1.ŌĆģņä£ļĪĀ

ĻĖ░ĻĖłĒśĢ Ēć┤ņ¦üņŚ░ĻĖł ņĀ£ļÅäņØś ļÅäņ×ģņØ┤ ĻĖ░ļīĆļÉśļ®┤ņä£ OCIO(outsourced chief investment officer) ņŗ£ņןņØś ĻĘ£ļ¬©Ļ░Ć ņ”ØĻ░ĆĒĢĀ Ļ▓āņØ┤ļØ╝ļŖö ņĀäļ¦ØņØ┤ ņĀ£ņŗ£ļÉśĻ│Ā ņ׳ļŗż. ņØ┤ņŚÉ ļö░ļØ╝ OCIO ņŗ£ņןņØä ņäĀņĀÉĒĢśĻĖ░ ņ£äĒĢ┤ Ēł¼ņ×ÉņÜ┤ņÜ®ņé¼ Ļ░äņØś Ļ▓Įņ¤üņØ┤ ņ╣śņŚ┤ĒĢśļŗż. OCIO ņä£ļ╣äņŖżļŖö ņ×Éņé░ņåīņ£Āņ×É(asset owner)Ļ░Ć ņ×Éņé░ņÜ┤ņÜ®ņØś ņĀäļ░śņØä ņÖĖļČĆņØś ņ×Éņé░ņÜ┤ņÜ®ņ×É(asset manager)ņŚÉĻ▓ī ņ£äĒāüĒĢśļŖö ņä£ļ╣äņŖżļĪ£, ņĀäĒåĄņĀü ņ£äĒāüļ░®ņŗØĻ│╝ ļŗ¼ļ”¼ ņĀäļץņĀü ņØśņé¼Ļ▓░ņĀĢņŚÉ ļīĆĒĢ£ ĻČīĒĢ£Ļ╣īņ¦Ć ĒżĻ┤äņĀüņ£╝ļĪ£ ņ£äņ×äĒĢśņŚ¼ ņóģĒĢ®ņĀüņØĖ ņ×Éņé░Ļ┤Ćļ”¼ ņä£ļ╣äņŖżļź╝ ņĀ£Ļ│ĄĒĢśļŖö Ļ▓āņØ┤ ĒŖ╣ņ¦ĢņØ┤ļŗż. ĻĄŁļé┤ņŚÉņä£ļŖö ĻĖ░ĒÜŹņ×¼ņĀĢļČĆņŚÉ ņØśĒĢ┤ Ļ│ĄņĀü ņŚ░ĻĖ░ĻĖł Ēł¼ņ×ÉĒÆĆ(investment pools)ņØ┤ ļÅäņ×ģļÉ£ ņØ┤ĒøäļĪ£ ļŗżņ¢æĒĢ£ Ļ│ĄņĀü ņŚ░ĻĖ░ĻĖłņØ┤ OCIO ĒśĢĒā£ļĪ£ ņ×Éņé░ņØä ņÜ┤ņÜ®ĒĢśĻ│Ā ņ׳ļŗż. ņĄ£ĻĘ╝ņŚÉļŖö ĻĖ░ĻĖłĒśĢ Ēć┤ņ¦üņŚ░ĻĖł ņĀ£ļÅäĻ░Ć ļÅäņ×ģļÉĀ Ļ▓āņ£╝ļĪ£ ĻĖ░ļīĆļÉ©ņŚÉ ļö░ļØ╝ ļ»╝Ļ░äĻĖ░ĻĖłņØś ņłśņÜöļÅä ņ”ØĻ░ĆĒĢĀ Ļ▓āņØ┤ļØ╝ļŖö ņĀäļ¦ØņØ┤ ņØ┤ņ¢┤ņ¦ĆĻ│Ā ņ׳ļŗż. ņØ┤ļĪ£ ņØĖĒĢ┤ OCIO ņŗ£ņןņØś ĻĘ£ļ¬©Ļ░Ć ņ”ØĻ░ĆĒĢśļ”¼ļØ╝ļŖö ĻĖ░ļīĆĻ░Ć ĒśĢņä▒ļÉśļ®┤ņä£ ļŗżņ¢æĒĢ£ ņÜ┤ņÜ®ņé¼ņÖĆ ņ”ØĻČīņé¼Ļ░Ć OCIO Ļ│ĄĻĖēņŗ£ņןņØä ņäĀņĀÉĒĢśĻĖ░ ņ£äĒĢ┤ Ļ▓Įņ¤üĒĢśĻ│Ā ņ׳ļŗż. ĒĢ£ĻĄŁĒł¼ņ×Éņ”ØĻČīņØĆ Ļ│ĀņÜ®ļ│┤ĒŚśĻĖ░ĻĖłņØä ņÜ┤ņÜ®ĒĢśĻ│Ā ņ׳ļŗż. ņé╝ņä▒ņ×Éņé░ņÜ┤ņÜ®ņØĆ ņé░ņ×¼ļ│┤ĒŚśĻĖ░ĻĖłņØä ņÜ┤ņÜ®ĒĢśĻ│Ā ņ׳ņ£╝ļ®░, Ļ│ĄņĀü ņŚ░ĻĖ░ĻĖł Ēł¼ņ×ÉĒÆĆņØä ņÜ┤ņÜ®ĒĢśĻ│Ā ņ׳ļŗż. ĒĢ£ĻĄŁĒł¼ņ×ÉņŗĀĒāüņÜ┤ņÜ®ņØĆ ņé╝ņä▒ņ×Éņé░ņÜ┤ņÜ®Ļ│╝ ĒĢ©Ļ╗ś Ļ│ĄņĀü ņŚ░ĻĖ░ĻĖł Ēł¼ņ×ÉĒÆĆņØä ņÜ┤ņÜ®ĒĢ┤ ņÖöņ£╝ļ®░, ļ»╝Ļ░äĻĖ░ĻĖłņØä ļīĆņāüņ£╝ļĪ£ ĒĢ£ ļ»╝Ļ░ä ņŚ░ĻĖ░ĻĖł Ēł¼ņ×ÉĒÆĆņØä ņÜ┤ņÜ®ĒĢśĻ│Ā ņ׳ļŗż. ļ»ĖļלņŚÉņģŗņ×Éņé░ņÜ┤ņÜ®Ļ│╝ NHĒł¼ņ×Éņ”ØĻČīņØĆ ļ│Ąņłś ņŻ╝Ļ░äņÜ┤ņÜ®ņé¼ļĪ£ ņŻ╝ĒāØļÅäņŗ£ĻĖ░ĻĖłņØä ņÜ┤ņÜ®ĒĢśĻ│Ā ņ׳ņ£╝ļ®░, ļ»ĖļלņŚÉņģŗņ×Éņé░ņÜ┤ņÜ®ņØĆ 2021ļģä Ļ▓Įņ¤üņ×ģņ░░ņŚÉņä£ ĻĖ░ņĪ┤ ņŻ╝Ļ░äņÜ┤ņÜ®ņé¼ņØĖ ĒĢ£ĻĄŁĒł¼ņ×ÉņŗĀĒāüņÜ┤ņÜ®ņØä ļīĆņŗĀĒĢśņŚ¼ Ļ│ĄņĀü ņŚ░ĻĖ░ĻĖł Ēł¼ņ×ÉĒÆĆņØś ņŻ╝Ļ░äņÜ┤ņÜ®ņé¼ļĪ£ ņäĀņĀĢļÉśņŚłļŗż.

Ēśäņ×¼ ĻĄŁļé┤ OCIO ņŗ£ņן ņāüĒÖ®ņŚÉņä£ļŖö Ļ│ĄĻĖēņ×É ņĖĪņØś Ļ▓Įņ¤üņ£╝ļĪ£ ņØĖĒĢśņŚ¼, OCIO ņä£ļ╣äņŖżņØś ļ│┤ņłśĻ░Ć ĒĢ┤ņÖĖņŚÉ ļ╣äĒĢ┤ ļé«Ļ▓ī ĒśĢņä▒ļÉśļŖö ņĖĪļ®┤ņØ┤ ņ׳ļŗż.

1) OCIOņØś ļ│┤ņłśļŖö ņÜ┤ņÜ®ļ│┤ņłśņÖĆ ņä▒Ļ│╝ļ│┤ņłśļĪ£ ļéśļē£ļŗż. ņÜ┤ņÜ®ļ│┤ņłśļŖö ņŗżņĀüĻ│╝ ļ¼┤Ļ┤ĆĒĢśĻ▓ī ņÜ┤ņÜ®ļīĆņāüņØĖ ĻĖ░ĻĖłņØś Ēü¼ĻĖ░ņŚÉ ļö░ļØ╝ Ļ▓░ņĀĢļÉśļŖö ļ│┤ņłśņØ┤ļŗż. ļ░śļ®┤, ņä▒Ļ│╝ ļ│┤ņłśļŖö ļīĆļ”¼ņØĖ ļ¼ĖņĀ£ļź╝ ĒĢ┤ņåīĒĢśĻĖ░ ņ£äĒĢ┤ ņĀ£Ļ│ĄļÉśļŖö ņØ╝ņóģņØś ņØĖņä╝Ēŗ░ļĖī(incentive)ļĪ£, ļ▓żņ╣śļ¦łĒü¼ (benchmark) ņłśņØĄļźĀ ļīĆļ╣ä ņ┤łĻ│╝ņłśņØĄļźĀņŚÉ ļö░ļØ╝ Ļ▓░ņĀĢļÉ£ļŗż. ĻĄŁļé┤ OCIO ņŗ£ņןņØś Ļ▓ĮņÜ░ ņä▒Ļ│╝ļ│┤ņłśĻ░Ć Ļ▒░ņØś ņ¦ĆĻĖēļÉśĻ│Ā ņ׳ņ¦Ć ņĢŖņ£╝ļ»ĆļĪ£, OCIO Ļ│ĄĻĖēĻĖ░ņŚģņØĆ ņÜ┤ņÜ®ļ│┤ņłśļź╝ ĒåĄĒĢ£ ņłśņ×ģļ¦īņØä ĻĖ░ļīĆĒĢ£ļŗż. ĻĘĖļ¤¼ļéś ņÜ┤ņÜ®ļ│┤ņłśļŖö OCIO ņŗ£ņןņØś ļÅäņ×ģĻĖ░ņØĖ 2000ļģäļīĆ ņ┤łļ░śņŚÉļŖö 8bpņŚÉņä£, 2020ļģäņŚÉļŖö ĒÅēĻĘĀ 4bp ņłśņżĆņ£╝ļĪ£ ĒĢśļØĮĒĢśņśĆļŗż.

2) ņØ┤ļŖö 8bp ņĀĢļÅäļĪ£ ņ£Āņ¦ĆļÉśļŖö ĒĢ┤ņÖĖņØś ņé¼ļĪĆņÖĆ ļ╣äĻĄÉĒĢśļ®┤ ņĀłļ░ś ņłśņżĆņØ┤ļ®░, ĻĖ░ĻĖłņØś ĻĘ£ļ¬©Ļ░Ć ņČ®ļČäĒ׳ Ēü¼ņ¦Ć ņĢŖļŗżļ®┤ OCIO ņ▓┤Ļ│äļź╝ ĻĄ¼ņČĢĒĢśĻ│Ā ņĀäļ¼ĖņØĖļĀźņØä ļÅÖņøÉĒĢśļŖö ļō▒ Ļ│ĀņĀĢņĀüņ£╝ļĪ£ ļ░£ņāØĒĢśļŖö ļ╣äņÜ®ņØä ņČ®ļŗ╣ĒĢśĻĖ░ ņ¢┤ļĀżņÜĖ ņłś ņ׳ļŗż. ņÜ┤ņÜ®ļ│┤ņłśĻ░Ć ņØ┤ņ▓śļ¤╝ ļé«ņĢäņ¦ĆļŖö ņČöņäĖļŖö Ļ│ĄĻĖēņ×É ņĖĪņØś Ļ▓Įņ¤üņØ┤ ņ”ØĻ░ĆĒĢ©ņŚÉ ļö░ļØ╝ ļéśĒāĆļé£ Ēśäņāüņ£╝ļĪ£ ļ│┤ņØĖļŗż.

3)

OCIO ņŗ£ņןņŚÉņä£ Ļ│ĄĻĖēņ×É ņĖĪņØś Ļ▓Įņ¤üņØĆ ņČöĒøä ĻĖ░ĻĖłĒśĢ Ēć┤ņ¦üņŚ░ĻĖłņĀ£ļÅäņØś ļÅäņ×ģņŚÉ ļīĆĒĢ£ ņĀäļ¦ØĻ│╝ Ļ┤ĆļĀ©ļÉ£ļŗż. ņ¦Ćļé£ 20ļīĆ ĻĄŁĒÜīņŚÉņä£ Ēć┤ņ¦üņŚ░ĻĖłņŚÉ Ļ┤ĆĒĢ£ ļ▓ĢņĢłņØ┤ ļ░£ņØśļÉśņŚłņ£╝ļéś, ĒÅÉĻĖ░ļÉśņ¢┤ Ēśäņ×¼ ĻĄŁļé┤ņŚÉņä£ļŖö ĻĖ░ĻĖłĒśĢ Ēć┤ņ¦üņŚ░ĻĖłņØ┤ ļÅäņ×ģļÉśņ¦Ć ņĢŖņØĆ ņāüĒÖ®ņØ┤ļŗż. ĻĘĖļ¤¼ļéś 21ļīĆ ĻĄŁĒÜīņŚÉņä£ ļŗżņŗ£ ļ░£ņØśļÉśņŚłņ£╝ļ®░, ĒĢÖĻ│äņÖĆ ņŚģĻ│ä ņŚÉņä£ļÅä ĻĖ░ĻĖłĒśĢ Ēć┤ņ¦üņŚ░ĻĖł ļÅäņ×ģņŚÉ ļīĆĒĢ£ ļģ╝ņØśĻ░Ć Ļ│äņåŹļÉśĻ│Ā ņ׳ļŗż. ĻĄŁļé┤ņØś Ļ│äņĢĮĒśĢ Ēć┤ņ¦üņŚ░ĻĖłņĀ£ļÅäĻ░Ć Ļ░¢ļŖö ĻĄ¼ņĪ░ņĀü ļ¼ĖņĀ£ņÖĆ ņÜ┤ņÜ®ņŚÉņä£ņØś ļ╣äĒÜ©ņ£©ņä▒ ļō▒ņØä ĻĘ╝Ļ▒░ļĪ£ Ē¢źĒøä ĻĄŁļé┤ņŚÉļÅä ĻĖ░ĻĖłĒśĢ Ēć┤ņ¦üņŚ░ĻĖłņØ┤ ļÅäņ×ģļÉĀ Ļ▓āņ£╝ļĪ£ ņĀäļ¦ØļÉ£ļŗż.

4) ĒśäĒ¢ē Ļ│äņĢĮĒśĢ Ēć┤ņ¦üņŚ░ĻĖłņĀ£ļÅäļŖö ĻĖ░ņŚģņØ┤ Ēć┤ņ¦üņŚ░ĻĖł ņé¼ņŚģņ×ÉņØĖ ĻĖłņ£ĄĒÜīņé¼ņÖĆ Ļ│äņĢĮņØä ļ¦║Ļ│Ā ņĀ£ļÅäņÜ┤ņśüĻ│╝ ņĀüļ”ĮĻĖł ņÜ┤ņÜ®ņØä ņ£äĒāüĒĢśļŖö ļ░®ņŗØņ£╝ļĪ£, Ēć┤ņ¦üņŚ░ĻĖł Ļ░Ćņ×ģņ×ÉņØĖ ĻĘ╝ļĪ£ņ×ÉĻ░Ć ņĀüļ”ĮĻĖł ņÜ┤ņÜ®ņŚÉ ņ░ĖņŚ¼ĒĢśĻĖ░ ņ¢┤ļĀĄļŗżļŖö ņĀÉĻ│╝ Ēć┤ņ¦üņŚ░ĻĖł ņé¼ņŚģņ×ÉņŚÉĻ▓ī Ļ│╝ļÅäĒĢśĻ▓ī ņØśņĪ┤ĒĢ£ļŗżļŖö ņĀÉņØ┤ ļ¼ĖņĀ£ļĪ£ ņĀ£ĻĖ░ļÉśĻ│Ā ņ׳ļŗż. ņØ┤ņÖĆ ļŗ¼ļ”¼ ĻĖ░ĻĖłĒśĢ Ēć┤ņ¦üņŚ░ĻĖłņĀ£ļÅäļŖö ĻĖ░ņŚģņØ┤ ļ│äļÅäņØś ņłśĒāüļ▓ĢņØĖņ£╝ļĪ£ ĻĖ░ĻĖłņØä ņäżļ”ĮĒĢśĻ│Ā ņØ┤ļź╝ ĒåĄĒĢ┤ Ēć┤ņ¦üņŚ░ĻĖłņØä Ļ┤Ćļ”¼ĒĢśĻ│Ā ņÜ┤ņÜ®ĒĢśļŖö ĻĄ¼ņĪ░ļĪ£, ņÜ┤ņÜ®ņ£äņøÉĒÜī ĻĄ¼ņä▒ņøÉņŚÉ ĻĘ╝ļĪ£ņ×É ļīĆĒæ£ļź╝ ĒżĒĢ©ĒĢśļŖö ļō▒ņØś ļ░®ļ▓ĢņØä ĒåĄĒĢ┤ ļŗżņ¢æĒĢ£ ņØ┤ĒĢ┤Ļ┤ĆĻ│äļź╝ ļ░śņśüĒĢĀ ņłś ņ׳ļŗż.

ĻĖ░ĻĖłĒśĢ Ēć┤ņ¦üņŚ░ĻĖłņĀ£ļÅäĻ░Ć ļÅäņ×ģļÉśĻ│Ā ļŗżņłśņØś Ēć┤ņ¦üņŚ░ĻĖłņØ┤ OCIO ņä£ļ╣äņŖżļź╝ ņé¼ņÜ®ĒĢśĻ▓ī ļÉśļ®┤, ĻĄŁļé┤ Ēć┤ņ¦üņŚ░ĻĖłņØś OCIO ņłśņÜöļ¦īĒü╝ ņŗ£ņןņØś ĻĘ£ļ¬©Ļ░Ć ņ╗żņ¦ł Ļ▓āņØ┤ļŗż. ļö░ļØ╝ņä£ Ļ│ĄņĀü ĻĖ░ĻĖłņØä ņŻ╝ņÜö Ļ│ĀĻ░Øņ£╝ļĪ£ ĒĢśļŖö Ēśäņ×¼ņØś ĻĄŁļé┤ OCIO ņŗ£ņןņŚÉ ļŗżņłśņØś ņé¼ņĀüņŚ░ĻĖłņØ┤ Ļ│ĀĻ░Øņ£╝ļĪ£ ļČĆņāüĒĢĀ Ļ░ĆļŖźņä▒ņØ┤ Ēü¼ļŗż.

5) ņäĀņ¦äĻĄŁņØś Ļ▓ĮņÜ░, ĻĖ░ņŚģņØś Ēć┤ņ¦üņŚ░ĻĖłņØä ĒżĒĢ©ĒĢśņŚ¼ ļīĆĒĢÖĻĖ░ĻĖłņØ┤ļéś ņ×¼ļŗ© ļō▒ ņé¼ņĀü ņŚ░ĻĖ░ĻĖłļÅä OCIO ņä£ļ╣äņŖżļź╝ ņé¼ņÜ®ĒĢśĻ│Ā ņ׳ņ£╝ļ®░, ņĄ£ĻĘ╝ ĻĄŁļé┤ņŚÉņä£ļŖö ņé╝ņä▒ņ×Éņé░ņÜ┤ņÜ®ņØ┤ ņä£ņÜĖļīĆĒĢÖĻĄÉ ļ░£ņĀäĻĖ░ĻĖłĻ│╝ ņØ┤ĒÖöņŚ¼ņ×ÉļīĆĒĢÖĻĄÉ ļīĆĒĢÖĻĖ░ĻĖłņØś OCIOļĪ£ ņäĀņĀĢļÉśņŚłļŗż.

