1. Agarwal, V, P Hanouna, R Moussawi, and C. W Stahel, 2018, Do ETFs Increase the Commonality in Liquidity of Underlying Stocks?,

28th Annual Conference on Financial Economics and Accounting, Fifth Annual Conference on Financial Market Regulation,

2. Baek, K. T, B. K Min, and J. W. Baek, 2021, The Effect of Trading Behavior of Each Investor Group on the Return in the Korean Stock Market, Journal of Management and Economics, Vol. 43 (1), pp. 249-278.

3. Baker, M, and J. C Stein, 2004, Market Liquidity as a Sentiment Indicator,

Journal of Financial Markets, Vol. 7 (3), pp. 271-299.

4. Baker, M, and J Wurgler, 2000, The Equity Share in New Issues and Aggregate Stock Returns,

The Journal of Finance, Vol. 55 (5), pp. 2219-2257.

5. Baker, M, and J Wurgler, 2004, Appearing and Disappearing Dividends:The Link to Catering Incentives,

Journal of Financial Economics, Vol. 73 (2), pp. 271-288.

6. Baker, M, and J Wurgler, 2006, Investor Sentiment and the Cross-section of Stock Returns,

The Journal of Finance, Vol. 61 (4), pp. 1645-1680.

7. Baker, M, and J Wurgler, Investor Sentiment in the Stock Market,

Journal of Economic Perspectives, Vol. 21 (2), pp. 129-151.

8. Bandopadhyaya, A, and A. L Jones, 2008, Measures of Investor Sentiment:A Comparative Analysis Put-call Ratio vs. Volatility Index,

Journal of Business &Economics Research (JBER), Vol. 6 (8),

9. Barber, B. M, Y. T Lee, Y. J Liu, and T Odean, 2009, Just How Much do Individual Investors Lose by Trading?,

The Review of Financial Studies, Vol. 22 (2), pp. 609-632.

10. Barber, B. M, and T Odean, 2000, Trading is Hazardous to Your Wealth:The Common Stock Investment Performance of Individual Investors,

The Journal of Finance, Vol. 55 (2), pp. 773-806.

11. Ben-David, I, F Franzoni, and R Moussawi, 2018, Do ETFs Increase Volatility?,

The Journal of Finance, Vol. 73 (6), pp. 2471-2535.

13. Brown, D. C, S. W Davies, and M. C Ringgenberg, 2021, ETF Arbitrage, Non-fundamental Demand, and Return Predictability,

Review of Finance, Vol. 25 (4), pp. 937-972.

14. Brown, S. J, W. N Goetzmann, T Hiraki, N Shiraishi, and M Watanabe, 2003, Investor sentiment in Japanese and US Daily Mutual Fund Flows, NBER Working Paper,

https://www.nber.org/papers/w9470

15. Byun, J. H, and K. S Kim, 2013, Application of Investor Sentiment Index in Financial Studies, The Korean Journal of Financial Management, Vol. 30 (4), pp. 225-248.

16. Byun, J. H, and K. S Kim, 2010, Investor Sentiment and Market Timing of Stock Repurchase, Korean Journal of Business Administration, Vol. 23 (4), pp. 2271-2288.

17. Byun, J. H, M. S Kim, and I. C Choi, 2007, Individual Investors'Excessive Trading and Investment Performance, Korean Management Review, Vol. 36 (7), pp. 1707-1730.

18. Byun, Y. H, 2005, The Common Stock Investment Performance of Individual Investors in Korea, The Korean Journal of Financial Management, Vol. 22 (2), pp. 135-164.

19. Choi, B. H, S Jin, and J. H Hahn, 2022, Exchange-Traded Funds Ownership and Stock Volatility,

Korean Journal of Financial Studies, Vol. 51 (3), pp. 245-280.

20. Chung, C. H, and S. K Kim, 2009, The Linkages between Stock Returns and Market Liquidity as a Measure of Investor Sentiment,

The Korean Journal of Financial Engineering, Vol. 8 (4), pp. 65-90.

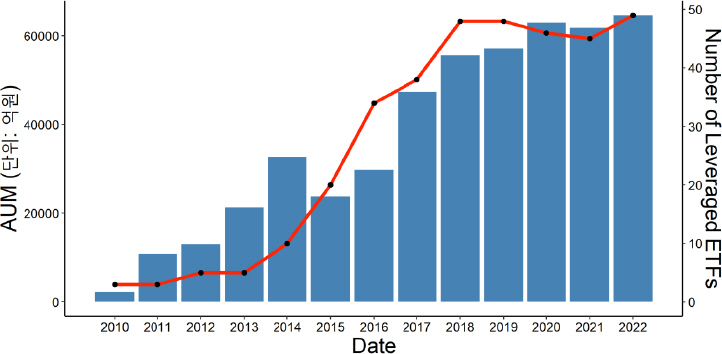

21. Chung, J. M, 2021, Leverage ETF Market Timing Abilities of Individual Investors,

Financial Planning Review, Vol. 14 (4), pp. 1-20.

