻĖ░ņŚģ ņĀ£ļīĆļĪ£ ĻĖĖļ¤¼ļé┤ļĀżļ®┤ŌĆØ, ļ╣äņ”łļŗłņŖżņøīņ╣ś, 2019ļģä 5ņøö.

12) ŌĆ£ļ░░ļŗ¼ņØśļ»╝ņĪ▒ņ▓śļ¤╝ŌĆ” ņ£ĀļŗłņĮśĻĖ░ņŚģ 90% ĻĄŁņÖĖņ×Éļ│ĖņØ┤ ĒéżņøĀļŗżŌĆØ, ĒĢ£Ļ▓©ļĀł, 2020ļģä 1ņøö.

13) ņØ╝ļ░ś Ēł¼ņ×Éņ×ÉņØś Ļ▓ĮņÜ░, Ļ▒░ļל ĻĘ£ļ¬©Ļ░Ć Ēü░ ļ░£Ē¢ēņŗ£ņןņŚÉ ņ░ĖĻ░ĆĒĢśĻĖ░ Ēלļōżļŗż. ļö░ļØ╝ņä£ ņØ╝ļ░ś Ēł¼ņ×Éņ×É ņ£Āņ×ģņŚÉ ļö░ļźĖ ļ│ĆĒÖöļź╝ ļČäņäØĒĢśļŖö ļ│Ė ļģ╝ļ¼ĖņŚÉņä£ļŖö ņ£ĀĒåĄņŗ£ņןņŚÉ ļīĆĒĢ┤ņä£ļ¦ī ļŗżļŻ¼ļŗż.

14) ņןĻĖ░ņĀü Ēł¼ņ×ÉļŖö ĻĖ░ņŚģ Ļ░Ćņ╣śņŚÉ ņśüĒ¢źņØä ļ»Ėņ╣śņ¦Ć ņĢŖĻ│Ā ļŗ©ĻĖ░ņĀüņØĖ ļ¦żņČ£ ņāüņŖ╣ļ¦īņØä ņ£ĀļÅäĒĢśļŖö ĻĘ╝ņŗ£ņĢłņĀü Ēł¼ņ×ÉņÖĆ ļīĆļ╣äļÉśļŖö Ļ░£ļģÉņØ┤ļØ╝Ļ│Ā ĒĢĀ ņłś ņ׳ļŗż.

15) ņä▒Ļ│ĄĒÖĢļźĀļ┐Éļ¦ī ņĢäļŗłļØ╝ Ēł¼ņ×É ņä▒Ļ│ĄņŚÉ ļö░ļźĖ ļ│┤ņłśņØĖ IĻ╣īņ¦Ć Ēł¼ņ×ÉņłśņżĆ iņØś ņ”ØĻ░ĆĒĢ©ņłśļĪ£ Ļ░ĆņĀĢĒĢĀ ņłśļÅä ņ׳ņ£╝ļéś, ņÖĖļČĆ ņŻ╝ņŻ╝Ļ░Ć Ēł¼ņ×ÉņłśņżĆņŚÉ ļö░ļźĖ ļ│┤ņłśņØś ļČäĒżļź╝ ņĢłļŗżĻ│Ā Ļ░ĆņĀĢĒĢśļŖö ĒĢ£ Ļ▓░Ļ│╝ņŚÉļŖö Ēü░ ņśüĒ¢źņØä ļ»Ėņ╣śņ¦Ć ņĢŖļŖöļŗż. ļ│Ė ļģ╝ļ¼ĖņŚÉņä£ļŖö ņ¦üĻ┤ĆņĀüņØĖ ĒĢ┤ņäØņØä ņ£äĒĢ┤ Ēł¼ņ×ÉļĪ£ ņØĖĒĢ£ ļ│┤ņłśļź╝ ņ£äņÖĆ Ļ░ÖņØ┤ ļŗ©ņł£ĒÖöĒĢśņśĆļŗż.

16) ņØ┤ļ¤¼ĒĢ£ Ļ░ĆņĀĢņØĆ Edmans(2009)ņØś ņŚ░ĻĄ¼ļź╝ ņ░ĖĻ│ĀĒĢśņśĆļŗż. ļŗ©, Edmans(2009)ņØś ņŚ░ĻĄ¼ņŚÉņä£ļŖö Ļ▓Įņśüņ×ÉņÖĆ ņŻ╝ņÜö ļīĆņŻ╝ņŻ╝Ļ░Ć ļČäļ”¼ļÉśņ¢┤ ņ׳ņ¢┤ ņŻ╝ņÜö ļīĆņŻ╝ņŻ╝ ļśÉĒĢ£ Ēł¼ņ×ÉņŚÉ Ļ┤ĆĒĢ£ ņØśņé¼Ļ▓░ņĀĢņØä ņĢīņ¦Ć ļ¬╗ĒĢ£ļŗżĻ│Ā Ļ░ĆņĀĢĒĢśņśĆņ£╝ļéś, ļ│Ė ņŚ░ĻĄ¼ņŚÉņä£ļŖö Ļ▓Įņśüņ×ÉĻ░Ć ņŻ╝ņŗØĻ▒░ļלņŚÉ ņ░ĖņŚ¼ĒĢśļ®┤ņä£ļÅä Ēł¼ņ×ÉļĪ£ ņØĖĒĢ£ ļ│ĆĒÖöļÅä ņØĖņ¦ĆĒĢ£ļŗż.

17) ŌĆ£ļ╣äņāüņןņŻ╝ņŗØ Ļ▒░ļל ĒŚłņÜ®Ē¢łļŖöļŹ░ŌĆ” ņ”ØĻČīņé¼ļōżņØ┤ ņÖĖļ®┤ĒĢśļŖö Ļ╣īļŗŁņØĆŌĆØ, ĒĢ£ĻĄŁĻ▓ĮņĀ£, 2019ļģä 9ņøö.

18) ņ£ĀĻ▒░ņåĪ┬ĘĻ╣ĆĻ▓ĮĒøł, ŌĆ£ļĖöļĪØņ▓┤ņØĖŌĆØ, KISTEP ĻĖ░ņłĀļÅÖĒ¢źļĖīļ”¼Ēöä, ĒĢ£ĻĄŁĻ│╝ĒĢÖĻĖ░ņłĀĻĖ░ĒÜŹĒÅēĻ░ĆņøÉ, 2018-01ĒśĖ(2018), pp. 1-33.

19) ĻĖłņ£Ąņ£äņøÉĒÜī, ŌĆ£ĒĢ┤ņÖĖ ņ”ØĻČīĻ▒░ļלņåīņØś ļĖöļĪØņ▓┤ņØĖ ĻĖ░ņłĀ ļÅäņ×ģ ĒśäĒÖ® ļ░Å ņŗ£ņé¼ņĀÉŌĆØ, 2018ļģä 8ņøö ļ│┤ļÅäņ×ÉļŻī.

The Implied Cost of Equity Capital and Corporate Governance Practices2008 ;37(1)

|

|