6) ņØ┤ļŖö ņČöĒøä ņé¼ņĀü ņŚ░ĻĖ░ĻĖłņØś ņ░ĖņŚ¼ļĪ£ ĻĄŁļé┤ OCIO ņŗ£ņןņØś ĻĘ£ļ¬©Ļ░Ć ņä▒ņןĒĢĀ ņłś ņ׳ņØīņØä ļ│┤ņŚ¼ņżĆļŗż. ņØ┤ņŚÉ ļö░ļØ╝ ņÜ┤ņÜ®ņé¼ņÖĆ ņ”ØĻČīņé¼ļŖö OCIO ņŗ£ņןņØä ņäĀņĀÉĒĢśļĀż Ļ▓Įņ¤üĒĢśĻ│Ā ņ׳ļŗż. ļŗ©ĻĖ░ņĀüņ£╝ļĪ£ļŖö ļé«ņØĆ ņÜ┤ņÜ®ļ│┤ņłśļĪ£ ņØĖĒĢ┤ ņłśņØĄņä▒ņØ┤ ļé«ņ¦Ćļ¦ī, ņÜ┤ņÜ® ņØ┤ļĀźņØä ļé©Ļ▓© ņŗ£ņןņØä ņäĀņĀÉĒĢ©ņ£╝ļĪ£ņŹ© ĻĘ£ļ¬©Ļ░Ć ņ╗żņ¦ä OCIO ņŗ£ņןņŚÉņä£ ņ¦Ćļ░░ņĀüņØĖ ņ£äņ╣śļź╝ ņ░©ņ¦ĆĒĢśĻ│Āņ×É Ļ▓Įņ¤üņØä ņØ┤ņ¢┤Ļ░ĆļŖö Ļ▓āņ£╝ļĪ£ ļ│┤ņØĖļŗż.

ĒĢśņ¦Ćļ¦ī ĻĖ░ĻĖłĒśĢ Ēć┤ņ¦üņŚ░ĻĖłņØ┤ ļÅäņ×ģļÉśļŹöļØ╝ļÅä OCIO ņŗ£ņןņØś ĻĘ£ļ¬©Ļ░Ć ĻĖ░ļīĆĒĢ£ ļ¦īĒü╝ ņ”ØĻ░ĆĒĢĀ Ļ▓āņØ┤ļØ╝Ļ│Ā ļŗ©ņ¢ĖĒĢĀ ņłśļŖö ņŚåļŗż. Ēśäņ×¼ ĻĄŁļé┤ OCIO ņŗ£ņןņØĆ ļīĆĒśĢ Ļ│ĄņĀü ĻĖ░ĻĖłņØä ņżæņŗ¼ņ£╝ļĪ£ ņÜ┤ņśüļÉśĻ│Ā ņ׳ņ£╝ļ®░, ļīĆļČĆļČäņØś OCIO ņä£ļ╣äņŖżļŖö ĻĖ░ĻĖłļ│äļĪ£ ņĀäļŗ┤ņĪ░ņ¦üņØä ĻĄ¼ņä▒ĒĢśņŚ¼ ĻĖ░ĻĖłņØä ņÜ┤ņÜ®ĒĢśļŖö ĒśĢĒā£ļź╝ ļØżļŗż. OCIO ņä£ļ╣äņŖżļź╝ ņé¼ņÜ®ĒĢśļŖö ļīĆĒśĢ Ļ│ĄņĀü ĻĖ░ĻĖłņØĆ ņĀäļŗ┤ņØĖļĀźņ£╝ļĪ£ ļČĆņä£ļź╝ ĻĄ¼ņä▒ĒĢĀ Ļ▓āņØä ņÜöĻĄ¼ĒĢśĻ│Ā ņ׳ņ£╝ļ®░, ņĀäļŗ┤ņØĖļĀźņØś ĻĘ£ļ¬© ļ░Å ņÜ░ņłśņä▒ņØĆ ņĀĢņä▒ĒÅēĻ░ĆņØś ņŻ╝ņÜö ĒĢŁļ¬®ņØ┤ļŗż. ņØ┤ļŖö ĒĢ┤ņÖĖņØś OCIO ņé¼ļĪĆņÖĆ ņ░©ņØ┤ļź╝ ļ│┤ņØĖļŗż. ĒĢ┤ņÖĖņØś Ļ▓ĮņÜ░, OCIOĻ░Ć ļŗżņłśņØś ņŚ░ĻĖłņŚÉ ļīĆĒĢ£ ņ┤ØĻ┤äĻ┤Ćļ”¼ļØ╝ļŖö Ļ░£ļģÉņ£╝ļĪ£ ņä▒ņןĒĢśĻ│Ā ņ׳ļŗż. ņØ┤ņÖĆ ļŗ¼ļ”¼ ĻĄŁļé┤ņŚÉņä£ļŖö OCIOĻ░Ć ĻĖ░ĻĖł ļé┤ļČĆņŚÉ ņ׳ļŹś ņÜ┤ņÜ®ņĪ░ņ¦üņØä ļŗ©ņł£Ē׳ ņÖĖļČĆļĪ£ ņś«ĻĖ┤ ņĀĢļÅäņØś ņŚŁĒĢĀļĪ£ ņĀ£ĒĢ£ļÉśņ¢┤ ņ׳ļŗż. ņØ┤ņŚÉ ļö░ļØ╝ OCIO ņä£ļ╣äņŖżĻ░Ć Ļ░¢ļŖö ĒĢĄņŗ¼ņĀüņØĖ ĻĖ░ļŖźņØĖ ņĀäļץņĀü ņØśņé¼Ļ▓░ņĀĢņŚÉ ļīĆĒĢ£ ņ£äņ×äļÅä ņåīĻĘ╣ņĀüņØĖ ĒÄĖņØ┤ļŗż. ņĄ£ĻĘ╝ ĻĄŁļé┤ OCIO ņŗ£ņןņŚÉņä£ ņĀäļŗ┤ņĪ░ņ¦üņØś ņØĖļĀź ĻĘ£ļ¬©ņÖĆ ņłśņżĆņØ┤ ļåÆņĢäņ¦ĆĻ│Ā ņ׳ņ¦Ćļ¦ī, ņÜ┤ņÜ®ņé¼ Ļ░äņØś Ļ▓Įņ¤üņ£╝ļĪ£ ņÜ┤ņÜ®ļ│┤ņłśļŖö ļé«Ļ▓ī ņ£Āņ¦ĆļÉśņ¢┤ ņłśņØĄņä▒ņØ┤ ņĢģĒÖöļÉĀ ņłś ņ׳ļŗż. 2021ļģäņŚÉ Ļ│ĄņĀü ņŚ░ĻĖ░ĻĖł Ēł¼ņ×ÉĒÆĆņØś OCIOļĪ£ ņäĀņĀĢļÉ£ ļ»ĖļלņŚÉņģŗņ×Éņé░ņÜ┤ņÜ®ņØĆ 30ļ¬ģ ĻĘ£ļ¬©ņØś ņĀäļŗ┤ņĪ░ņ¦üņØä ĻĄ¼ņä▒ĒĢśņśĆņ£╝ļ®░, ļ░®ņé¼ņä▒ĒÅÉĻĖ░ļ¼╝Ļ┤Ćļ”¼ĻĖ░ĻĖłņØś OCIOļĪ£ ņ×¼ņäĀņĀĢļÉ£ ņŗĀĒĢ£ņ×Éņé░ņÜ┤ņÜ®ņØĆ 10ļ¬ģ ņØ┤ņāüņØś ņĀäļŗ┤ņØĖļĀźņØä ĻĄ¼ņä▒ĒĢśĻ│Ā ņ׳ļŗż. Ēśäņ×¼ņØś ņÜ┤ņÜ®ļ│┤ņłśņØś ņłśņżĆņØä Ļ│ĀļĀżĒĢśļ®┤ ņĀäļŗ┤ņĪ░ņ¦üņØś ņ£Āņ¦ĆļŖö ņÜ┤ņÜ®ņé¼ņŚÉĻ▓ī ļČĆļŗ┤ņØ┤ ļÉĀ ņłś ņ׳ļŗż. ņĀäļŗ┤ņĪ░ņ¦ü ĻĄ¼ņä▒ņØś ļČĆļŗ┤ņØ┤ ņ╗żņ¦Ćļ®┤ Ēü░ ņ┤łĻĖ░Ēł¼ņ×Éļ╣äņÜ®ņ£╝ļĪ£ ņØĖĒĢ┤ ņØ╝ļČĆ ļīĆĒśĢņÜ┤ņÜ®ņé¼ ņÖĖņŚÉļŖö ņŗ£ņןņŚÉ ņ¦äņ×ģĒĢśĻĖ░ ņ¢┤ļĀĄĻ▓ī ļ¦īļō£ļŖö ņןļ▓Įņ£╝ļĪ£ ņ×æņÜ®ĒĢ£ļŗż. ļśÉĒĢ£, Ēśäņ×¼ļŖö ņŗ£ņן ņäĀņĀÉņØä ņ£äĒĢ┤ ļé«ņØĆ ņÜ┤ņÜ®ļ│┤ņłśļź╝ ņĀ£ņŗ£ĒĢśĻ│Ā ņ׳ņ¦Ćļ¦ī, ņŗ£ņןņØä ņäĀņĀÉĒĢ£ ĒøäņŚÉļŖö OCIOĻ░Ć ņĀäļŗ┤ņĪ░ņ¦ü ĻĄ¼ņä▒ņ£╝ļĪ£ ņØĖĒĢ£ ļ╣äņÜ®ņØä ļ│┤ņāüļ░øĻĖ░ ņ£äĒĢśņŚ¼ ļåÆņØĆ ņÜ┤ņÜ®ļ│┤ņłśļź╝ ņÜöĻĄ¼ĒĢĀ Ļ░ĆļŖźņä▒ņØ┤ Ēü¼ļŗż. ĻĖ░ĻĖłĒśĢ Ēć┤ņ¦üņŚ░ĻĖłņĀ£ļÅäĻ░Ć ļÅäņ×ģļÉ£ ņØ┤ĒøäņŚÉ ņåīĻĘ£ļ¬© ļ»╝Ļ░äĻĖ░ĻĖłņØ┤ OCIO ņä£ļ╣äņŖż ņé¼ņÜ®ņØä Ēؼļ¦ØĒĢĀ Ļ▓ĮņÜ░, OCIOļŖö ļ╣äņÜ®ņāüņØś ļ¼ĖņĀ£ļĪ£ ļåÆņØĆ ņÜ┤ņÜ®ļ│┤ņłśļź╝ ņÜöĻĄ¼ĒĢĀ Ļ░ĆļŖźņä▒ņØ┤ ņ׳ņ£╝ļ®░, ņØ┤ Ļ▓ĮņÜ░ ņāüļŗ╣ņłśņØś ļ»╝Ļ░äĻĖ░ĻĖłņØĆ OCIO ņä£ļ╣äņŖżļź╝ ņé¼ņÜ®ĒĢĀ ņ£ĀņØĖņØ┤ ņżäņ¢┤ļōżĻ▓ī ļÉ£ļŗż. ņ”ē, Ēśäņ×¼ņØś ĻĄŁļé┤ OCIO ņ▓┤Ļ│äņŚÉņä£ļŖö ĻĖ░ĻĖłĒśĢ Ēć┤ņ¦üņŚ░ĻĖł ņĀ£ļÅäĻ░Ć ļÅäņ×ģļÉśļŹöļØ╝ļÅä OCIO ņŗ£ņןņØś ņłśņÜöĻ░Ć ņČ®ļČäĒ׳ ņä▒ņןĒĢĀ Ļ▓āņØ┤ļØ╝ ĻĖ░ļīĆĒĢśĻĖ░ ņ¢┤ļĀżņÜĖ Ļ▓āņØ┤ļŗż. ļ░śļ®┤, ĒĢ┤ņÖĖņØś ņé¼ļĪĆņÖĆ Ļ░ÖņØ┤ OCIOĻ░Ć ņŚ¼ļ¤¼ ĻĖ░ĻĖłņØä ĒåĄĒĢ®ĒĢśņŚ¼ ņ┤ØĻ┤äņĀüņ£╝ļĪ£ ņÜ┤ņÜ®ĒĢĀ Ļ▓ĮņÜ░, ņåīĻĘ£ļ¬©ņØś ĻĖ░ĻĖłņŚÉ ļīĆĒĢ£ ņÜ┤ņÜ®ļ│┤ņłśņØś ļČĆļŗ┤ņØ┤ ņżäņ¢┤ļōżņ¢┤ OCIO ņä£ļ╣äņŖżļź╝ ņé¼ņÜ®ĒĢĀ Ļ░ĆļŖźņä▒ņØ┤ ņ׳ļŗż.

ļ│Ė ņŚ░ĻĄ¼ņŚÉņä£ļŖö ņØ┤ļ¤¼ĒĢ£ ĻĄŁļé┤ OCIO ņŗ£ņןņØś ĻĄ¼ņĪ░ņÖĆ ņāüĒÖ®, ĻĘĖļ”¼Ļ│Ā ĻĘĀĒśĢņØä Ļ▓Įļ¦ż(auction)ņŚÉ Ļ┤ĆĒĢ£ Ļ▓īņ×äņØ┤ļĪĀ(game theory)ņØä ĒåĄĒĢ┤ ņ▓┤Ļ│äņĀüņ£╝ļĪ£ ļČäņäØĒĢ£ļŗż. Ļ░£ļ│ä ĻĖ░ĻĖłņØĆ ņ×ÉņŗĀņØś Ļ│äņĢĮņŻ╝ĻĖ░ņŚÉ ļ¦×ņČ░ OCIO ņäĀņĀĢĻ│╝ņĀĢņØä ņ¦äĒ¢ēĒĢ£ļŗż. Ļ│äņĢĮ ĻĖ░Ļ░äņØĆ ĻĖ░ĻĖłļ¦łļŗż ļŗżļź╝ ņłś ņ׳ņ£╝ļéś, ĻĄŁļé┤ OCIOļŖö ļ│┤ĒåĄ 4ļģä ņĀĢļÅäņØ┤ļ®░, ĻĖ░ņĪ┤ OCIO Ļ│äņĢĮņØ┤ ņóģļŻīļÉśļ®┤ ĻĖ░ĻĖłņØĆ OCIO ņäĀņĀĢĻ│╝ņĀĢņØä ņāłļĪŁĻ▓ī ņ¦äĒ¢ēĒĢ£ļŗż. ĻĖ░ĻĖłņØĆ ņłśņØĄļźĀĻ│╝ ņ£äĒŚśĻ┤Ćļ”¼ļŖźļĀźĻ│╝ Ļ░ÖņØ┤ OCIO ņä£ļ╣äņŖżņÖĆ Ļ┤ĆļĀ©ļÉ£ ņŚ¼ļ¤¼ ĒÅēĻ░Ć ĻĖ░ņżĆņØä ņĀ£ņŗ£ĒĢśĻ│Ā, OCIO ņäĀņĀĢĻ│äĒÜŹņØä Ļ│Ąņ¦ĆĒĢ£ļŗż. ņØ╝ļ░śņĀüņ£╝ļĪ£ ņ×¼ļ¼┤Ļ▒┤ņĀäņä▒Ļ│╝ ņĀäļ¼ĖņØĖļĀźņłś, Ļ▓ĮļĀź ļō▒ņØś ņĀĢļ¤ēņĀüņØĖ ņÜ┤ņÜ®ņŚŁļ¤ē Ļ┤ĆļĀ© ņ¦ĆĒæ£, ņÜ┤ņÜ®ņä▒Ļ│╝ ļō▒ņŚÉ Ļ┤ĆĒĢ£ ņĀĢļ¤ēĒÅēĻ░ĆņÖĆ Ēł¼ņ×É ĒöäļĪ£ņäĖņŖż, ņ╗┤ĒöīļØ╝ņØ┤ņ¢ĖņŖż(compliance) ņŗ£ņŖżĒģ£ ļō▒ņØä ĒżĒĢ©ĒĢśļŖö ņĀĢņä▒ĒÅēĻ░ĆļĪ£ ĻĄ¼ļČäļÉ£ļŗż. OCIOļĪ£ ņ¦ĆņøÉņØä Ēؼļ¦ØĒĢśļŖö ņÜ┤ņÜ®ņé¼ļŖö ĻĖ░ĻĖłņØ┤ ņĀ£ņŗ£ĒĢ£ ĒÅēĻ░ĆĒĢŁļ¬®ņØä ļ░öĒāĢņ£╝ļĪ£ ņä£ļźśļź╝ ņżĆļ╣äĒĢśņŚ¼ ņ¦ĆņøÉĒĢśļ®░, ĒĢäņÜöņŚÉ ļö░ļØ╝ ĻĄ¼ņłĀņŗ¼ņé¼ļź╝ ĒåĄĒĢ┤ ĒÅēĻ░Ćļ░øĻĖ░ļÅä ĒĢ£ļŗż. ĻĖ░ĻĖłņØĆ ĒÅēĻ░Ć ĻĖ░ņżĆņŚÉ ļö░ļØ╝ Ļ░ü ņÜ┤ņÜ®ņé¼ļź╝ ĒÅēĻ░ĆĒĢśĻ│Ā ņāüĒśĖ ļ╣äĻĄÉĒĢśņŚ¼ Ļ░Ćņן ļåÆņØĆ ņĀÉņłśļź╝ ĒÜŹļōØĒĢ£ ņÜ┤ņÜ®ņé¼ļź╝ OCIOļĪ£ ņäĀņĀĢĒĢ£ļŗż.

ĻĖ░ĻĖłņØ┤ OCIOļź╝ ņäĀņĀĢĒĢśļŖö Ļ│╝ņĀĢņØĆ ļæÉ Ļ░Ćņ¦Ć Ļ┤ĆņĀÉņŚÉņä£ Ļ▓ĆĒåĀĒĢĀ ņłś ņ׳ļŗż. ņ▓½ ļ▓łņ¦ĖļŖö ļČłĒÖĢņŗżņä▒ ĒĢśņŚÉņä£ ĻĖ░ĻĖłņØś ņØśņé¼Ļ▓░ņĀĢņŚÉ ņ┤łņĀÉņØä ļ¦×ņČöļŖö Ļ▓āņØ┤ļŗż. ĻĖ░ĻĖłņØĆ ņŚ¼ļ¤¼ ĒÅēĻ░Ć ĻĖ░ņżĆņŚÉ ļö░ļØ╝ OCIOļź╝ ņäĀņĀĢĒĢśĻĖ░ Ēؼļ¦ØĒĢśņ¦Ćļ¦ī, ņÜ┤ņÜ®ņé¼Ļ░Ć ņĀ£ņŗ£ĒĢ£ ņĀĢļ│┤ļź╝ ņÖäļ▓ĮĒĢśĻ▓ī ņŗĀļó░ĒĢĀ ņłś ņŚåņ£╝ļ®░, ļ¬©ļōĀ ņĀĢļ│┤ļź╝ ņÖäļ▓ĮĒĢśĻ▓ī ĒīīņĢģĒĢĀ ņłś ņŚåļŗż. ņØ┤ļ¤¼ĒĢ£ ņāüĒÖ®ņŚÉņä£ ĻĖ░ĻĖłņØ┤ ņ¦üĻ┤ĆņĀüņ£╝ļĪ£ ņĄ£ņĀüņØś ĒīÉļŗ©ņØä ĒĢĀ ņłś ņ׳ļŖö ņĢīĻ│Āļ”¼ņ”śņØä ņŚ░ĻĄ¼ĒĢśļŖö ļ░®Ē¢źņ£╝ļĪ£ ļČäņäØĒĢĀ ņłś ņ׳ļŗż. ņØ┤ļ¤¼ĒĢ£ ļ¦źļØĮņŚÉņä£ ļŗżņ¢æĒĢ£ ņĢīĻ│Āļ”¼ņ”śņØ┤ ņĀ£ņĢłļÉśĻ│Ā ņ׳ļŗż(Ip et al., 2003; Mladineo et al., 2017). ĒĢśņ¦Ćļ¦ī ņØ┤ļ¤¼ĒĢ£ ļČäņäØņØĆ Ļ░£ļ│ä ĻĖ░ņŚģņØś ņĄ£ņĀü ņØśņé¼Ļ▓░ņĀĢņŚÉ ņ¦æņżæĒĢśĻĖ░ ļĢīļ¼ĖņŚÉ ņŗ£ņן ņĀäļ░śņŚÉ ļīĆĒĢ£ ņČ®ļČäĒĢ£ ĒĢ©ņØśļź╝ ļÅäņČ£ĒĢśĻĖ░ ļČĆņĀüĒĢ®ĒĢĀ ņłś ņ׳ļŗż. ļæÉ ļ▓łņ¦ĖļŖö ĻĖ░ĻĖłņØś OCIO ņäĀņĀĢĻ│╝ņĀĢņØä ĒĢśļéśņØś Ļ▓Įļ¦żļĪ£ ļ│┤Ļ│Ā ļČäņäØĒĢśļŖö Ļ▓āņØ┤ļŗż. ĻĖ░ĻĖłņØ┤ OCIOļź╝ ņäĀņĀĢĒĢśļŖö Ļ│╝ņĀĢņØä ņé┤ĒÄ┤ļ│┤ļ®┤ ņØ╝ņóģņØś ņĪ░ļŗ¼ Ļ▓Įļ¦ż(procurement auction)ņŚÉ ĒĢ┤ļŗ╣ĒĢ£ļŗżĻ│Ā ĒĢĀ ņłś ņ׳ņ£╝ļ®░, ņŚ¼ļ¤¼ ĒÅēĻ░ĆņÜöņåīļź╝ Ļ│ĀļĀżĒĢśļŖö ļŗżņ░©ņøÉ Ļ▓Įļ¦ż(multidimensional auction) ļ¬©ĒśĢņ£╝ļĪ£ ļČäņäØĒĢĀ ņłś ņ׳ļŗż. ļŗżņ░©ņøÉ Ļ▓Įļ¦żņŚÉņä£ļŖö ņ×ģņ░░ņ×É(bidder)Ļ░Ć ņĀ£ņŗ£ĒĢ£ ņĪ░Ļ▒┤ņØä ļ░öĒāĢņ£╝ļĪ£ ĒÅēĻ░ĆņĀÉņłś(score)ļź╝ ņé░ņĀĢĒĢśĻ│Ā, Ļ░Ćņן ļåÆņØĆ ĒÅēĻ░ĆņĀÉņłśļź╝ ļ░øņØĆ ņ×ģņ░░ņ×ÉĻ░Ć ļéÖņ░░ņØä ļ░øļŖöļŗż. ņØ┤ļ¤¼ĒĢ£ ņĀæĻĘ╝ ļ░®ļ▓ĢņØĆ ņĢ×ņäĀ ļ░®ņŗØņŚÉ ļ╣äĒĢ┤ ĻĖ░ĻĖłņØś ņØśņé¼Ļ▓░ņĀĢņØä ļŗ©ņł£ĒÖöĒĢśņ¦Ćļ¦ī, ĻĖ░ĻĖłĻ│╝ ņÜ┤ņÜ®ņé¼ņØś ņØśņé¼Ļ▓░ņĀĢņØä ļ¬©ļæÉ Ļ│ĀļĀżĒĢĀ ņłś ņ׳ņ£╝ļ®░, ņØ┤ņŚÉ ļö░ļØ╝ ņŗ£ņן ņĀäņ▓┤ņŚÉ ļīĆĒĢ£ Ļ▓ĮņĀ£ĒĢÖņĀü ĒĢ©ņØśļź╝ ļÅäņČ£ĒĢĀ ņłś ņ׳ļŗż. ņØ┤ņŚÉ ļö░ļØ╝ ļ│Ė ļģ╝ļ¼ĖņŚÉņä£ļŖö Ļ░£ļ│ä ĻĖ░ĻĖłņŚÉņä£ņØś OCIO ņäĀņĀĢĻ│╝ņĀĢņØä ĒĢśļéśņØś Ļ▓Įļ¦żļĪ£ ļ│┤Ļ│Ā, Ļ░üĻ░üņØś ĻĖ░ĻĖłņŚÉ ļīĆĒĢ┤ ņÜ┤ņÜ®ņé¼Ļ░Ć OCIO ņäĀņĀĢ Ļ▓Įņ¤üņŚÉ ņ░ĖņŚ¼ĒĢśļŖö ņāüĒÖ®ņØä ļČäņäØĒĢśņŚ¼ ĻĘĀĒśĢņØä ļÅäņČ£ĒĢ£ļŗż.

ļ│Ė ļģ╝ļ¼ĖņŚÉņä£ļŖö OCIOĻ░Ć ĻĖ░ĻĖłņØä ņÜ┤ņÜ®ĒĢśļŖö ļ░®ņŗØņŚÉ ļö░ļØ╝ ņŗ£ņן ĻĘĀĒśĢņØ┤ ļŗżļź┤Ļ▓ī ļÅäņČ£ļÉĀ ņłś ņ׳ņØīņØä Ļ│ĀļĀżĒĢśņŚ¼ ņä£ļĪ£ ļŗżļźĖ ĻĖ░ĻĖł ņÜ┤ņÜ®ļ░®ņŗØņØä ļ╣äĻĄÉĒĢ£ļŗż. ņ▓½ ļ▓łņ¦ĖļŖö Ēśäņ×¼ ĻĄŁļé┤ OCIO ņŗ£ņןņŚÉņä£ ĒÖ£ņÜ®ļÉśļŖö ļ░®ņŗØņ£╝ļĪ£, ĻĖ░ĻĖłļ│äļĪ£ ņĀäļŗ┤ņĪ░ņ¦üņØä ĻĄ¼ņä▒ĒĢśņŚ¼ ņÜ┤ņÜ®ĒĢśļŖö ĒśĢĒā£ņØ┤ļŗż. ļæÉ ļ▓łņ¦ĖļŖö ĒĢ┤ņÖĖņŚÉņä£ ņŻ╝ļĪ£ ļ░£Ļ▓¼ļÉśļŖö ņé¼ļĪĆļĪ£, OCIOĻ░Ć ņŚ¼ļ¤¼ ĻĖ░ĻĖłņØä ņ┤ØĻ┤äņĀüņ£╝ļĪ£ Ļ┤Ćļ”¼ĒĢśņŚ¼ ņÜ┤ņÜ®ĒĢśļŖö ĒśĢĒā£ņØ┤ļŗż. ļČäņäØĻ▓░Ļ│╝, OCIO ņÜ┤ņÜ® ļ░®ņŗØĻ│╝ ņāüĻ┤ĆņŚåņØ┤ ņÜ┤ņÜ®ņŚŁļ¤ēņØ┤ ļåÆņØĆ ņåīņłśņØś ņÜ┤ņÜ®ņé¼Ļ░Ć ņŗ£ņןņØä ļÅģĻ│╝ņĀÉĒĢśĻ▓ī ļÉĀ Ļ░ĆļŖźņä▒ņØ┤ ņ׳ļŗż. OCIO ņÜ┤ņÜ®ļ░®ņŗØņØ┤ ĻĖ░ĻĖłļ│äļĪ£ ņĀäļŗ┤ņĪ░ņ¦üņØä ĻĄ¼ņä▒ĒĢśļŖö ĒśĢĒā£ņØ╝ Ļ▓ĮņÜ░, ņåīĻĘ£ļ¬© ĻĖ░ĻĖłņØĆ ļåÆņØĆ ņÜ┤ņÜ®ļ│┤ņłśļĪ£ ņØĖĒĢ£ ļ╣äņÜ®ļČĆļŗ┤ ļĢīļ¼ĖņŚÉ OCIO ņä£ļ╣äņŖżļź╝ ņé¼ņÜ®ĒĢĀ ņ£ĀņØĖņØ┤ ņŚåĻ▓ī ļÉ£ļŗż. ļ░śļ®┤, OCIOĻ░Ć ņ┤ØĻ┤äņĀüņ£╝ļĪ£ ņŚ¼ļ¤¼ ĻĖ░ĻĖłņØś ņ×Éņé░ņØä ņÜ┤ņÜ®ĒĢĀ Ļ▓ĮņÜ░, ņåīĻĘ£ļ¬©ņØś ĻĖ░ĻĖłļÅä OCIO ņä£ļ╣äņŖżļź╝ ņĀüņØĆ ļ╣äņÜ®ņ£╝ļĪ£ ņé¼ņÜ®ĒĢĀ ņłś ņ׳Ļ▓ī ļÉ£ļŗż.

ļ│Ė ļģ╝ļ¼ĖņØś ņŚ░ĻĄ¼ļ░®ļ▓ĢļĪĀņØĆ Ļ▓Įņ¤üņØś ņĖĪļ®┤ņŚÉņä£ OCIO ņŗ£ņןņØä ļČäņäØĒĢ£ļŗżļŖö ņĀÉņŚÉņä£ ļīĆļ”¼ņØĖ ļ¼ĖņĀ£ņŚÉ ņżæņĀÉņØä ļæö ĻĖ░ņĪ┤ņØś OCIO ņŚ░ĻĄ¼ņÖĆ ņ░©ļ│äĒÖöļÉ£ļŗż(Shin and Lee, 2020; Yoon and Lee, 2019). ļ│Ė ļģ╝ļ¼ĖņØś Ļ▓░Ļ│╝ļŖö ĻĖ░ĻĖłĒśĢ Ēć┤ņ¦üņŚ░ĻĖłņĀ£ļÅäņØś ļÅäņ×ģņŚÉ ļö░ļźĖ OCIO ņŗ£ņןņØś ļ│ĆĒÖöņŚÉ ļīĆĒĢ┤ ļ¬ć Ļ░Ćņ¦Ć ņĀĢņ▒ģņĀü ĒĢ©ņØśļź╝ Ļ░¢ļŖöļŗż. ņ▓½ņ¦Ė, OCIO ņ▓┤Ļ│äĻ░Ć ņŗ£ņןņØś ņä▒ņןņŚÉņä£ ņżæņÜöĒĢ£ ļČĆļČäņØ╝ ņłś ņ׳ļŗż. ļæśņ¦Ė, ņĀäļŗ┤ņĪ░ņ¦üņØä ĻĄ¼ņä▒ĒĢśņŚ¼ ņÜ┤ņÜ®ĒĢśļŖö Ēśäņ×¼ņØś OCIO ņ▓┤Ļ│äņŚÉņä£ļŖö ĻĖ░ĻĖłĒśĢ Ēć┤ņ¦üņŚ░ĻĖł ņĀ£ļÅäņØś ļÅäņ×ģņØ┤ OCIO ņŗ£ņן ĻĘ£ļ¬©ņØś ņä▒ņןņ£╝ļĪ£ ņØ┤ņ¢┤ņ¦ĆĻĖ░ ņ¢┤ļĀżņÜĖ ņłś ņ׳ļŗż. ņģŗņ¦Ė, ĻĖ░ĻĖłĒśĢ Ēć┤ņ¦üņŚ░ĻĖł ņĀ£ļÅäņØś ļÅäņ×ģņØ┤ ņŗ£ņןņØś ņä▒ņןņ£╝ļĪ£ ņØ┤ņ¢┤ņ¦ĆĻĖ░ ņ£äĒĢ┤ņä£ļŖö ĻĄŁļé┤ OCIO ņ▓┤Ļ│äĻ░Ć ņåīĻĘ£ļ¬©ņØś ĻĖ░ĻĖłņØä ĒĢśļéśļĪ£ ļ¼Čņ¢┤ ņ┤ØĻ┤äņĀüņ£╝ļĪ£ Ļ┤Ćļ”¼ĒĢśļŖö ĒśĢĒā£ļĪ£ ļ│ĆĒÖöĒĢĀ ĒĢäņÜöĻ░Ć ņ׳ņØä ņłś ņ׳ļŗż.

ļ│Ė ņŚ░ĻĄ¼ņØś ĻĄ¼ņä▒ņØĆ ļŗżņØīĻ│╝ Ļ░Öļŗż. ņĀ£2ņןņŚÉņä£ļŖö Ļ┤ĆļĀ© ņäĀĒ¢ēņŚ░ĻĄ¼ļź╝ ņĀĢļ”¼ĒĢśĻ│Ā ņŚ░ĻĄ¼ņØś ļÅÖĻĖ░ļź╝ ņäżļ¬ģĒĢ£ļŗż. ņĀ£3ņןņŚÉņä£ļŖö ļ¬©ĒśĢņØä ņäżĻ│äĒĢśĻ│Ā ļČäņäØĒĢ£ļŗż. ņĀ£4ņןņŚÉņä£ļŖö ļ¬©ĒśĢņØä ĒåĄĒĢ┤ ļČäņäØĒĢ£ Ļ▓░Ļ│╝ļź╝ ļ░öĒāĢņ£╝ļĪ£ ĻĄŁļé┤ OCIO ņŗ£ņןņŚÉ ļīĆĒĢ£ ņĀĢņ▒ģ ĒĢ©ņØśļź╝ ņĀ£ņŗ£ĒĢ£ļŗż. ļ¦łņ¦Ćļ¦ēņ£╝ļĪ£ ņĀ£5ņןņŚÉņä£ļŖö ļČäņäØļé┤ņÜ®ņØä ņÜöņĢĮĒĢśĻ│Ā Ļ▓░ļĪĀņØä ņĀ£ņŗ£ĒĢ£ļŗż.

2.ŌĆģņäĀĒ¢ēņŚ░ĻĄ¼ŌĆģļ░ÅŌĆģņŚ░ĻĄ¼ņØśŌĆģļÅÖĻĖ░

ņĄ£ĻĘ╝ OCIOņŚÉ Ļ┤ĆĒĢ£ ņĀĢļČĆ ļ░Å ĒĢÖĻ│äņÖĆ ņŚģĻ│äņØś Ļ┤Ćņŗ¼ņØ┤ ņ”ØĻ░ĆĒĢśĻ│Ā ņ׳ņ£╝ļéś, ņØ┤ņŚÉ Ļ┤ĆĒĢ£ ņŗ¼ņĖĄņĀüņØĖ ĒĢÖņłĀņŚ░ĻĄ¼ļŖö ļ¦żņÜ░ ļČĆņĪ▒ĒĢśļŗż. OCIOņØś Ļ░£ļģÉĻ│╝ ĒśäĒÖ®ņŚÉ Ļ┤ĆĒĢ┤ Ļ▓ĆĒåĀĒĢ£ ļģ╝ļ¼ĖņØĆ ļŗżņØīĻ│╝ Ļ░Öļŗż. Clark and Urwin(2017)ņØĆ OCIOņØś Ļ░£ļģÉņØä ņĀĢļ”¼ĒĢśĻ│Ā, Ēł¼ņ×ÉņŚÉ ļīĆĒĢ£ ņĀĢļ│┤ļ¤ēĻ│╝ ņĀäļ¼Ėņä▒ņŚÉ ļö░ļØ╝ ĻĖ░ĻĖłņØś ņ£ĀĒśĢņØä ļČäļźśĒĢ£ļŗż. Shin et al.(2020)ņØĆ ĻĄŁļé┤ OCIO ĒśäĒÖ®ņØä Ļ░£Ļ┤äņĀüņ£╝ļĪ£ Ļ▓ĆĒåĀĒĢ£ļŗż. ņØ┤ļōżņØĆ ĒĢ┤ņÖĖ OCIOņÖĆ ļ╣äĻĄÉĒĢśņŚ¼ ĻĄŁļé┤ OCIO ņŗ£ņןņØä ļ»Ėņä▒ņłÖĒĢ£ ņ┤łĻĖ░ ļŗ©Ļ│äļĪ£ ņĀĢņØśĒĢśĻ│Ā, ĻĄŁļé┤ OCIO ņŗ£ņןņØś ĒŖ╣ņä▒ņØä Ļ▓ĆĒåĀĒĢśĻĖ░ ņ£äĒĢ┤ OCIO ņŗ£ņןņŚÉ ļīĆĒĢ£ OCIOņØś ņłśņÜöņ×ÉņØĖ ĻĖ░ĻĖłĻ│╝ Ļ│ĄĻĖēņ×ÉņØĖ ņÜ┤ņÜ®ņé¼ ļ░Å ņ”ØĻČīņé¼ņØś ņØĖņŗØņØä ņäżļ¼Ėņ£╝ļĪ£ ņĪ░ņé¼ĒĢ£ļŗż. ņØ┤ļōżņØĆ ĻĖ░ĻĖłĻ│╝ ņÜ┤ņÜ®ņé¼ ļ¬©ļæÉ ņłśņØĄļźĀĻ│╝ ņ£äĒŚśĻ┤Ćļ”¼ļź╝ OCIOņØś ņżæņÜöĒĢ£ ņÜöņåīļĪ£ ņØĖņŗØĒĢśĻ│Ā ņ׳ņØīņØä ĒÖĢņØĖĒĢ£ļŗż.

OCIO ņŗ£ņןņØä ņØ┤ļĪĀņĀüņ£╝ļĪ£ ļČäņäØĒĢ£ ļģ╝ļ¼ĖļÅä ņĪ┤ņ×¼ĒĢśņ¦Ćļ¦ī, ĻĖ░ņĪ┤ņØś OCIOņŚÉ Ļ┤ĆĒĢ£ ļģ╝ņØśļŖö OCIOņØś ļīĆļ”¼ņØĖ ļ¼ĖņĀ£ņŚÉ ņ┤łņĀÉņØä ļ¦×ņČöĻ│Ā ņ׳ļŗż.

Won(2006)ņØĆ Ē¢ēļÅÖĻ▓ĮņĀ£ĒĢÖ Ļ┤ĆņĀÉņŚÉņä£ ņ£äĒŚśĒÜīĒö╝ņä▒Ē¢ź ļ│ĆĒÖöņŚÉ ļö░ļØ╝ ņŚ░ĻĖ░ĻĖłņØś ĒżĒŖĖĒÅ┤ļ”¼ņśż ņĪ░ņĀĢņØä ļČäņäØĒĢśņŚ¼ ņ▒äĻČī ņäĀĒśĖļÅäĻ░Ć ļéśĒāĆļé©ņØä ļ│┤ņØĖļŗż.

Shin and Lee(2020) ļśÉĒĢ£ Ē¢ēļÅÖĻ▓ĮņĀ£ĒĢÖ Ļ┤ĆņĀÉņŚÉņä£ OCIOņØś ļé«ņØĆ ņłśņØĄļźĀņØä ļČäņäØĒĢ£ļŗż. OCIOĻ░Ć ņåÉņŗżĒÜīĒö╝(loss aversion) ņä▒Ē¢źņØä ļ│┤ņØĖļŗżļŖö Ļ░ĆņĀĢĒĢśņŚÉ, ĒÅēĻ░Ć ĻĖ░Ļ░äņØ┤ ņ¦¦ņØĆ Ļ▓āņØ┤ ĻĄŁļé┤ OCIOĻ░Ć ņłśņØĄļźĀņØä ļé«Ļ▓ī ņ£Āņ¦ĆĒĢśļŖö ņøÉņØĖņØ┤ļØ╝ ņŻ╝ņןĒĢ£ļŗż. ņØ┤ļōżņØĆ ņĀäļ¦ØņØ┤ļĪĀ(prospect theory)ņØä ĒåĄĒĢ┤ ļÅäņČ£ĒĢ£ ņĀüņĀĢ ĒÅēĻ░Ć ĻĖ░Ļ░äĻ│╝ ļ╣äĻĄÉĒĢśņŚ¼, ņŗżņĀ£ OCIOņØś ĒÅēĻ░Ć ĻĖ░Ļ░äņØ┤ ņ¦¦ņØīņØä ļ│┤ņØĖļŗż.

Yoon and Lee(2019)ļŖö OCIOņØś ļ│┤ņłśņ▓┤Ļ│äļź╝ ņØ┤ļĪĀļ¬©ĒśĢņ£╝ļĪ£ ĻĄ¼ņä▒ĒĢśĻ│Ā ņØ┤ļź╝ ļ░öĒāĢņ£╝ļĪ£ ņĄ£ņĀüĒÖö ļ¼ĖņĀ£ļź╝ ĒÆĆņ¢┤ OCIOņØś ļīĆļ”¼ņØĖ ļ¼ĖņĀ£ļź╝ ļČäņäØĒĢśĻ│Ā, ļīĆļ”¼ņØĖ ļ¼ĖņĀ£ļź╝ ĒĢ┤Ļ▓░ĒĢśĻĖ░ ņ£äĒĢ┤ņä£ļŖö OCIOņŚÉ ņ¦ĆĻĖēļÉśļŖö ņä▒Ļ│╝ļ│┤ņłśņØś ļ╣äņżæņØ┤ ņ╗żņĢ╝ ĒĢ£ļŗżĻ│Ā ņŻ╝ņןĒĢ£ļŗż.

ņØ┤ļ¤¼ĒĢ£ ņŻ╝ņןņØĆ OCIOļ│┤ļŗż ĒżĻ┤äņĀüņØĖ Ļ░£ļģÉņØĖ ņ£äĒāüņ×Éņé░ņÜ┤ņÜ®ņŚÉ Ļ┤ĆĒĢ£ ļģ╝ņØśņÖĆ Ļ┤ĆļĀ©ņØ┤ ņ׳ļŗż.

Jensen (1968)ņØś ņŚ░ĻĄ¼ ņØ┤Ēøä, ņ£äĒāüņ×Éņé░ņÜ┤ņÜ® ņŚ░ĻĄ¼ņŚÉņä£ ļīĆļ”¼ņØĖ ļ¼ĖņĀ£ļŖö ņżæņÜöĒĢ£ ņ£äņ╣śļź╝ ņ░©ņ¦ĆĒĢśĻ│Ā ņ׳ļŗż. ļ¦ÄņØĆ ņŚ░ĻĄ¼Ļ░Ć ņ×Éņé░ņØä ņ£äĒāüĒĢśļŖö Ļ│╝ņĀĢņŚÉņä£ ņÜ┤ņÜ®ņä▒Ļ│╝Ļ░Ć ņĢģĒÖöļÉ£ļŗżļŖö ņĀÉņØä ņŗżņ”ØņĀüņ£╝ļĪ£ ļ│┤ņØĖļŗż(

Bergstresser et al., 2009;

Chen et al., 2013;

Guercio and Reuter, 2014;

Jenkinson et al., 2016;

Stoughton et al., 2011). ņØ┤ļ¤¼ĒĢ£ ļČäņäØņØĆ ņ£äĒāüņÜ┤ņÜ®ņŚÉņä£ ĻĄ¼ņĪ░ņĀüņØĖ ļ╣äĒÜ©ņ£©ņä▒ņØ┤ ļéśĒāĆļé©ņØä ļ│┤ņØ┤ļ®░, ĻĘĖ ņøÉņØĖņ£╝ļĪ£ ņÜ┤ņÜ®ļ╣äņÜ®(

Blake et al., 1993;

Cho, 2014;

Elton et al., 1993)Ļ│╝ ļ│┤ņłśĻĄ¼ņĪ░(

Cuoco and Kaniel, 2011;

Kyle et al., 2011;

Li and Tiwari, 2009; Ma et al., 2019;

Ou-Yang, 2003;

Stoughton, 1993;

Stracca, 2006)ņŚÉ ņŻ╝ļ¬®ĒĢ£ļŗż. ļ│┤ņłśĻĄ¼ņĪ░ņŚÉ Ļ┤ĆĒĢ£ ĻĖ░ņĪ┤ ļģ╝ņØśļŖö ņä▒Ļ│╝ļ│┤ņłśĻ░Ć ļīĆļ”¼ņØĖ ļ¼ĖņĀ£ ĒĢ┤Ļ▓░ņØś ĒĢäņłśņĀüņØĖ ņÜöņåīļØ╝Ļ│Ā ņŻ╝ņןĒĢ£ļŗż. ĻĘĖļ¤¼ļéś ņä▒Ļ│╝ļ│┤ņłśļź╝ ņ¦ĆĻĖēĒĢśņŚ¼ ļ¦żļŗłņĀĆĻ░Ć ņłśņØĄņä▒Ļ│╝ļź╝ Ļ░£ņäĀĒĢśļÅäļĪØ ĒĢśļŹöļØ╝ļÅä ņ£äĒŚśĻ┤Ćļ”¼ņä▒Ļ│╝Ļ░Ć ņĢģĒÖöļÉĀ ņłś ņ׳ļŗż(

Huang et al., 2011).

Lee et al.(2019)ņØś ņŚ░ĻĄ¼ļŖö ņä▒Ļ│╝ļ│┤ņłśĻ░Ć ļ¦żļŗłņĀĆņØś ņ£äĒŚśĻ┤Ćļ”¼ļź╝ ņĢģĒÖöņŗ£Ēé¼ ņłś ņ׳ņØīņØä ņ¦ĆņĀüĒĢ£ļŗż.

Ryu and Park(2020)ņØĆ ļīĆļ”¼ņØĖ ļ¼ĖņĀ£ļĪ£ ņØĖĒĢśņŚ¼, ĻĖ░ĻĖłņØ┤ ļŗ©ņł£Ē׳ OCIOņØś ņä▒Ļ│╝ļ│┤ņłś ļ╣äņżæņØä ļŖśļ”¼ļŖö Ļ▓āņØĆ ņ£äĒŚśĻ┤Ćļ”¼ņä▒Ļ│╝ļź╝ ņĢģĒÖöņŗ£Ēé¼ ņłś ņ׳ļŗżĻ│Ā ņŻ╝ņןĒĢ£ļŗż. Ļ│äņĢĮ ĻĖ░Ļ░äĻ│╝ ņ×¼Ļ│äņĢĮ Ļ░ĆļŖźņä▒ņØä Ļ│ĀļĀżĒĢ£ ņłśļ”¼ņĀü ļ¬©ĒśĢņØä ĻĄ¼ņä▒ĒĢśņŚ¼ ņØ┤ļź╝ ņ▓┤Ļ│äņĀüņ£╝ļĪ£ ņäżļ¬ģĒĢ£ļŗż.

Ēśäņ×¼Ļ╣īņ¦Ć OCIO ņŗ£ņןņØä ņ▓┤Ļ│äņĀüņ£╝ļĪ£ ļČäņäØĒĢ£ ņŚ░ĻĄ¼ļŖö ļō£ļ¼╝ļ®░, ņØ┤ļĪĀņŚ░ĻĄ¼ ļśÉĒĢ£ ņŻ╝ļĪ£ ļīĆļ”¼ņØĖ ļ¼ĖņĀ£ņŚÉ Ļ┤ĆĒĢśņŚ¼ ņ┤łņĀÉņØä ļ¦×ņČöĻ│Ā ņ׳ļŗż. ņØ┤ļ¤¼ĒĢ£ ĻĖ░ņĪ┤ ņŚ░ĻĄ¼ļŖö ĻĖ░ĻĖłņØ┤ OCIOļź╝ ņäĀņĀĢĒĢ£ ņØ┤Ēøä, OCIOņØś ņØśņé¼Ļ▓░ņĀĢņŚÉ ļīĆĒĢ£ ļČäņäØņØä ņŗ£ļÅäĒĢśņ¦Ćļ¦ī, ĻĖ░ĻĖłņØ┤ OCIOļź╝ ņäĀņĀĢĒĢśļŖö Ļ│╝ņĀĢņØä ĒżĻ┤äĒĢśņ¦ĆļŖö ļ¬╗ĒĢ£ļŗż. ĻĄŁļé┤ OCIO ņŗ£ņןņŚÉņä£ņØś ļ│ĆĒÖöļŖö ĻĖ░ĻĖłĒśĢ Ēć┤ņ¦üņŚ░ĻĖłņØ┤ ļÅäņ×ģļÉ©ņŚÉ ļö░ļØ╝ OCIO ņŗ£ņןņŚÉ ņ░ĖĻ░ĆĒĢĀ Ļ▓āņ£╝ļĪ£ ĻĖ░ļīĆļÉśļŖö ņåīĻĘ£ļ¬© ĻĖ░ĻĖłņØś ņØśņé¼Ļ▓░ņĀĢņŚÉ ņśüĒ¢źņØä ļ░øņØä Ļ▓āņØ┤ļŗż. ņØ┤ļŖö ĻĖ░ņĪ┤ņØś ņŚ░ĻĄ¼Ļ░Ć ņČöĒøä ĻĄŁļé┤ OCIO ņŗ£ņןņØś ļ│ĆĒÖöļź╝ ņČ®ļČäĒ׳ ņäżļ¬ģĒĢśĻĖ░ ņ¢┤ļĀĄļŗżļŖö Ļ▓āņØä ņØśļ»ĖĒĢ£ļŗż. ņØ┤ņŚÉ ļö░ļØ╝ ļ│Ė ļģ╝ļ¼ĖņŚÉņä£ļŖö ĻĖ░ņĪ┤ņØś ņŚ░ĻĄ¼ņÖĆļŖö ļŗ¼ļ”¼, OCIO ņäĀņĀĢĻ│╝ņĀĢņŚÉņä£ņØś Ļ▓Įņ¤üņØä ņØ┤ļĪĀļ¬©ĒśĢņØä ĒåĄĒĢ┤ ļČäņäØĒĢ©ņ£╝ļĪ£ņŹ© ĻĖ░ĻĖłņØ┤ OCIO ņä£ļ╣äņŖżļź╝ ņé¼ņÜ®ĒĢĀ ņĪ░Ļ▒┤ņØä Ļ▓ĆĒåĀĒĢ£ļŗż.

ļ│Ė ņŚ░ĻĄ¼ņŚÉņä£ļŖö ĻĖ░ĻĖłņØ┤ OCIOļź╝ ņäĀņĀĢĒĢśļŖö Ļ│╝ņĀĢņØ┤ ņĪ░ļŗ¼ Ļ▓Įļ¦żņØś ĒśĢĒā£ļź╝ ļØżļŗżļŖö ņĀÉņŚÉ ņ░®ņĢłĒĢśņŚ¼ OCIO ņäĀņĀĢĻ▓īņ×äņØä ņĪ░ļŗ¼ Ļ▓Įļ¦żņŚÉ Ļ┤ĆĒĢ£ ļ¬©ĒśĢņ£╝ļĪ£ ņäżĻ│äĒĢśĻ│Ā ļČäņäØĒĢ£ļŗż. ņĪ░ļŗ¼ Ļ▓Įļ¦żļŖö ņØ╝ļ░śņĀüņ£╝ļĪ£ ņ×¼ĒÖöļéś ņä£ļ╣äņŖżļź╝ ĒīÉļ¦żĒĢśļŖö ņ¬ĮņØ┤ Ļ▓Įņ¤üĒĢśņŚ¼ ļéÖņ░░ņØä ļ░øļŖö Ļ▓Įļ¦ż ĒśĢĒā£ļĪ£, ņŻ╝ļĪ£ ļīĆĻĘ£ļ¬© Ļ│ĄĻ│Ąņé¼ņŚģņØś ņé¼ņŚģņ×É ņäĀņĀĢĻ│╝ņĀĢņØ┤ ņØ┤ņŚÉ ĒĢ┤ļŗ╣ĒĢ£ļŗż. ĻĄŁļé┤ OCIOņØś ņäĀņĀĢĻ│╝ņĀĢņØĆ ņØ╝ļ░śņĀüņ£╝ļĪ£ ņĪ░ļŗ¼ Ļ▓Įļ¦żņÖĆ Ļ░ÖņØĆ Ļ│╝ņĀĢņØä ĒåĄĒĢ┤ ņØ┤ļŻ©ņ¢┤ņ¦äļŗż. ņĪ░ļŗ¼ Ļ▓Įļ¦żņŚÉņä£ļÅä Ļ░ĆĻ▓®ņÜöņåīļź╝ ņżæņŗ¼ņ£╝ļĪ£ ļéÖņ░░ņ×Éļź╝ ņäĀņĀĢĒĢśļŖö ļ¬©ĒśĢņŚÉ ļīĆĒĢ£ ļģ╝ņØśĻ░Ć ļŗżņ¢æĒĢśĻ▓ī ņ¦äĒ¢ēļÉśņŚłļŗż(

Anton and Yao, 1992;

Bernheim and Whinston, 1986). Ļ░Ćņן ļīĆĒæ£ņĀüņØĖ ĒśĢĒā£ļŖö Ļ░Ćņן ļé«ņØĆ Ļ░ĆĻ▓®ņØä ņĀ£ņŗ£ĒĢ£ ņ×ģņ░░ņ×ÉĻ░Ć ņé¼ņŚģņ×ÉļĪ£ ļéÖņ░░ļ░øļŖö ņĄ£ņĀĆĻ░ĆĻ▓®ļéÖņ░░ņĀ£ļÅä ņØ┤ļŗż. ņØ┤ļź╝ ļ│ĆĒśĢĒĢśņŚ¼ ĻĘĀĒśĢņØä ļÅäņČ£ĒĢśĻ│Ā ļŗżļźĖ ĒśĢĒā£ņØś Ļ▓Įļ¦żņÖĆ ļ╣äĻĄÉĒĢśļŖö ļō▒ņØś ļ░®ņŗØņØä ĒåĄĒĢ┤ ņĀüĒĢ®ĒĢ£ Ļ▓Įļ¦ż ļ¬©ĒśĢņŚÉ Ļ┤ĆĒĢ£ ļŗżņ¢æĒĢ£ ņŚ░ĻĄ¼Ļ░Ć ņ¦äĒ¢ēļÉśĻ│Ā ņ׳ļŗż(

Kokott et al., 2019;

Li et al., 2018;

Paulsen et al., 2020).

ĻĘĖļ¤¼ļéś OCIO ņé¼ņŚģņ×É ņäĀņĀĢņØĆ Ļ░ĆĻ▓®ņŚÉ ĒĢ┤ļŗ╣ĒĢśļŖö ņÜ┤ņÜ®ļ│┤ņłśļéś ņä▒Ļ│╝ļ│┤ņłś ņØ┤ņÖĖņŚÉļÅä OCIO ņä£ļ╣äņŖżņØś ĒÆłņ¦łņØä Ļ░ĆļŖĀĒĢĀ ņłś ņ׳ļŖö ņŚ¼ļ¤¼ ĒÅēĻ░Ć ĻĖ░ņżĆņŚÉ ļö░ļØ╝ ņ¦äĒ¢ēļÉ£ļŗż. ļö░ļØ╝ņä£ Ļ░ĆĻ▓®ņÜöņåīņŚÉ ĒĢ£ņĀĢĒĢ£ Ļ▓Įļ¦ż ļ¬©ĒśĢ ņ£╝ļĪ£ļŖö ņČ®ļČäĒ׳ ņäżļ¬ģĒĢśĻĖ░ ņ¢┤ļĀĄļŗż. ņØ┤ņÖĆ Ļ┤ĆļĀ©ĒĢśņŚ¼

Che(1993)Ļ░Ć ņĀ£ņĢłĒĢ£ ļŗżņ░©ņøÉ Ļ▓Įļ¦ż ļ¬©ĒśĢņØĆ OCIO ņäĀņĀĢĻ│╝ņĀĢņØä ļČäņäØĒĢśĻĖ░ņŚÉ ņĀüĒĢ®ĒĢśļŗż.

Che(1993)ļŖö ńŠÄ ĻĄŁļ░®ļČĆ(U.S. Department of Defense)Ļ░Ć ļ░®ņ£äņé░ņŚģņŚÉ Ļ┤ĆĒĢ£ ņĪ░ļŗ¼ņØä Ļ▓Įņ¤üņ×ģņ░░ļĪ£ ņ¦äĒ¢ēĒĢśļŖö ņé¼ļĪĆļź╝ ļČäņäØĒĢśĻĖ░ ņ£äĒĢ┤ ļŗżņ░©ņøÉ Ļ▓Įļ¦ż ļ¬©ĒśĢņØä ņĀ£ņĢłĒĢ£ļŗż. ņĪ░ļŗ¼ Ļ▓Įņ¤üņŚÉņä£ ņāüĒÆłņØś ņä▒ļŖźĻ│╝ ĒÆłņ¦łņØĆ ļéÖņ░░ņŚģņ▓┤ļź╝ ņäĀņĀĢĒĢśļŖö ņżæņÜöĒĢ£ ĻĖ░ņżĆņØ┤ļ»ĆļĪ£, ļŗżņ░©ņøÉ Ļ▓Įļ¦ż ļ¬©ĒśĢņŚÉņä£ļŖö Ļ░ĆĻ▓®ņÜöņåī ņØ┤ņÖĖņŚÉļÅä ĒÆłņ¦ł ļ│ĆņłśĻ░Ć ņĀĢņØśļÉ£ļŗż. ļéÖņ░░ņ×É ņäĀņĀĢņØĆ Ļ░ĆĻ▓®Ļ│╝ ĒÆłņ¦łņŚÉ ļö░ļØ╝ ļÅäņČ£ļÉ£ ĒÅēĻ░ĆņĀÉņłśļź╝ ļ░öĒāĢņ£╝ļĪ£ ņØ┤ļŻ©ņ¢┤ņ¦äļŗż.

Che(1993)ņØś ņŚ░ĻĄ¼ ņØ┤ĒøäņŚÉļŖö Ļ░ĆĻ▓®ņÜöņåī ļ░Å ļ╣äĻ░ĆĻ▓®ņÜöņåīļź╝ ļ¬©ļæÉ Ļ│ĀļĀżĒĢśņŚ¼ ļéÖņ░░ņ×Éļź╝ ņäĀņĀĢĒĢśļŖö ļŗżņ░©ņøÉ Ļ▓Įļ¦żņŚÉ ļīĆĒĢ£ ļČäņäØņØ┤ ņ¦äĒ¢ēļÉśņŚłļŗż.

Asker and Cantillon(2008,

2010)ņØĆ ĒÆłņ¦ł ļ│Ćņłśļź╝ ļ▓ĪĒä░(vector)ļĪ£ ņĀĢņØśĒĢ©ņ£╝ļĪ£ņŹ©

Che(1993)ņØś ļ¬©ĒśĢņŚÉ ļ╣äĒĢ┤ ļŹö ļŗżņ¢æĒĢ£ ĒÅēĻ░ĆĒĢŁļ¬®ņØä ĒżĻ┤äĒĢĀ ņłś ņ׳ļŖö ļ░®Ē¢źņ£╝ļĪ£ ļģ╝ņØśļź╝ ĒÖĢņןĒĢśņśĆļŗż.

Chen(2021)ņØĆ ĻĄ¼ļ¦żņ×ÉĻ░Ć ĒŖ╣ņĀĢ ĻĖ░ņżĆņŚÉ ļö░ļØ╝ ļéÖņ░░ņ×ÉņÖĆ Ļ│äņĢĮĒĢśņ¦Ć ņĢŖņØä ņłśļÅä ņ׳ļŗżļŖö ņśĄņģśņØä ņČöĻ░ĆĒĢśņŚ¼ ļ¬©ĒśĢņØä ĒÖĢņןĒĢ£ļŗż.

Chen et al.(2011),

Liu et al.(2012),

Papakonstantinou and Bogetoft(2017)ņØś ņŚ░ĻĄ¼ļŖö Ļ░üĻ░ü ĒŖ╣ņĀĢĒĢ£ ļ╣äĻ░ĆĻ▓®ņÜöņåīņŚÉ ņ┤łņĀÉņØä ļ¦×ņČ░ ļŗżņ░©ņøÉ ņĪ░ļŗ¼ Ļ▓Įļ¦żņŚÉ ļīĆĒĢ£ ņØ┤ļĪĀņĀü ļ¬©ĒśĢņØä ĻĄ¼ņä▒ĒĢśĻ│Ā ĻĘĀĒśĢņØä ļÅäņČ£ĒĢ£ļŗż. ļ│Ė ņŚ░ĻĄ¼ņŚÉņä£ļŖö ņØ┤ļ¤¼ĒĢ£ ņäĀĒ¢ēņŚ░ĻĄ¼ļź╝ ņ░ĖĻ│ĀĒĢśņŚ¼ ļŗżņ░©ņøÉ Ļ▓Įļ¦ż ļ¬©ĒśĢņØś ĒŗĆ ĒĢśņŚÉņä£ OCIO ņäĀņĀĢĻ│╝ņĀĢņŚÉņä£ņØś Ļ▓Įņ¤üņāüĒÖ®ņØä ņ¦üĻ┤ĆņĀüņ£╝ļĪ£ ļČäņäØĒĢśĻ│Ā, ņØ┤ļź╝ ĒåĀļīĆļĪ£ ņĀĢņ▒ģņŗ£ņé¼ņĀÉņØä ļÅäņČ£ĒĢ£ļŗż.

3.ŌĆģļ¬©ĒśĢņØśŌĆģņäżĻ│äŌĆģļ░ÅŌĆģļČäņäØ

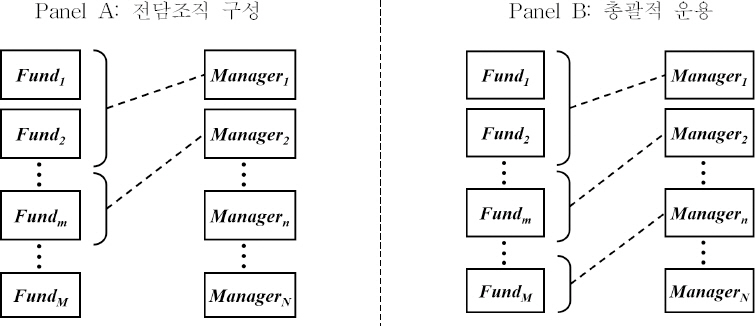

ļ│Ė ņĀłņŚÉņä£ļŖö ļŗżņ░©ņøÉ Ļ▓Įļ¦ż ļ¬©ĒśĢņØä ņØæņÜ®ĒĢśņŚ¼ ņ┤Ø M Ļ░£ņØś ĻĖ░ĻĖłĻ│╝ N Ļ░£ņØś ņÜ┤ņÜ®ņé¼Ļ░Ć OCIO Ļ│äņĢĮņØä ņ▓┤Ļ▓░ĒĢśļŖö ņāüĒÖ®ņØä ļČäņäØĒĢ£ļŗż. Ļ░£ļ│ä ĻĖ░ĻĖłņØĆFundm, m=1,2, ŌĆ”,M, ņ£╝ļĪ£ ļéśĒāĆļé┤ļ®░, ĻĖ░ĻĖłņØś ņ¦æĒĢ®ņØĆFund= {Fund1 , Fund2 , ŌĆ”, FundM} ņØ┤ļŗż. ņ×Éņé░ņÜ┤ņÜ®ņé¼ņØś ņ¦æĒĢ®ņØĆ Manager={Manager0 , Manager1 , Manager2 , ŌĆ” , ManagerN}ņØ┤ļŗż. Ļ░£ļ│ä ĻĖ░ĻĖłņØĆ ņÜ┤ņÜ®ņé¼ ņ¦æĒĢ® ņżæ ĒĢśļéśļź╝ ņ×ÉņŗĀņØś OCIOļĪ£ ņäĀņĀĢĒĢ£ļŗż. ņ”ē, Ļ░£ļ│ä ņÜ┤ņÜ®ņé¼ Managern , n=1, 2, ŌĆ”, N,ņżæ ĒĢśļéśĻ░Ć ņäĀņĀĢļÉ£ļŗż. ĒĢ£ĒÄĖ, OCIO ņä£ļ╣äņŖżļź╝ ņé¼ņÜ®ĒĢśļŖö Ļ▓āņØ┤ ņØ┤ļōØņØ┤ ļÉśņ¦Ć ņĢŖņØä Ļ▓ĮņÜ░, ĻĖ░ĻĖłņØĆ OCIOļź╝ ņäĀņĀĢĒĢśņ¦Ć ņĢŖņØä ņłś ņ׳ļŗż. ĻĖ░ĻĖłņØ┤ OCIOļź╝ ņäĀņĀĢĒĢśņ¦Ć ņĢŖļŖö Ļ▓ĮņÜ░, ĻĖ░ĻĖłņØĆ ņÜ┤ņÜ®ņé¼ ņ¦æĒĢ®ņŚÉņä£Manager0ņØä ņäĀĒāØĒĢśļŖö Ļ▓āņ£╝ļĪ£ ņäżņĀĢĒĢ£ļŗż. ĻĖ░ĻĖłņØĆ ņ×Éņé░ņØś ĻĘ£ļ¬© ņł£ņä£ļĪ£, ņÜ┤ņÜ®ņé¼ļŖö ņÜ┤ņÜ®ņŚŁļ¤ēņØ┤ Ēü░ ņł£ņä£ļīĆļĪ£ ņĀĢļĀ¼ļÉ£ļŗż. ņ×Éņé░ņØś ĻĘ£ļ¬©Ļ░Ć Ēü░ ņł£ņä£ļīĆļĪ£ ĻĖ░ĻĖłņØä ļéśņŚ┤ĒĢ£ļŗżĻ│Ā ĒĢĀ ļĢī, mļ▓łņ¦Ė ĻĖ░ĻĖł(Fundm)ņØś ņ×Éņé░ĻĘ£ļ¬©ļŖö Fm ņØ┤ļŗż. ņÜ┤ņÜ®ņŚŁļ¤ēņØĆ ņÜ┤ņÜ®ņé¼Ļ░Ć ļÅÖņŗ£ņŚÉ ņÜ┤ņÜ®ĒĢĀ ņłś ņ׳ļŖö ĻĖ░ĻĖłņØś ņ┤Ø ĻĘ£ļ¬©ļź╝ ņØśļ»ĖĒĢ£ļŗż. ļ¼╝ļĪĀ ĒśäņŗżņŚÉņä£ļŖö ņÜ┤ņÜ®ņŚŁļ¤ēņØä ņĀĢņØśĒĢĀ ļĢī ĻĖ░ĻĖłņØś ĻĘ£ļ¬©ļ┐É ņĢäļŗłļØ╝ ĻĖ░ĻĖłņØś ņłśļÅä Ļ│ĀļĀżĒĢ┤ņĢ╝ ĒĢĀ Ļ▓āņØ┤ļŗż. ĻĖ░ĻĖłļ│äļĪ£ ņ£äĒŚśņäĀĒśĖļÅäļéś ļ¬®Ēæ£ņłśņØĄļźĀ, Ēł¼ņ×É ņĀ£ņĢĮņĪ░Ļ▒┤ ļō▒ņØ┤ ļŗżļź┤ļ»ĆļĪ£, ņÜ┤ņÜ®ĒĢśļŖö ĻĖ░ĻĖłņØś ņłśĻ░Ć ļŖśņ¢┤ļéśļ®┤ ĻĖ░ĻĖłļ│ä ĒŖ╣ņä▒ņØä Ļ│ĀļĀżĒĢśņŚ¼ ļ│äļÅäļĪ£ ĻĖ░ĻĖłņØä Ļ┤Ćļ”¼ĒĢ┤ņĢ╝ ĒĢśĻ│Ā ņČöĻ░ĆņĀüņØĖ ņÜ┤ņÜ®ņŚŁļ¤ēņØś ņåīņ¦äņØ┤ ļ░£ņāØĒĢ£ļŗż. ĻĘĖļ¤¼ļéś ļīĆĒśĢĻĖ░ĻĖłņØś Ļ▓ĮņÜ░ ņØ╝ļ░śņĀüņ£╝ļĪ£ ļČäņäØņ×ÉļŻīņØś ņÜöĻĄ¼ ļ╣łļÅäņÖĆ ņłśņżĆņØ┤ ļåÆņ£╝ļ»ĆļĪ£, ĻĖ░ĻĖł ĻĘ£ļ¬©ņŚÉ ļö░ļØ╝ ņÜ┤ņÜ®ņé¼ņØś ņÜ┤ņÜ®ņŚŁļ¤ēņØä ņåīņ¦äĒĢ£ļŗżĻ│Ā ņāØĻ░üĒĢĀ ņłś ņ׳ļŗż. ļö░ļØ╝ņä£, ļ│Ė ņŚ░ĻĄ¼ņŚÉņä£ļŖö ņÜ┤ņÜ®ņé¼ņØś ņÜ┤ņÜ®ņŚŁļ¤ēņØä ņÜ┤ņÜ®ĻĖ░ĻĖłņØś ĻĘ£ļ¬©ļĪ£ ņäżņĀĢĒĢ£ļŗż.

ņÜ┤ņÜ®ņŚŁļ¤ēņØ┤ ļåÆņØĆ ņł£ņä£ļīĆļĪ£ ņÜ┤ņÜ®ņé¼ļź╝ ņĀĢļĀ¼ĒĢĀ ļĢī,

nļ▓łņ¦Ė ņÜ┤ņÜ®ņé¼(

Managern)ņØś ņÜ┤ņÜ®ņŚŁļ¤ēņØĆ

On ņØ┤ļŗż. ĻĖ░ĻĖłņØĆ ĒĢśļéśņØś ņÜ┤ņÜ®ņé¼ņÖĆ Ļ│äņĢĮņØä ņ▓┤Ļ▓░ĒĢśļŖö ļ░śļ®┤, ņÜ┤ņÜ®ņé¼ļŖö ņ×ÉņŗĀņØś ņÜ┤ņÜ®ņŚŁļ¤ē ļ▓öņ£ä ļé┤ņŚÉņä£ ņŚ¼ļ¤¼ ĻĖ░ĻĖłĻ│╝ ļÅÖņŗ£ņŚÉ Ļ│äņĢĮĒĢĀ ņłś ņ׳ļŗż.

7) ņÜ┤ņÜ®ņé¼ļŖö ņÜ┤ņÜ® Ļ░ĆļŖźĒĢ£ ĻĖ░ĻĖłņØś ņ┤Ø ĻĘ£ļ¬©ņŚÉņä£ļ¦ī ņ░©ņØ┤Ļ░Ć ņ׳Ļ│Ā, ņłśņØĄļźĀĻ│╝ ņ£äĒŚśņŚÉ ļīĆĒĢ£ Ļ┤Ćļ”¼ļŖźļĀź ļō▒ OCIO ņä£ļ╣äņŖżņØś ĒÆłņ¦łņØĆ ļ¬©ļæÉ Ļ░ÖļŗżĻ│Ā Ļ░ĆņĀĢĒĢ£ļŗż. ņÜ┤ņÜ®ņé¼ļŖö ņ×ÉņŗĀņØś ņÜ┤ņÜ®ņŚŁļ¤ēņŚÉ ļö░ļØ╝, ĻĘ£ļ¬©Ļ░Ć Ēü░ ĻĖ░ĻĖłņØś OCIO ņäĀņĀĢ Ļ▓Įņ¤üļČĆĒä░ ņ░ĖņŚ¼ĒĢ£ļŗż.

8) ņśłļź╝ ļōżņ¢┤ ņÜ┤ņÜ®ņé¼Ļ░Ć ņ┤Ø 10ņĪ░ ņøÉņØś ņ×Éņé░ņØä ņÜ┤ņÜ®ĒĢĀ ņłś ņ׳ļŖö ļŖźļĀźņØ┤ ņ׳Ļ│Ā, ņ×Éņé░ĻĘ£ļ¬©Ļ░Ć Ļ░üĻ░ü 11ņĪ░, 8ņĪ░, 3ņĪ░ ņøÉņØĖ ĻĖ░ĻĖłņØ┤ ņĪ┤ņ×¼ĒĢśļŖö ņāüĒÖ®ņØä Ļ░ĆņĀĢĒĢśļ®┤ ĒĢ┤ļŗ╣ ņÜ┤ņÜ®ņé¼ņØś ņØśņé¼Ļ▓░ņĀĢ Ļ│╝ņĀĢņØĆ ļŗżņØīĻ│╝ Ļ░Öļŗż. ņ×ÉņŗĀņØś ņÜ┤ņÜ®ņŚŁļ¤ēņØä ļäśņ¢┤ņä£ļŖö 11ņĪ░ ņøÉ ĻĘ£ļ¬©ņØś ĻĖ░ĻĖłņŚÉ ļīĆĒĢ┤ņä£ļŖö ņäĀņĀĢ Ļ▓Įņ¤üņŚÉ ņ░ĖņŚ¼ĒĢśņ¦Ć ņĢŖņ£╝ļ®░, 8ņĪ░ ĻĘ£ļ¬©ņØś OCIO ņäĀņĀĢ Ļ▓Įņ¤üņŚÉ ņ░ĖņŚ¼ĒĢ£ļŗż. 8ņĪ░ ĻĘ£ļ¬©ņØś ĻĖ░ĻĖłņŚÉ ļīĆĒĢ£ OCIOļĪ£ ņäĀņĀĢļÉśļ®┤ ļé©ņØĆ ņÜ┤ņÜ®ņŚŁļ¤ēņØś ļ▓öņ£ä ļé┤ņŚÉņä£ļŖö 3ņĪ░ ĻĘ£ļ¬©ņØś ĻĖ░ĻĖłņØĆ ņČöĻ░ĆļĪ£ ņÜ┤ņÜ®ĒĢĀ ņłś ņŚåļŗż. 8ņĪ░ ĻĘ£ļ¬©ņØś ĻĖ░ĻĖłņŚÉ ļīĆĒĢ£ OCIOļĪ£ ņäĀņĀĢļÉśņ¦Ć ņĢŖņØä Ļ▓ĮņÜ░, 3ņĪ░ ĻĘ£ļ¬©ņØĖ ļ¦łņ¦Ćļ¦ē ĻĖ░ĻĖłņØś OCIO ņäĀņĀĢ Ļ▓Įņ¤üņŚÉ ņ░ĖņŚ¼ĒĢ£ļŗż. Ļ░ÖņØĆ ņāüĒÖ®ņŚÉņä£ ņ┤Ø 20ņĪ░ ņøÉ ĻĘ£ļ¬©ņØś ņ×Éņé░ņØä ņÜ┤ņÜ®ĒĢĀ ņłś ņ׳ļŖö ņÜ┤ņÜ®ņé¼ņØś Ļ▓ĮņÜ░, 11ņĪ░ ĻĘ£ļ¬©ņØś ņ▓½ ļ▓łņ¦Ė ĻĖ░ĻĖłņØś OCIO ņäĀņĀĢ Ļ▓Įņ¤üņŚÉ ņ░ĖņŚ¼ĒĢśĻ│Ā, ļŗżņØīņ£╝ļĪ£ ļæÉ ļ▓łņ¦Ė, ņäĖ ļ▓łņ¦Ė ĻĖ░ĻĖłņØś ņ×ģņ░░ņŚÉ ņ░ĖņŚ¼ĒĢĀņ¦Ćļź╝ Ļ▓░ņĀĢĒĢ£ļŗż. ņ▓½ ļ▓łņ¦Ė(11ņĪ░ ĻĘ£ļ¬©)ņÖĆ ļæÉ ļ▓łņ¦Ė(8ņĪ░ ĻĘ£ļ¬©)ņØś ĻĖ░ĻĖłņŚÉņä£ ļ¬©ļæÉ OCIOļĪ£ ņäĀņĀĢļÉĀ Ļ▓ĮņÜ░, ņäĖ ļ▓łņ¦Ė ĻĖ░ĻĖłļČĆĒä░ļŖö ņÜ┤ņÜ®ņŚŁļ¤ēņØä ļäśņ¢┤ņä£ļ»ĆļĪ£ ņ×ģņ░░ņŚÉ ņ░ĖņŚ¼ĒĢśņ¦Ć ņĢŖļŖöļŗż.

Ļ░üĻ░üņØś ĻĖ░ĻĖłņØ┤ OCIOļź╝ ņäĀņĀĢĒĢśļŖö Ļ│╝ņĀĢņØĆ Ļ▓īņ×äņØ┤ļĪĀņŚÉņä£ņØś Ļ▓Įļ¦ż ĒśĢĒā£ļź╝ ļ│┤ņØĖļŗż. ņ¢┤ļ¢ż ĻĖ░ĻĖłņØ┤ OCIOļź╝ ņäĀņĀĢĒĢ£ļŗżĻ│Ā ĒĢĀ ļĢī, ļŗżņłśņØś ņÜ┤ņÜ®ņé¼Ļ░Ć ĒĢ┤ļŗ╣ ĻĖ░ĻĖłņØś ĻĘ£ļ¬©ļź╝ Ļ│ĀļĀżĒĢśņŚ¼ ļ╣äņÜ®ņØä ņ▒ģņĀĢĒĢśĻ│Ā, ņØ┤ļź╝ ļ░öĒāĢņ£╝ļĪ£ ņÜ┤ņÜ®ļ│┤ņłśļź╝ ņĀ£ņŗ£ĒĢ£ļŗż.

9) ĻĖ░ĻĖłņØĆ Ļ▓Įļ¦żņŚÉ ņ░ĖņŚ¼ĒĢ£ ņÜ┤ņÜ®ņé¼ ņżæ ĒĢśļéśļź╝ ņäĀĒāØĒĢśĻ▒░ļéś OCIO ņä£ļ╣äņŖżļź╝ ņé¼ņÜ®ĒĢśņ¦Ć ņĢŖņØä ņłś ņ׳ļŗż. ņ”ē,

OCIOmņØä

FundmņØ┤ ņäĀņĀĢĒĢ£ OCIOļØ╝Ļ│Ā ĒĢĀ ļĢī,

OCIOm Ōłł

ManagerņØ┤ļŗż.

Managern ņØ┤ ņĀ£ņŗ£ĒĢ£ ņÜ┤ņÜ®ļ│┤ņłśļź╝

╬▒n ņØ┤ļØ╝Ļ│Ā ĒĢĀ ļĢī,

mļ▓łņ¦Ė ĻĖ░ĻĖł(

Fundm)ņØ┤ ņ¢┤ļ¢ż ņÜ┤ņÜ®ņé¼ļź╝ OCIOļĪ£ ņäĀĒāØĒĢśļŖÉļāÉņŚÉ ļö░ļØ╝ ņÜ┤ņÜ®ļ│┤ņłśĻ░Ć Ļ▓░ņĀĢļÉ£ļŗż.

OCIOmņŚÉ ļīĆĒĢ£ ņÜ┤ņÜ®ļ│┤ņłśņØś ĒĢ©ņłśļź╝

╬▒ :ManagerŌåÆ[0,1] ņØ┤ļØ╝Ļ│Ā ĒĢĀ ļĢī, ╬▒(

Managern )=

╬▒n ,

n=0, ŌĆ”,

NņØ┤ļŗż. ņØ┤ļĢī, OCIOļź╝ ņäĀņĀĢĒĢśņ¦Ć ņĢŖņ£╝ļ®┤ ņÜ┤ņÜ®ļ│┤ņłśĻ░Ć ļ░£ņāØĒĢśņ¦Ć ņĢŖņ£╝ļ»ĆļĪ£

╬▒0 =0ņØ┤ļŗż.

Fundm ņØĆ ĒÅēĻ░ĆņĀÉņłś (

S(ŌĆó))Ļ░Ć Ļ░Ćņן ļåÆņØĆ ņÜ┤ņÜ®ņé¼ļź╝

OCIOm ļĪ£ ņäĀņĀĢĒĢ£ļŗż. ņÜ┤ņÜ®ņé¼Ļ░Ć ņĀ£ņŗ£ĒĢśļŖö OCIO ņä£ļ╣äņŖżņØś ĒÆłņ¦łņØĆ ņÜ┤ņÜ®ņŚŁļ¤ēņŚÉ ļö░ļØ╝ ņä£ļĪ£ ļŗżļź┤ļŗżĻ│Ā Ļ░ĆņĀĢĒĢ£ļŗż.

nļ▓łņ¦Ė ņÜ┤ņÜ®ņé¼ņØś ņä£ļ╣äņŖż ĒÆłņ¦łņØ┤

qn ņØ┤Ļ│Ā,

q1 >ŌĆ”>

qn >

q0ņØ┤ ņä▒ļ”ĮĒĢ£ļŗż.

q0ņØĆ OCIOļź╝ ņäĀņĀĢĒĢśņ¦Ć ņĢŖņĢśņØä ļĢīņØś ņä£ļ╣äņŖż ĒÆłņ¦łņØ┤ļ»ĆļĪ£, ĻĖ░ĻĖłņØ┤ ņ×Éņé░ņØä ņ¦üņĀæ ņÜ┤ņÜ®ĒĢśļŖö Ļ▓ĮņÜ░ņØś ĒÜ©ņÜ®ņØä ņØśļ»ĖĒĢ£ļŗż.

OCIOm ņŚÉ ļīĆĒĢ£ ņä£ļ╣äņŖż ĒÆłņ¦łņØś ĒĢ©ņłśļź╝

q :ManagerŌåÆ[

q0 ,1] ņØ┤ļØ╝Ļ│Ā ĒĢĀ ļĢī,

q(Mangern)=

qn , forŌĆä

n=0,ŌĆ”,

NņØ┤ļŗż. ņØ┤ļ¤¼ĒĢ£ Ļ░ĆņĀĢņØĆ ļŗżņ░©ņøÉ Ļ▓Įļ¦ż ļ¬©ĒśĢņŚÉ Ļ┤ĆĒĢ£ ņäĀĒ¢ēņŚ░ĻĄ¼ņØś ĒĢĄņŗ¼ņĀüņØĖ Ļ▓░Ļ│╝ļź╝ ļ░śņśüĒĢ£ļŗż.

Che(1993)ņÖĆ Asker and Cantillon(2008)ņØĆ ņ×ģņ░░ņ×ÉĻ░Ć ņäĀĒāØĒĢśļŖö ņĄ£ņĀüņØś ĒÆłņ¦łņØ┤ ļ╣äņÜ®ņŚÉ Ļ┤ĆĒĢ£ ļ¬©ņłśņŚÉ ļö░ļØ╝ Ļ▓░ņĀĢļÉ£ļŗżļŖö ņé¼ņŗżņØä ļ│┤ņØĖļŗż. ļ│Ė ņŚ░ĻĄ¼ņŚÉņä£ļŖö ņØ┤ļ¤¼ĒĢ£ Ļ▓░Ļ│╝ļź╝ ļ░śņśüĒĢśņŚ¼ ņÜ┤ņÜ®ņé¼ņØś ļ╣äņÜ® ļ¬©ņłśņŚÉ ĒĢ┤ļŗ╣ĒĢśļŖö ņÜ┤ņÜ®ņŚŁļ¤ēņŚÉ ļö░ļØ╝ ņä£ļ╣äņŖżņØś ĒÆłņ¦łņØ┤ Ļ▓░ņĀĢļÉ£ļŗżļŖö ņé¼ņŗżņØä Ļ░ĆņĀĢĒĢ£ Ļ▓āņØ┤ļŗż.

m ļ▓łņ¦Ė ĻĖ░ĻĖł(Fundm)ņØĆ ņŗØ (1)Ļ│╝ Ļ░ÖņØ┤ ĒÅēĻ░ĆņĀÉņłś(S(OCIOm))ļź╝ ĻĘ╣ļīĆĒÖöĒĢĀ ņłś ņ׳ļŖö ņÜ┤ņÜ®ņé¼ļź╝ OCIOļĪ£ ņäĀņĀĢĒĢ£ļŗż.

m ļ▓łņ¦Ė ĻĖ░ĻĖłFundmņØś OCIO ņäĀņĀĢ Ļ▓Įļ¦żņŚÉņä£ Ļ░üĻ░üņØś ņÜ┤ņÜ®ņé¼ļŖö ņ×ÉņŗĀņØś ļ╣äņÜ®Cn ņØä Ļ│ĀļĀżĒĢśņŚ¼ ņÜ┤ņÜ®ļ│┤ņłś ╬▒n Ļ│╝ ņä£ļ╣äņŖż ĒÆłņ¦łqn ņØä ņĀ£ņŗ£ĒĢ£ļŗż.nļ▓łņ¦Ė ņÜ┤ņÜ®ņé¼(Managern)ņŚÉ ļīĆĒĢ£ ĒÅēĻ░ĆņĀÉņłśļź╝sn =S(Managern )=qn -╬▒nņØ┤ļØ╝Ļ│Ā ĒĢĀ ļĢī, snņØä ņĀ£ņÖĖĒĢ£ ļŗżļźĖ ĒÅēĻ░ĆņĀÉņłś ņżæ Ļ░Ćņן ļåÆņØĆ Ļ░ÆņØĖ s-n =max[s0 , ŌĆ”, sn-1 ,sn+1 ,ŌĆ”,sN]ļ│┤ļŗżsnņØ┤ Ēü┤ Ļ▓ĮņÜ░, ManagernņØ┤ OCIOļĪ£ ņäĀņĀĢļÉśļ®░, ņÜ┤ņÜ® ĻĘ£ļ¬©ņØĖ Fm ņŚÉ ņ×ÉņŗĀņØś ņÜ┤ņÜ®ļ│┤ņłśņØĖ ╬▒n ņØä Ļ│▒ĒĢ£ ļ¦īĒü╝ņØś ĻĖłņĢĪņØä ļ░øļŖöļŗż. ĻĘĖļ”¼Ļ│Ā ņÜ┤ņÜ®ņŚÉ ļö░ļźĖ ļ╣äņÜ®ņ£╝ļĪ£Cn ņØ┤ ļ░£ņāØĒĢ£ļŗż. Ļ░Ćņן ļåÆņØĆ ĒÅēĻ░ĆņĀÉņłśļź╝ ļ░øņØĆ ņÜ┤ņÜ®ņé¼Ļ░Ć ņ┤Øk Ļ░£ ņĪ┤ņ×¼ĒĢĀ Ļ▓ĮņÜ░, ĻĘĖ ņÜ┤ņÜ®ņé¼ļōżņØĆ Ļ░ÖņØĆ ĒÅēĻ░ĆņĀÉņłśļź╝ ļ░øļŖöļŗż. ļ│Ė ņŚ░ĻĄ¼ņŚÉņä£ļŖö ĻĖ░ĻĖłņØ┤ ĒĢ┤ļŗ╣ ņÜ┤ņÜ®ņé¼ ņżæ ĒĢśļéśļź╝ ļ¼┤ņ×æņ£äļĪ£ ņäĀņĀĢĒĢ£ļŗżĻ│Ā Ļ░ĆņĀĢĒĢ£ļŗż. ņØ┤ņŚÉ ļö░ļØ╝ ņÜ┤ņÜ®ņé¼Ļ░Ć ĻĖ░ļīĆĒĢĀ ņłś ņ׳ļŖö ņØ┤ņ£żņØĆ OCIOļĪ£ ņäĀņĀĢļÉÉņØä ļĢī ņ¢╗ņØä ņłś ņ׳ļŖö ņØ┤ņ£żņØĖ ╬▒n Fm -Cn ņØäkļĪ£ ļéśļłł Ļ░ÆņØ┤ļŗż. ļ¦łņ¦Ćļ¦ēņ£╝ļĪ£ ņ¢┤ļ¢ż ļŗżļźĖ ņÜ┤ņÜ®ņé¼Ļ░Ć ņ×ÉņŗĀļ│┤ļŗż ļåÆņØĆ ĒÅēĻ░ĆņĀÉņłśļź╝ ļ░øņØä Ļ▓ĮņÜ░, OCIOļĪ£ ņäĀņĀĢļÉĀ ņłś ņŚåņ£╝ļ»ĆļĪ£ ņØ┤ņ£żņØĆ 0ņØ┤ ļÉ£ļŗż. ņØ┤ņŚÉ ļö░ļØ╝Managern ņØś ņØ┤ņ£ż ĻĘ╣ļīĆĒÖö ļ¼ĖņĀ£ļŖö ņŗØ (2)ņÖĆ Ļ░Öļŗż.

ļ│Ė ņŚ░ĻĄ¼ņŚÉņä£ļŖö ņÜ┤ņÜ®ļ░®ņŗØņŚÉ ļö░ļØ╝ ņÜ┤ņÜ®ļ╣äņÜ®ņŚÉ ļīĆĒĢ£ Ļ░ĆņĀĢņØä ļæÉ Ļ▓ĮņÜ░ļĪ£ ļéśļłäņ¢┤ ļČäņäØĒĢ£ļŗż. ņ▓½ ļ▓łņ¦Ė ņÜ┤ņÜ®ļ░®ņŗØņØĆ OCIOĻ░Ć ĻĖ░ĻĖłļ│äļĪ£ ņĀäļŗ┤ņĪ░ņ¦üņØä ĻĄ¼ņä▒ĒĢśņŚ¼ ņÜ┤ņÜ®ĒĢśļŖö Ļ▓ĮņÜ░ņØ┤ļŗż. ņÜ┤ņÜ®ņé¼Ļ░Ć ĻĘ£ļ¬©Ļ░Ć ņ×æņØĆ ĻĖ░ĻĖłņØä ņÜ┤ņÜ®ĒĢśļŹöļØ╝ļÅä, ņĀäļŗ┤ņĪ░ņ¦üņØä ĻĄ¼ņä▒ĒĢśĻĖ░ ņ£äĒĢ┤ņä£ļŖö ņØ╝ņĀĢņłśņżĆ ņØ┤ņāüņØś ļ╣äņÜ®ņØ┤ ļ░£ņāØĒĢ£ļŗż. ļö░ļØ╝ņä£ Ēü░ ĻĖ░ĻĖłņØ╝ņłśļĪØ ĻĖ░ĻĖłņØś ĻĘ£ļ¬© ļīĆļ╣ä ļ╣äņÜ®ņØś Ēü¼ĻĖ░Ļ░Ć ņżäņ¢┤ļōĀļŗż. ļö░ļØ╝ņä£ ņÜ┤ņÜ®ņé¼ļŖö ņ┤Ø ĻĖ░ĻĖłņØś ĻĘ£ļ¬©ņŚÉ ļīĆĒĢ£ ņÜ┤ņÜ®ļ╣äņÜ®ņØś ĒĢ©ņłśļź╝f ļØ╝Ļ│Ā ĒĢĀ ļĢī, ņ▓½ ļ▓łņ¦Ė ņÜ┤ņÜ®ļ░®ņŗØņŚÉņä£ Managern ņØś ļ╣äņÜ®ņØĆ ņŗØ (3)Ļ│╝ Ļ░ÖņØ┤ ņĀĢņØśĒĢĀ ņłś ņ׳ļŗż.

ļæÉ ļ▓łņ¦Ė ņÜ┤ņÜ®ļ░®ņŗØņØĆ OCIOĻ░Ć ļŗżņłśņØś ĻĖ░ĻĖłņØä ņ┤ØĻ┤äņĀüņ£╝ļĪ£ ņÜ┤ņÜ®ĒĢśļŖö Ļ▓ĮņÜ░ņØ┤ļŗż. ņ▓½ ļ▓łņ¦Ė ņÜ┤ņÜ®ļ░®ņŗØĻ│╝ ļŗ¼ļ”¼ ĻĖ░ĻĖłļ│äļĪ£ ņĀäļŗ┤ņĪ░ņ¦üņØä ĻĄ¼ņä▒ĒĢĀ ĒĢäņÜö ņŚåņØ┤ ņÜ┤ņÜ®ņé¼Ļ░Ć ņĀäņ▓┤ ņ×Éņé░ņŚÉ ļīĆĒĢ£ Ļ┤Ćļ”¼ņĪ░ņ¦üņØä ĻĄ¼ņä▒ĒĢśļ®┤ ļÉśļ»ĆļĪ£ ņÜ┤ņÜ®ņŚŁļ¤ēņØ┤ Ēü░ OCIOņØ╝ņłśļĪØ ņÜ┤ņÜ®ņŚÉ ļö░ļźĖ ļ╣äņÜ®ņØ┤ ļé«ļŗż. ņŗØ (4)ņŚÉņä£ņÖĆ ļŗżļź┤Ļ▓ī ļæÉ ļ▓łņ¦Ė ņÜ┤ņÜ®ļ░®ņŗØņŚÉņä£ļŖö ņÜ┤ņÜ®ņé¼Ļ░Ć ņÜ┤ņÜ®ĒĢśļŖö ņĀäņ▓┤ ĻĖ░ĻĖłņŚÉ ļīĆĒĢ┤ ņÜ┤ņÜ®ņĪ░ņ¦üņØä ĻĄ¼ņä▒ĒĢśļ»ĆļĪ£ ņÜ┤ņÜ®ĒĢśļŖö ĻĖ░ĻĖłņØś ņ┤Ø ĻĘ£ļ¬© ļīĆļ╣ä ļ╣äņÜ®ņØ┤ ņÜ┤ņÜ®ņŚŁļ¤ēņØĖ

On ņŚÉ ļö░ļØ╝ Ļ▓░ņĀĢļÉ£ļŗż. ņØ┤ņŚÉ ļö░ļØ╝ ļæÉ ļ▓łņ¦Ė ņÜ┤ņÜ®ļ░®ņŗØņŚÉņä£

Managern ņØś ļ╣äņÜ®ņØĆ ņŗØ (4)ņÖĆ Ļ░ÖņØ┤ ņĀĢņØśĒĢĀ ņłś ņ׳ļŗż.

10)

ņÜ┤ņÜ®ņŚŁļ¤ēņŚÉ ļö░ļØ╝ ņÜ┤ņÜ®ņé¼ņØś ņä£ļ╣äņŖż ĒÆłņ¦łņØ┤ ņä£ļĪ£ ļŗżļź┤ļ»ĆļĪ£ ņÜ┤ņÜ®ņŚŁļ¤ēņØś Ļ│ĄĻ░£ ņŚ¼ļČĆĻ░Ć Ļ░£ļ│ä ņÜ┤ņÜ®ņé¼ņØś ņĀäļץ Ļ▓░ņĀĢņŚÉ ņśüĒ¢źņØä ļ»Ėņ╣Ā ņłś ņ׳ļŗż. ļö░ļØ╝ņä£ Ļ░ü ņÜ┤ņÜ®ņé¼Ļ░Ć Ļ▓Įņ¤üņé¼ņØś ņÜ┤ņÜ®ņŚŁļ¤ēņØä ļ¬©ļź╝ ļĢīņŚÉ ļīĆĒĢ£ ļČäņäØņØ┤ ĒĢäņÜöĒĢśļŗż. ļö░ļØ╝ņä£ ļ│Ė ņŚ░ĻĄ¼ņŚÉņä£ļŖö ņ┤Ø ļäż Ļ░Ćņ¦Ć ĒśĢĒā£ņØś Ļ▓Įļ¦ż Ļ▓īņ×äņØä ĻĄ¼ņä▒ĒĢśņŚ¼ ļČäņäØņØä ņ¦äĒ¢ēĒĢ£ļŗż. ĻĖ░ĻĖłļ│äļĪ£ ņĀäļŗ┤ņĪ░ņ¦üņØä ĻĄ¼ņä▒ĒĢśļŖö ņ▓½ ļ▓łņ¦Ė ņÜ┤ņÜ®ļ░®ņŗØĻ│╝ OCIOĻ░Ć ņ┤ØĻ┤äņĀüņ£╝ļĪ£ ņ×Éņé░ņØä Ļ┤Ćļ”¼ĒĢśļŖö ļæÉ ļ▓łņ¦Ė ņÜ┤ņÜ®ļ░®ņŗØņŚÉ ļīĆĒĢ┤ Ļ░üĻ░ü ņÜ┤ņÜ®ņŚŁļ¤ēņØ┤ Ļ│ĄĻ░£ļÉśļŖö Ļ▓ĮņÜ░ņÖĆ ĻĘĖļĀćņ¦Ć ņĢŖņØĆ Ļ▓ĮņÜ░ļź╝ ļéśļłĀ ļČäņäØĒĢ£ļŗż. ņ┤Ø ļäż ļ▓łņØś Ļ▓Įļ¦ż Ļ▓īņ×äņŚÉņä£ Ļ░£ļ│ä ĻĖ░ĻĖłņØś OCIO ņäĀņĀĢĻ│╝ņĀĢņØä ļČäņäØĒĢśņŚ¼ ļé┤ņē¼ĻĘĀĒśĢ(Nash equilibrium)ņØä ļÅäņČ£ĒĢ£ ļÆż, ĻĖ░ĻĖłņØś ĻĘ£ļ¬©ņŚÉ ļö░ļØ╝ OCIO ņäĀņĀĢņØ┤ ņł£ņ░©ņĀüņ£╝ļĪ£ ņØ┤ļŻ©ņ¢┤ņ¦ĆļŖö ņāüĒÖ®ņØś ĻĘĀĒśĢņØä ļČäņäØĒĢ£ļŗż. ņØ┤ļĢīņØś ļé┤ņē¼ĻĘĀĒśĢņØĆ Ļ▓īņ×äņŚÉ ņ░ĖņŚ¼ĒĢ£ ļ¬©ļōĀ Ļ▓ĮĻĖ░ņ×É(player)Ļ░Ć ņ×ÉņŗĀņØś ņĀäļץ(strategy)ņØä ļ░öĻ┐Ć ņ£ĀņØĖņØ┤ ņŚåļŖö ĻĘĀĒśĢņāüĒÖ®ņØä ņØśļ»ĖĒĢ£ļŗż.

ņÜ░ņäĀ ĻĖ░ĻĖłļ│äļĪ£ ņĀäļŗ┤ņĪ░ņ¦üņØä ĻĄ¼ņä▒ĒĢśļŖö Ļ▓ĮņÜ░ļź╝ ļČäņäØĒĢśļ®┤ ļŗżņØīĻ│╝ Ļ░Öļŗż. ņØ┤ļĢī, ņÜ┤ņÜ®ņé¼ļŖö ļ¬©ļæÉ OCIOļĪ£ ņäĀņĀĢļÉśņŚłņØä ļĢī, f(Fm)ŌĆóFmņØś ļ╣äņÜ®ņØ┤ ļ░£ņāØĒĢ£ļŗż. ņÜ┤ņÜ®ņŚŁļ¤ēņØä ņä£ļĪ£ ņĢīĻ│Ā ņ׳ņØä ļĢī, ņä£ļ╣äņŖż ĒÆłņ¦łņØ┤ Ļ░Ćņן ļåÆņØĆ ņ▓½ ļ▓łņ¦Ė ņÜ┤ņÜ®ņé¼(Manager1)Ļ░Ć f(Fm) +(q1 -q2)ļ│┤ļŗż ņĪ░ĻĖł ņ×æņØĆ ņłśņżĆņ£╝ļĪ£ ņÜ┤ņÜ®ļ│┤ņłś╬▒1 ņØä ņĀ£ņŗ£ĒĢśĻ│Ā, ļŗżļźĖ ļ¬©ļōĀ ņÜ┤ņÜ®ņé¼(Managern, n=2, ŌĆ”, N)Ļ░Ćf(Fm)Ļ░Ćļ¦īĒü╝ņØä ņÜ┤ņÜ®ļ│┤ņłśļĪ£ ņĀ£ņŗ£ĒĢśļŖö Ļ▓ĮņÜ░Ļ░Ć ļé┤ņē¼ĻĘĀĒśĢņØ┤ ļÉĀ ņłś ņ׳ļŗż. Manager1ņØś ņ×ģņןņŚÉņä£ļŖö╬▒1 < f(Fm ) ņØĖ Ļ▓ĮņÜ░, OCIOļĪ£ ņäĀņĀĢļÉśņ¦Ćļ¦ī, ņåÉĒĢ┤ļź╝ ļ│┤Ļ▓ī ļÉśĻ│Ā, ╬▒1 Ōē¦ f(Fm)+(q1-q2) ņØĖ Ļ▓ĮņÜ░, ļæÉ ļ▓łņ¦Ė ņÜ┤ņÜ®ņé¼(Manager2)Ļ░Ć OCIOļĪ£ ņäĀņĀĢļÉĀ ņ£äĒŚśņØ┤ ņ׳ļŗż. f(Fm) Ōē” ╬▒1 < f(Fm)+(q1-q2)ņØĖ Ļ▓ĮņÜ░, OCIOļĪ£ ņäĀņĀĢļÉśļ»ĆļĪ£, Manager1ņØĆ ņØ┤ ņżæ Ļ░Ćņן ļåÆņØĆ ņØ┤ņ£żņØä ļé╝ ņłś ņ׳ļŖö f(Fm)+(q1-q2) -╬Ą ļ¦īĒü╝ņØś ņÜ┤ņÜ®ļ│┤ņłśļź╝ ņĀ£ņŗ£ĒĢ£ļŗż. ļŗżļźĖ ņÜ┤ņÜ®ņé¼ņØś Ļ▓ĮņÜ░, ╬▒n < f(Fm)ņØĖ Ļ▓ĮņÜ░, OCIOļĪ£ ņäĀņĀĢļÉśļŹöļØ╝ļÅä ņåÉĒĢ┤ļź╝ ļ│┤Ļ│Ā, ╬▒n > f(Fm)ņØĖ Ļ▓ĮņÜ░, OCIOļĪ£ ņäĀņĀĢļÉśņ¦Ć ļ¬╗ĒĢ£ļŗż. ļö░ļØ╝ņä£ ņÜ┤ņÜ®ņŚŁļ¤ēņØ┤ ļåÆņØĆ ņåīņłśņØś ņÜ┤ņÜ®ņé¼Ļ░Ć OCIO ņŗ£ņןņØä ļÅģĻ│╝ņĀÉĒĢ£ļŗż.

ļŗżņØīņ£╝ļĪ£ ņÜ┤ņÜ®ņŚŁļ¤ēņØ┤ Ļ│ĄĻ░£ļÉśņ¦Ć ņĢŖņØĆ ņāüĒÖ®ņŚÉņä£ ĻĖ░ĻĖłļ│ä ņĀäļŗ┤ņĪ░ņ¦üņØä ĻĄ¼ņä▒ĒĢśļŖö Ļ▓ĮņÜ░ļź╝ ļČäņäØĒĢśļ®┤ ļŗżņØīĻ│╝ Ļ░Öļŗż. ņÜ┤ņÜ®ņŚŁļ¤ēņØ┤ ļåÆņØäņłśļĪØ ņä£ļ╣äņŖż ĒÆłņ¦łņØ┤ ļåÆņ£╝ļ»ĆļĪ£, Ļ░£ļ│ä ņÜ┤ņÜ®ņé¼Ļ░Ć ļŗżļźĖ ņÜ┤ņÜ®ņé¼ņØś ņä£ļ╣äņŖż ĒÆłņ¦łņØ┤ ĻĘĀļō▒ļČäĒżļź╝ ļö░ļźĖļŗżĻ│Ā ļ»┐ļŖöļŗż(

qn Ōł╝

i.i.d.Uniform[q0,1]).

11) ņÜ┤ņÜ®ņé¼ņØś ņÜ┤ņÜ®ļ│┤ņłśļŖö ņ×ÉņŗĀņØś ņä£ļ╣äņŖż ĒÆłņ¦łņŚÉ ļö░ļØ╝ Ļ▓░ņĀĢļÉ£ļŗż(

╬▒n=B(qn)). ņØ┤ļĢī, Ļ░ĢĒĢ£ ļŗ©ņĪ░ĒĢ©ņłś(strictly monotonic function)ņØĖ

BļŖö Ļ░£ļ│ä ņÜ┤ņÜ®ņé¼ņØś ņĄ£ņĀüļ░śņØæĒĢ©ņłśļĪ£ ļ¬©ļōĀ ņÜ┤ņÜ®ņé¼ņŚÉ ļīĆĒĢ┤ ļÅÖņØ╝ĒĢśļŗżĻ│Ā Ļ░ĆņĀĢĒĢ£ļŗż.

nļ▓łņ¦Ė Ļ░£ļ│ä ņÜ┤ņÜ®ņé¼(

Managern)ņØś ĒÅēĻ░ĆņĀÉņłś(

qn-╬▒n)Ļ░Ć ļŗżļźĖ ņÜ┤ņÜ®ņé¼ļ│┤ļŗż Ēü┤ ļĢī OCIOļĪ£ ņäĀņĀĢļÉśņ¢┤,

Managern ņØĆ

╬▒n -f(Fm)ņØś ņØ┤ņ£żņØä ņ¢╗ļŖöļŗż. ņØ┤ņŚÉ ļö░ļØ╝

Managern ņØś ĻĖ░ļīĆņØ┤ņ£żĒĢ©ņłśļź╝ ņĀĢļ”¼ĒĢśļ®┤ ņŗØ (5)ņÖĆ Ļ░Öļŗż.

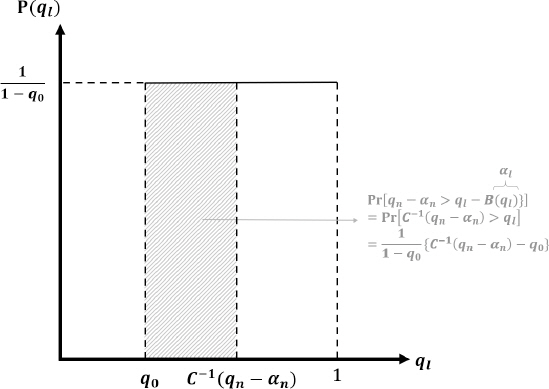

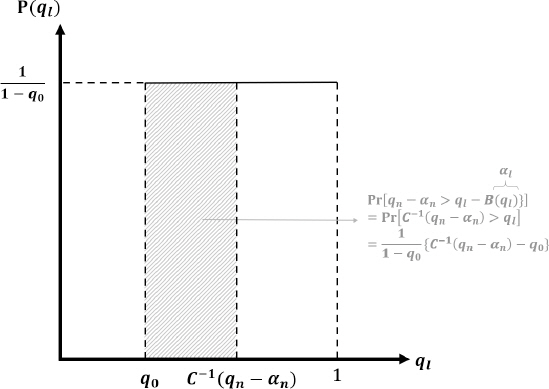

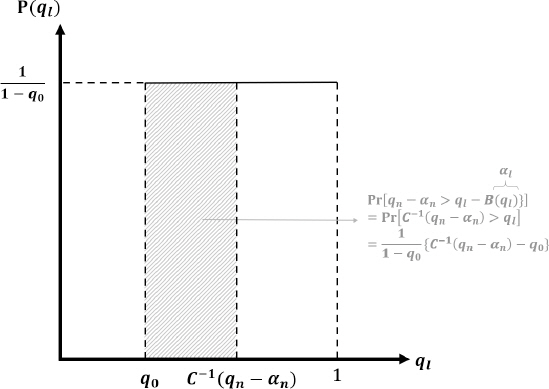

Managern ņŚÉ ļīĆĒĢ£ ĒÅēĻ░ĆņĀÉņłś(qn-╬▒n)Ļ░Ć ļŗżļźĖ ļ¬©ļōĀ ņÜ┤ņÜ®ņé¼ņŚÉ ļīĆĒĢ£ ĒÅēĻ░ĆņĀÉņłśļ│┤ļŗż Ēü┤ ĒÖĢļźĀņØĖ Pr[qn-╬▒n┬Ā>┬Āq-n-B(q-n)]ņØä Ļ│äņé░ĒĢśļ®┤ ņŗØ (6)Ļ│╝ Ļ░Öļŗż. Ļ░ü ņÜ┤ņÜ®ņé¼ņØś ņłśņØĄļźĀņØ┤ ļÅģļ”ĮņĀüņØ┤Ļ│Ā ļÅÖņØ╝ĒĢśĻ▓ī ļČäĒżļÉśņ¢┤ņ׳ļŗżĻ│Ā Ļ░ĆņĀĢĒĢśņśĆņ£╝ļ»ĆļĪ£, ManagernņØ┤ Ļ░Ćņן ļåÆņØĆ ĒÅēĻ░ĆņĀÉņłśļź╝ ļ░øņØä ĒÖĢļźĀņØĆ╬▒n ņØ┤ ļŗżļźĖ ņÜ┤ņÜ®ņé¼(Manager1, lŌēĀn)Ļ░Ć ļ░øņØĆ ĒÅēĻ░ĆņĀÉņłś(ql-B(ql))ļ│┤ļŗż ļåÆņØä ĒÖĢļźĀņØś Ļ│▒ņ£╝ļĪ£ ņĀĢļ”¼ĒĢĀ ņłś ņ׳ļŗż.

qn-╬▒n ņØ┤ ļŗżļźĖ ņ¢┤ļ¢ż ĒŖ╣ņĀĢ ņÜ┤ņÜ®ņé¼(

Managerl)ņŚÉ ļīĆĒĢ£ ĒÅēĻ░ĆņĀÉņłś(

ql-B(ql))ļ│┤ļŗż ļåÆņØä ĒÖĢļźĀņØĆ

<ĻĘĖļ”╝ 1>Ļ│╝ Ļ░ÖņØ┤ Ļ│äņé░ĒĢĀ ņłś ņ׳ļŗż. ņØ┤ļĢī,

C(ql)=ql -B(ql)ņØ┤ļŗż.

ļö░ļØ╝ņä£Managern ņØś ĻĖ░ļīĆņØ┤ņ£ż ĻĘ╣ļīĆĒÖö ļ¼ĖņĀ£ļŖö ņŗØ (7)Ļ│╝ Ļ░ÖņØ┤ ņĀĢļ”¼ĒĢĀ ņłś ņ׳ļŗż.

Managern ņØĆ ņŗØ (7)ņØä ņÜ┤ņÜ®ļ│┤ņłś╬▒n ņŚÉ ļīĆĒĢ┤ ĻĘ╣ļīĆĒÖöĒĢ£ļŗż. ņŗØ (8)ņØĆ ņØ┤ļź╝ ņ£äĒĢ┤ 1Ļ│ä ņĪ░Ļ▒┤ņØä Ļ│äņé░ĒĢ£ Ļ▓āņØ┤ļŗż.

ņĄ£ņĀüļ░śņØæĒĢ©ņłś

BļŖö ļ¬©ļōĀ ņÜ┤ņÜ®ņé¼ņŚÉ ļīĆĒĢśņŚ¼ ļīĆņ╣ŁņĀüņØ┤ļ®░,

╬▒n=B(qn)ņØ┤ļŗż.

╬▒n=B(qn) ļź╝ ņŗØ (8)ņŚÉ ļīĆņ×ģĒĢśņŚ¼ ņĀĢļ”¼ĒĢśļ®┤, ņŗØ (9)ņÖĆ Ļ░Öļŗż.

12)

ĻĖ░ĻĖłņØĆ ņłśņØĄļźĀņØ┤ ļåÆņØĆ ņÜ┤ņÜ®ņé¼ļź╝ ņäĀĒśĖĒĢśļ»ĆļĪ£ ņÜ┤ņÜ®ļ│┤ņłśļź╝ ļ¬©ļæÉf(Fm)ļ¦īĒü╝ ņĀ£ņŗ£ĒĢśĻ▓ī ļÉśļŹöļØ╝ļÅä ĻĖ░ĻĖłņØĆ ņłśņØĄļźĀņØ┤ Ļ░Ćņן ļåÆņØĆ ņÜ┤ņÜ®ņé¼ļź╝ OCIOļĪ£ ņäĀņĀĢĒĢ£ļŗżļŖö ņĀÉņŚÉņä£ ņŗ£ņן ĻĘĀĒśĢņØĆ ļŗżļź┤Ļ▓ī ļéśĒāĆļé£ļŗż. ĻĖ░ĻĖłļ│äļĪ£ ņĀäļŗ┤ņĪ░ņ¦üņØä ĻĄ¼ņä▒ĒĢśļŖö Ļ▓ĮņÜ░ļŖö ņłśņØĄļźĀņØś ņ░©ņØ┤Ļ░Ć ļ░£ņāØĒĢśĻ▓ī ļÉśņŚłņØä ļĢī, ļÅģņĀÉ ĒśäņāüņØ┤ ļéśĒāĆļé£ļŗż.

<ĻĘĖļ”╝┬Ā1>

ņ¢┤ļ¢ż ņÜ┤ņÜ®ņé¼ņŚÉ ļīĆĒĢ£ ĒÅēĻ░ĆņĀÉņłśĻ░Ć ļŗżļźĖ ņÜ┤ņÜ®ņé¼ļ│┤ļŗż ļåÆņØä ĒÖĢļźĀ

ņĢäļל ĻĘĖļ”╝ņØĆnļ▓łņ¦Ė ņÜ┤ņÜ®ņé¼ņŚÉ ļīĆĒĢ£ ĒÅēĻ░ĆņĀÉņłś(qn-╬▒n)Ļ░Ćlļ▓łņ¦Ė ņÜ┤ņÜ®ņé¼ņŚÉ ļīĆĒĢ£ ĒÅēĻ░ĆņĀÉņłś(ql -╬▒l)ļ│┤ļŗż ļåÆņØä ĒÖĢļźĀņØä ļ│┤ņŚ¼ņżĆļŗż.lļ▓łņ¦Ė ņÜ┤ņÜ®ņé¼ņØś ņä£ļ╣äņŖż ĒÆłņ¦łqlņØś ĒÖĢļźĀļČäĒżĻ░Ć ņĢäļלņÖĆ Ļ░ÖņØä ļĢī, qn-╬▒nņØ┤ql -╬▒l ļ│┤ļŗż ļåÆņØä ĒÖĢļźĀņØĆ ļ╣ŚĻĖł ņ╣£ ņśüņŚŁņØś ļäōņØ┤ņÖĆ Ļ░Öļŗż.

OCIOĻ░Ć ņ┤ØĻ┤äņĀüņ£╝ļĪ£ ĻĖ░ĻĖłņØä ņÜ┤ņÜ®ĒĢśļŖö Ļ▓ĮņÜ░, ņÜ┤ņÜ®ņé¼ļŖö OCIOļĪ£ ņäĀņĀĢļÉśņŚłņØä ļĢī, ņ×ÉņŗĀņØś ņŚŁļ¤ēņŚÉ ļö░ļØ╝f(On)ŌĆóFmņØś ņÜ┤ņÜ®ļ╣äņÜ®ņØ┤ ļ░£ņāØĒĢ£ļŗż. ņÜ┤ņÜ®ņŚŁļ¤ēņØä ņä£ļĪ£ ņĢīĻ│Ā ņ׳ļŖö Ļ▓ĮņÜ░, ņłśņØĄļźĀņØ┤ Ļ░Ćņן ļåÆņØĆ ņ▓½ ļ▓łņ¦Ė ņÜ┤ņÜ®ņé¼(Manager1)Ļ░Ćf(O2)+(q1-q2)ļ│┤ļŗż ņĪ░ĻĖł ņ×æņØĆ ņłśņżĆņ£╝ļĪ£ ņÜ┤ņÜ®ļ│┤ņłśļź╝ ņĀ£ņŗ£ĒĢśĻ│Ā, ļŗżļźĖ ļ¬©ļōĀ ņÜ┤ņÜ®ņé¼(Managern , n=2, ŌĆ”, N)Ļ░Ćf(On) ļ¦īĒü╝ņØä ņÜ┤ņÜ®ļ│┤ņłśļĪ£ ņĀ£ņŗ£ĒĢśļŖö Ļ▓ĮņÜ░Ļ░Ć ļé┤ņē¼ĻĘĀĒśĢņØ┤ ļÉĀ ņłś ņ׳ļŗż. Manager1ņØĆ╬▒1 < f(O1)ņØĖ Ļ▓ĮņÜ░, OCIOļĪ£ ņäĀņĀĢļÉśņ¦Ćļ¦ī, ņåÉĒĢ┤ļź╝ ļ│┤Ļ▓ī ļÉśĻ│Ā, ╬▒1 Ōē¦ f(O2)+(q1-q2)ņØĖ Ļ▓ĮņÜ░, ļæÉ ļ▓łņ¦Ė ņÜ┤ņÜ®ņé¼(Manager2)Ļ░Ć OCIOļĪ£ ņäĀņĀĢļÉĀ ņ£äĒŚśņØ┤ ņ׳ļŗż. f(O1) Ōē” ╬▒1 < f(O2)+(q1-q2) ņØĖ Ļ▓ĮņÜ░, OCIOļĪ£ ņäĀņĀĢļÉśļ»ĆļĪ£, Manager1ņØĆ ņØ┤ ņżæ Ļ░Ćņן Ēü░ ņØ┤ņ£żņØä ļé╝ ņłś ņ׳ļŖöf(O2)+(q1-q2)-╬Ą ļ¦īĒü╝ņØś ņÜ┤ņÜ®ļ│┤ņłśļź╝ ņĀ£ņŗ£ĒĢ£ļŗż. ļŗżļźĖ ņÜ┤ņÜ®ņé¼ņØś Ļ▓ĮņÜ░, ╬▒n < f(On) ņØĖ Ļ▓ĮņÜ░, OCIOļĪ£ ņäĀņĀĢļÉśļŹöļØ╝ļÅä ņåÉĒĢ┤ļź╝ ļ│┤Ļ│Ā, ╬▒n > f(On)ņØĖ Ļ▓ĮņÜ░, OCIOļĪ£ ņäĀņĀĢļÉśņ¦Ć ļ¬╗ĒĢ£ļŗż.

ņÜ┤ņÜ®ņé¼Ļ░Ć ņä£ļĪ£ņØś ņÜ┤ņÜ®ņŚŁļ¤ēņØä ļ¬©ļź┤ļŖö Ļ▓ĮņÜ░ņŚÉ ļīĆĒĢ£ ļČäņäØņØĆ ļŗżņØīĻ│╝ Ļ░Öļŗż. ņĀäļŗ┤ņĪ░ņ¦üņØä ĻĄ¼ņä▒ĒĢśļŖö Ļ▓ĮņÜ░ ļ¦łņ░¼Ļ░Ćņ¦ĆļĪ£ Ļ░£ļ│ä ņÜ┤ņÜ®ņé¼ļŖö ļŗżļźĖ ņÜ┤ņÜ®ņé¼ņØś ņä£ļ╣äņŖż ĒÆłņ¦łņØ┤ ĻĘĀļō▒ļČäĒżļź╝ ļö░ļźĖļŗżĻ│Ā ļ»┐ļŖöļŗż (qn Ōł╝i.i.d.Uniform[q0 ,1]). ņÜ┤ņÜ®ņé¼ņØś ņÜ┤ņÜ®ļ│┤ņłśļŖö ņ×ÉņŗĀņØś ņłśņØĄļźĀņŚÉ ļö░ļØ╝ Ļ▓░ņĀĢļÉ£ļŗż(╬▒n=B(qn)). ņØ┤ļĢī,BļŖö Ļ░£ļ│ä ņÜ┤ņÜ®ņé¼ņØś ņĄ£ņĀüļ░śņØæĒĢ©ņłśļĪ£ ļ»ĖļČä Ļ░ĆļŖźĒĢśļ®░, ļ¬©ļōĀ ņÜ┤ņÜ®ņé¼ņŚÉ ļīĆĒĢ┤ ļÅÖņØ╝ĒĢśĻ│Ā ļŗ©ņĪ░ ņ”ØĻ░ĆĒĢ£ļŗżĻ│Ā Ļ░ĆņĀĢĒĢ£ļŗż.nļ▓łņ¦Ė Ļ░£ļ│ä ņÜ┤ņÜ®ņé¼(Managern)ļŖö ņ×ÉņŗĀņØś ĒÅēĻ░ĆņĀÉņłś(qn-╬▒n)Ļ░Ć ļŗżļźĖ ņÜ┤ņÜ®ņé¼ ļōżļ│┤ļŗż Ēü┤ Ļ▓ĮņÜ░ OCIOļĪ£ ņäĀņĀĢļÉśņ¢┤╬▒n - f(On)ņØś ņØ┤ņ£żņØä ņ¢╗ļŖöļŗż. ņØ┤ņŚÉ ļö░ļØ╝Managern ņØś ĻĖ░ļīĆņØ┤ņ£ż ĒĢ©ņłśļź╝ ņĀĢļ”¼ĒĢśļ®┤ ņŗØ (10)Ļ│╝ Ļ░Öļŗż.

Managern ņØś ĒÅēĻ░ĆņĀÉņłśĻ░Ć ļŗżļźĖ ļ¬©ļōĀ ņÜ┤ņÜ®ņé¼ņØś ĒÅēĻ░ĆņĀÉņłśļ│┤ļŗż ņ×æņØä ĒÖĢļźĀņØĖ Pr[qn -╬▒n > q-n-B(q-n)] ņŚÉ ļīĆĒĢ£ Ļ│äņé░ņØĆ ņØ┤ņĀäĻ│╝ Ļ░Öļŗż. f(On)ņØĆ ņÜ┤ņÜ®ņŚŁļ¤ēņŚÉ ļö░ļźĖ ļ╣äņÜ®ņØä ņØśļ»ĖĒĢśļŖöļŹ░, ņÜ┤ņÜ®ņŚŁļ¤ēņØ┤ ļåÆņØäņłśļĪØ ļé«ņØĆ Ļ░ÆņØä Ļ░¢ļŖöļŗż. ļśÉĒĢ£, ņÜ┤ņÜ®ņŚŁļ¤ēņØ┤ ļåÆņØäņłśļĪØ ņłśņØĄļźĀņØ┤ ļåÆļŗżĻ│Ā Ļ░ĆņĀĢĒĢśļ»ĆļĪ£, f(On)ņØĆqn ņŚÉ ļīĆĒĢ£ ĒĢ©ņłśļĪ£ ņĀĢļ”¼ĒĢĀ ņłś ņ׳ļŗż. ļö░ļØ╝ņä£f(On)=g(qn) ņØ┤ļØ╝Ļ│Ā ņĀĢņØśĒĢ£ļŗż. ņä£ļ╣äņŖż ĒÆłņ¦łņØ┤ ļåÆņØäņłśļĪØ ņÜ┤ņÜ®ņŚŁļ¤ēņØ┤ ļåÆļŗżļŖö Ļ▓āņØä ņØśļ»ĖĒĢśļ»ĆļĪ£ g ļŖöqn ņŚÉ ļīĆĒĢ£ Ļ░ÉņåīĒĢ©ņłśņØ┤ļ»ĆļĪ£, gŌĆÖ < 0,ŌĆägŌĆÖŌĆÖ > 0 ņ×äņØä Ļ░ĆņĀĢĒĢ£ļŗż.

ļö░ļØ╝ņä£Managern ņØś ĻĖ░ļīĆņØ┤ņ£ż ĻĘ╣ļīĆĒÖö ļ¼ĖņĀ£ļŖö ņŗØ (11)Ļ│╝ Ļ░ÖņØ┤ ņĀĢļ”¼ĒĢĀ ņłś ņ׳ļŗż.

Managern ņØĆ ņŗØ (11)ņØä ņÜ┤ņÜ®ļ│┤ņłś╬▒n ņŚÉ ļīĆĒĢ┤ ĻĘ╣ļīĆĒÖöĒĢ£ļŗż. ņŗØ (12)ļŖö ņØ┤ļź╝ ņ£äĒĢ┤ 1Ļ│ä ņĪ░Ļ▒┤ņØä Ļ│äņé░ĒĢ£ Ļ▓āņØ┤ļŗż.

ņĄ£ņĀüļ░śņØæĒĢ©ņłś

BļŖö ļ¬©ļōĀ ņÜ┤ņÜ®ņé¼ņŚÉ ļīĆĒĢśņŚ¼ ļīĆņ╣ŁņĀüņØ┤ļ®░,

╬▒n=B(qn) ņØ┤ļŗż.

╬▒n=B(qn) ļź╝ ņŗØ (12)ņŚÉ ļīĆņ×ģĒĢśņŚ¼ ņĀĢļ”¼ĒĢśļ®┤, ņŗØ (13)Ļ│╝ Ļ░Öļŗż.

13)

ņŗØ (13)ņŚÉņä£g(qn)=f(On) ļĪ£ ņÜ┤ņÜ®ņé¼ņØś ļ╣äņÜ®ņØä ļéśĒāĆļéĖļŗż. J(q) ļŖö ņĀĢļ│┤ ļ╣äļīĆņ╣Łņä▒ņŚÉ ļö░ļØ╝ Ļ░ü ņÜ┤ņÜ®ņé¼Ļ░Ć ņ×ÉņŗĀņØś ļ╣äņÜ®ņØä Ļ░ÉņČöļŖö ņĀĢļÅäļź╝ ļéśĒāĆļé┤ļ®░, gŌĆÖ<0 ņØ┤ĻĖ░ ļĢīļ¼ĖņŚÉJ(qn)ļŖö ņ¢æņØś Ļ░ÆņØä Ļ░Ćņ¦äļŗż. ņ”ē, ņÜ┤ņÜ®ņé¼ļŖö ņ×ÉņŗĀņØś ļ╣äņÜ®ļ│┤ļŗż ņĪ░ĻĖł ļåÆņØĆ ņłśņżĆņØś ņÜ┤ņÜ®ļ│┤ņłśļź╝ ņĀ£ņŗ£ĒĢ£ļŗż. ņŗØ (13)ņŚÉņä£d╬▒n/dqn ņØä Ļ│äņé░ĒĢśļ®┤ ņŗØ (14)ņÖĆ Ļ░Öļŗż. gŌĆÖ<0 ņØ┤ļ»ĆļĪ£, ņŗØ (14)ņŚÉņä£d╬▒n/dqn ņ×äņØä ĒÖĢņØĖĒĢĀ ņłś ņ׳ļŗż.

ņØ┤ļŖö ņä£ļ╣äņŖż ĒÆłņ¦łĻ│╝ ņÜ┤ņÜ®ņŚŁļ¤ēņØ┤ ļåÆņØĆ ņÜ┤ņÜ®ņé¼ņØ╝ņłśļĪØ ļé«ņØĆ ņÜ┤ņÜ®ļ│┤ņłśļź╝ ņĀ£ņŗ£ĒĢ£ļŗżļŖö Ļ▓āņØä ņØśļ»ĖĒĢ£ļŗż. ļö░ļØ╝ņä£ Ļ░Ćņן ļåÆņØĆ ņÜ┤ņÜ®ņŚŁļ¤ēņØä Ļ░¢ļŖö ņÜ┤ņÜ®ņé¼Ļ░Ć OCIOļĪ£ ņäĀņĀĢļÉ£ļŗż. ņ”ē, ņ┤ØĻ┤äņĀüņ£╝ļĪ£ ĻĖ░ĻĖłņØä ņÜ┤ņÜ®ĒĢśļŖö Ļ▓ĮņÜ░ņŚÉļÅä ņĀäļŗ┤ņĪ░ņ¦üņØä ĻĄ¼ņä▒ĒĢśļŖö Ļ▓ĮņÜ░ņÖĆ ļ¦łņ░¼Ļ░Ćņ¦ĆļĪ£ ņÜ┤ņÜ®ņŚŁļ¤ēņØ┤ ļåÆņØĆ ņåīņłśņØś ņÜ┤ņÜ®ņé¼Ļ░Ć ņŗ£ņןņØä ļÅģĻ│╝ņĀÉĒĢśĻ▓ī ļÉ£ļŗż.

ĒĢśņ¦Ćļ¦ī ņÜ┤ņÜ®ļ░®ņŗØņŚÉ ļö░ļØ╝ ĻĖ░ĻĖłņØś ņØśņé¼Ļ▓░ņĀĢņŚÉļŖö ņ░©ņØ┤Ļ░Ć ņāØĻĖ┤ļŗż. ņØ┤ļź╝ ĒÖĢņØĖĒĢśĻĖ░ ņ£äĒĢ┤ ņÜ┤ņÜ®ļ░®ņŗØļ│äļĪ£ OCIO ņäĀņĀĢ Ļ▓Įņ¤üņØ┤ ļ░śļ│ĄļÉśļŖö ņāüĒÖ®ņØä ļČäņäØĒĢśļ®┤ ļŗżņØīĻ│╝ Ļ░Öļŗż. ņÜ┤ņÜ®ļ░®ņŗØĻ│╝ ļ¼┤Ļ┤ĆĒĢśĻ▓ī ĻĖ░ĻĖłņØĆ ņÜ┤ņÜ®ņŚŁļ¤ēņØ┤ Ļ░Ćņן ļåÆņØĆ ņÜ┤ņÜ®ņé¼ļź╝ OCIOļĪ£ ņäĀņĀĢĒĢ£ļŗż. ļö░ļØ╝ņä£ OCIO ņŗ£ņןņØś ĻĘĀĒśĢņØĆ ļ╣äņŖĘĒĢśĻ▓ī ļéśĒāĆļé£ļŗż. ĒĢśņ¦Ćļ¦ī ņÜ┤ņÜ®ļ░®ņŗØņŚÉ ļö░ļØ╝ ņÜ┤ņÜ®ļ│┤ņłśņŚÉ ņ░©ņØ┤Ļ░Ć ļ░£ņāØĒĢśĻĖ░ ļĢīļ¼ĖņŚÉ ĻĖ░ĻĖłņØś ĻĘ£ļ¬©Ļ░Ć ņØ╝ņĀĢ ņłśņżĆ ņØ┤ĒĢśņØĖ ĻĖ░ĻĖłņØĆ OCIOļź╝ ņäĀņĀĢĒĢśņ¦Ć ņĢŖņØä ņłś ņ׳ļŗż. ĻĖ░ĻĖłņØ┤ OCIOļź╝ ņäĀņĀĢĒĢśņ¦Ć ņĢŖĻ│Ā ņŖżņŖżļĪ£ ņ×Éņé░ņØä Ļ┤Ćļ”¼ĒĢĀ Ļ▓ĮņÜ░ ņÜ┤ņÜ®ļ│┤ņłśļŖö ļ░£ņāØĒĢśņ¦Ć ņĢŖĻ│Ā

q0 ļ¦īĒü╝ņØś ĒÜ©ņÜ®ņØä ņ¢╗ļŖöļŗżĻ│Ā ĒĢĀ ļĢī, ĻĖ░ĻĖłņØĆ OCIOņØś ĒÅēĻ░ĆņĀÉņłśĻ░Ć

q0ļ│┤ļŗż Ēü┤ Ļ▓ĮņÜ░ņŚÉļ¦ī OCIOļź╝ ņäĀņĀĢĒĢ£ļŗż. ņÜ┤ņÜ®ņé¼ļōżņØś ņÜ┤ņÜ®ņŚŁļ¤ēņØ┤ Ļ│ĄĻ░£ļÉśņ¢┤ņ׳ļŗżĻ│Ā Ļ░ĆņĀĢĒĢĀ ļĢī, ņĀäļŗ┤ņĪ░ņ¦üņØä ĻĄ¼ņä▒ĒĢĀ Ļ▓ĮņÜ░ņÖĆ ņ┤ØĻ┤ä ņÜ┤ņÜ®ĒĢśļŖö Ļ▓ĮņÜ░ņØś ĒÅēĻ░ĆņĀÉņłśļź╝ Ļ░üĻ░ü

s1 ,

s2 ļØ╝Ļ│Ā ĒĢśļ®┤

s1 =

q2-

f(Fm)+

╬ĄĻ│╝

s2 =

q2-

f(O1)+

╬Ą ņØ┤ļŗż. ĻĖ░ĻĖłņØś ņ×Éņé░ĻĘ£ļ¬©Ļ░Ć ņ×æņØäņłśļĪØ

f(Fm)ņØĆ Ēü░ Ļ░ÆņØä Ļ░Ćņ¦Ćļ»ĆļĪ£, ĻĘ£ļ¬©Ļ░Ć ņØ╝ņĀĢņłśņżĆ ņØ┤ĒĢśņØĖ ĻĖ░ĻĖłņŚÉ ļīĆĒĢ┤ņä£ļŖö

s1 <

q0 Ļ░Ć ņä▒ļ”ĮĒĢĀ ņłś ņ׳ļŗż. ņ”ē, ĻĘ£ļ¬©Ļ░Ć ņ×æņØĆ ĻĖ░ĻĖłņØĆ ņĀäļŗ┤ņĪ░ņ¦üņØä ĻĄ¼ņä▒ĒĢśļŖö Ļ▓ĮņÜ░ OCIO ņä£ļ╣äņŖżņØś ĒÆłņ¦łņŚÉ ļ╣äĒĢ┤ ļåÆņØĆ ļ╣äņÜ®ņØä ņ¦ĆĻĖēĒĢ┤ņĢ╝ ĒĢśļ»ĆļĪ£ OCIO ņä£ļ╣äņŖżļź╝ ņé¼ņÜ®ĒĢśņ¦Ć ņĢŖļŖöļŗż. ņØ┤ņŚÉ ļö░ļØ╝ ņĀäļŗ┤ņĪ░ņ¦üņØä ĻĄ¼ņä▒ĒĢśļŖö Ļ▓ĮņÜ░ņŚÉļŖö OCIO ņŗ£ņןņØś ĻĘĀĒśĢņØ┤

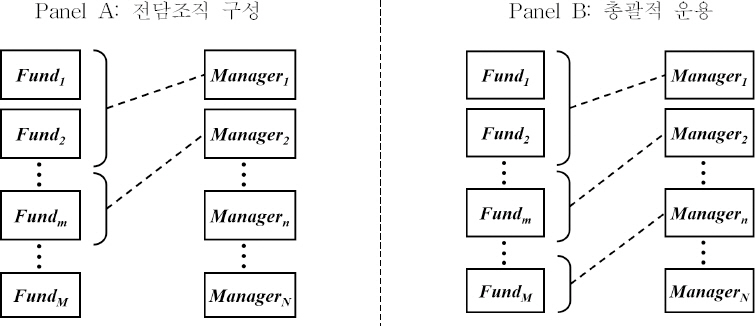

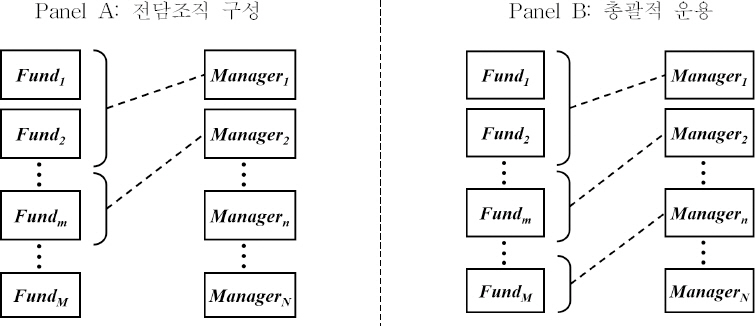

<ĻĘĖļ”╝ 2>ņØś Panel AņÖĆ Ļ░ÖņØĆ ĒśĢĒā£ļĪ£ ņŚ░Ļ▓░ļÉ£ļŗż. ļ░śļ®┤, OCIOĻ░Ć ĻĖ░ĻĖłņØä ņ┤ØĻ┤äņĀüņ£╝ļĪ£ ņÜ┤ņÜ®ĒĢĀ ļĢīļŖö ĒÅēĻ░ĆņĀÉņłś

q0 ļ│┤ļŗż ļé«Ļ▓ī ļéśņśżĻĖ░ ņ¢┤ļĀĄļŗż.

s2 <

q0ņØĆ ņÜ┤ņÜ®ņé¼ņØś ņÜ┤ņÜ®ņŚŁļ¤ēņØ┤ ņ×æĻ▒░ļéś ņä£ļ╣äņŖżņØś ĒÆłņ¦łņØ┤ ļé«ļŗżļŖö Ļ▓āņØä ņØśļ»ĖĒĢśļŖöļŹ░, ņØ┤ Ļ▓ĮņÜ░ ņÜ┤ņÜ®ņé¼ļŖö OCIO ņŗ£ņןņŚÉ ņ¦äņ×ģĒĢĀ ņłś ņŚåļŗż. ļö░ļØ╝ņä£ ņŗ£ņןņŚÉ ņ¦äņ×ģĒĢ£ ņÜ┤ņÜ®ņé¼ņŚÉ ļīĆĒĢ┤ņä£ļŖö ĒĢŁņāü

q0 <

s2ņØś Ļ┤ĆĻ│äĻ░Ć ņä▒ļ”ĮĒĢ£ļŗż. ņØ┤ņŚÉ ļö░ļØ╝ ņ┤ØĻ┤ä ņÜ┤ņÜ®ĒĢśļŖö Ļ▓ĮņÜ░ OCIO ņŗ£ņןņØś ĻĘĀĒśĢņØĆ

<ĻĘĖļ”╝ 2>ņØś Panel BņÖĆ Ļ░Öļŗż. ņÜ┤ņÜ®ņŚŁļ¤ēņØ┤ Ļ│ĄĻ░£ļÉśņ¢┤ņ׳ņ¦Ć ņĢŖņØĆ Ļ▓ĮņÜ░, ņĀäļŗ┤ņĪ░ņ¦üņØä ĻĄ¼ņä▒ĒĢśļŖö Ļ▓ĮņÜ░ņÖĆ ņ┤ØĻ┤ä ņÜ┤ņÜ®ĒĢśļŖö Ļ▓ĮņÜ░ņØś ĒÅēĻ░ĆņĀÉņłśļŖö Ļ░üĻ░ü

s1 =

q1 -

f(Fm),

s2 =

q1 -

f(O1)-

J(q1) ņØ┤ļŗż. ĻĖ░ĻĖłņØś ņ×Éņé░ĻĘ£ļ¬©Ļ░Ć ņČ®ļČäĒ׳ ņ×æņØĆ ĻĖ░ĻĖłņŚÉ ļīĆĒĢ┤

s1 <

q0 <

s2 Ļ░Ć ņä▒ļ”ĮĒĢĀ ņłś ņ׳ņ£╝ļ»ĆļĪ£, ņÜ┤ņÜ®ņŚŁļ¤ēņØ┤ Ļ│ĄĻ░£ļÉ£ Ļ▓ĮņÜ░ņÖĆ ļÅÖņØ╝ĒĢ£ ĻĘĀĒśĢņØ┤ ļÅäņČ£ļÉ£ļŗż.

<ĻĘĖļ”╝┬Ā2>

ņÜ┤ņÜ®ļ░®ņŗØņŚÉ ļö░ļźĖ OCIO ņŗ£ņןņØś ĻĘĀĒśĢ

ņĢäļל ĻĘĖļ”╝ņØĆ ņÜ┤ņÜ®ļ░®ņŗØņŚÉ ļö░ļźĖ OCIO ņŗ£ņןņØś ĻĘĀĒśĢņØä ļÅäņŗØĒÖöĒĢ£ Ļ▓āņØ┤ļŗż. Panel AļŖö ĻĖ░ĻĖłļ│äļĪ£ ņĀäļŗ┤ņĪ░ņ¦üņØä ĻĄ¼ņä▒ĒĢśļŖö Ļ▓ĮņÜ░ļź╝ ļ│┤ņŚ¼ņŻ╝ļ®░, Panel BļŖö OCIOĻ░Ć ņ┤ØĻ┤äņĀüņ£╝ļĪ£ ĻĖ░ĻĖłņØä Ļ┤Ćļ”¼ĒĢśļŖö Ļ▓ĮņÜ░ļź╝ ļ│┤ņŚ¼ņżĆļŗż. Fundm ņØĆ ĻĖ░ĻĖłņØä, Managern ņØĆ ņÜ┤ņÜ®ņé¼ļź╝ ņØśļ»ĖĒĢ£ļŗż. ņĀÉņäĀņØĆ ĻĖ░ĻĖłĻ│╝ ņÜ┤ņÜ®ņé¼Ļ░Ć ņāüĒśĖ OCIO Ļ│äņĢĮņØä ņ▓┤Ļ▓░ĒĢ©ņØä ņØśļ»ĖĒĢ£ļŗż.

OCIO ņä£ļ╣äņŖż ĒÆłņ¦łņØś ņ░©ņØ┤ļĪ£ ņØĖĒĢśņŚ¼ ĻĖ░ĻĖłņØĆ ņÜ┤ņÜ®ļŖźļĀźņØ┤ ļåÆņØĆ ņÜ┤ņÜ®ņé¼ļź╝ ņäĀĒśĖĒĢśĻ▓ī ļÉśĻ│Ā, ņØ┤ņŚÉ ļö░ļØ╝ ņÜ┤ņÜ®ļ░®ņŗØĻ│╝ ļ¼┤Ļ┤ĆĒĢśĻ▓ī ņÜ┤ņÜ®ņŚŁļ¤ēņØ┤ ļåÆņØĆ ņÜ┤ņÜ®ņé¼ļōżņØ┤ ņŗ£ņןņØä ņ¦Ćļ░░ĒĢśĻ▓ī ļÉ£ļŗż. ļ░śļ®┤, ņä£ļ╣äņŖż ĒÆłņ¦łņŚÉ ņ░©ņØ┤Ļ░Ć ļ░£ņāØĒĢśļŹöļØ╝ļÅä, OCIOĻ░Ć ņ┤ØĻ┤äņĀüņ£╝ļĪ£ ĻĖ░ĻĖłņØä ņÜ┤ņÜ®ĒĢśļŖö Ļ▓ĮņÜ░ļŖö ļ╣äņÜ®ņāüņØś ņØ┤ņĀÉņ£╝ļĪ£ ņØĖĒĢ┤ ļ¬©ļōĀ ĻĖ░ĻĖłņØ┤ OCIO ņä£ļ╣äņŖżļź╝ ņé¼ņÜ®ĒĢĀ ņłś ņ׳ņ¦Ćļ¦ī, ĻĖ░ĻĖłļ│ä ņĀäļŗ┤ņĪ░ņ¦üņØä ĻĄ¼ņä▒ĒĢśļŖö Ļ▓ĮņÜ░ņŚÉļŖö ĻĘ£ļ¬©Ļ░Ć ņ×æņØĆ ĻĖ░ĻĖłņØ┤ OCIO ņä£ļ╣äņŖżļź╝ ņé¼ņÜ®ĒĢśņ¦Ć ņĢŖĻ▓ī ļÉĀ ņłś ņ׳ļŗż. ņä£ļ╣äņŖż ĒÆłņ¦łņØś ņ░©ņØ┤ļź╝ Ļ│ĀļĀżĒĢśņŚ¼ ļ¬©ĒśĢņØä ļ│┤ļŗż ĒśäņŗżņĀüņ£╝ļĪ£ ĒÖĢņןĒĢĀ Ļ▓ĮņÜ░, ņĀäļŗ┤ņĪ░ņ¦üņØä ĻĄ¼ņä▒ĒĢśļŖö ļ░®ņŗØņØś OCIO ņ▓┤Ļ│äĻ░Ć ĻĖ░ĻĖłņØś OCIO ņä£ļ╣äņŖż ņé¼ņÜ®ņØä ņĀ£ĒĢ£ĒĢĀ ļ┐Éļ¦ī ņĢäļŗłļØ╝ OCIO Ļ│ĄĻĖēņ×ÉņØś ļÅģĻ│╝ņĀÉ ĒśĢĒā£Ļ░Ć ļéśĒāĆļéĀ ņłś ņ׳ņØīņØä ļ│┤ņŚ¼ņżĆļŗż.