22. Da, Z, and S Shive, 2018, Exchange Traded Funds and Asset Return Correlations,

European Financial Management, Vol. 24 (1), pp. 136-168.

23. Daniel, K, and D Hirshleifer, 2015, Overconfident Investors, Predictable Returns, and Excessive Trading,

Journal of Economic Perspectives, Vol. 29 (4), pp. 61-88.

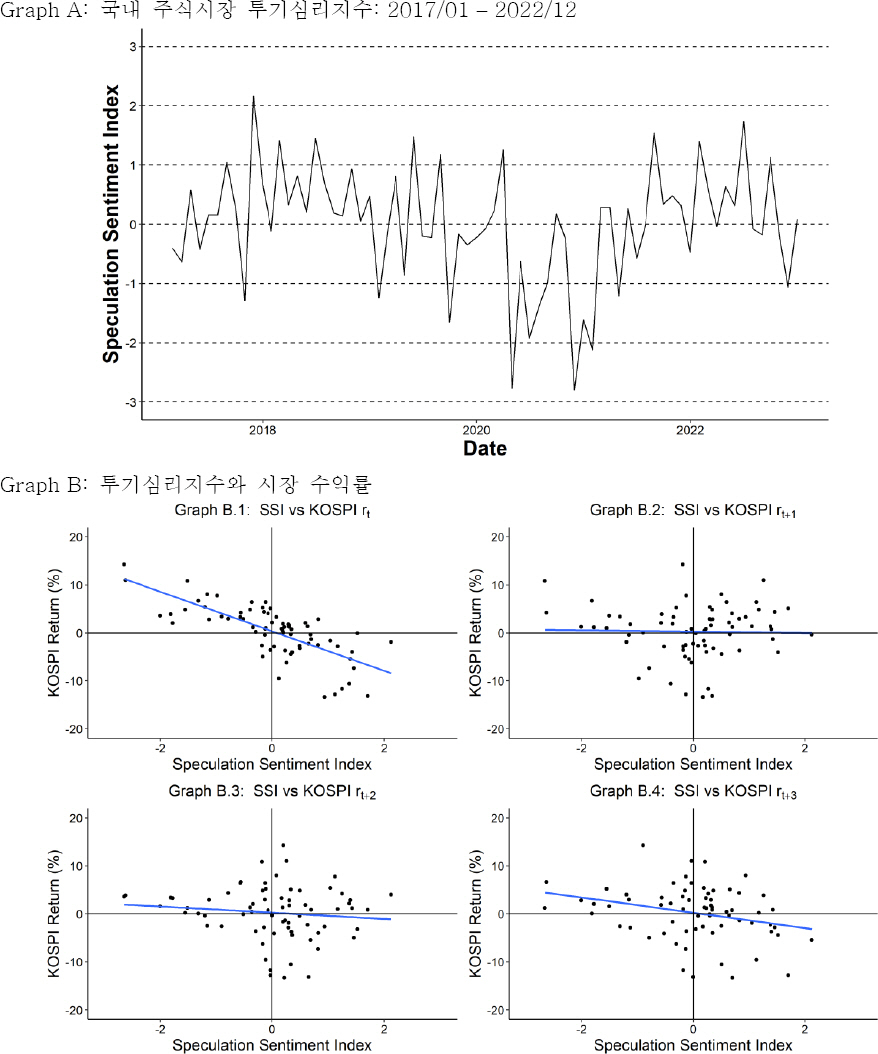

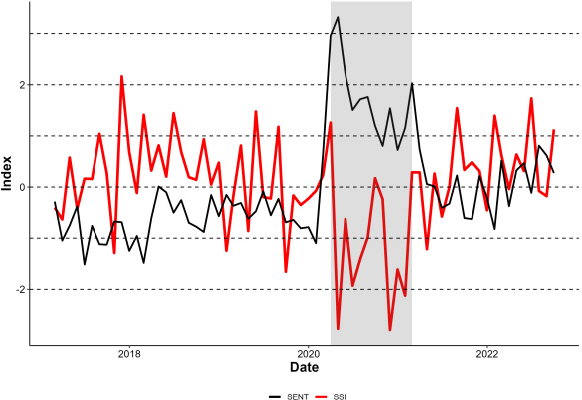

24. Davies, S. W, 2022, Speculation Sentiment,

Journal of Financial and Quantitative Analysis, Vol. 57 (7), pp. 2485-2515.

25. De Long, J. B, A Shleifer, L. H Summers, and R. J Waldmann, 1990, Noise Trader Risk in Financial Markets,

Journal of Political Economy, Vol. 98 (4), pp. 703-738.

26. Evans, R. B, R Moussawi, M. S Pagano, and J Sedunov, 2019, ETF Short Interest and Failures-to-deliver:Naked Short-selling or Operational Shorting? SSRN.

27. Fama, E. F, and R. K French, 1993, Common Risk Factors in the Returns on Stocks and Bonds,

Journal of Financial Economics, Vol. 33 (1), pp. 3-56.

28. Frazzini, A, and L. H Pedersen, 2014, Betting Against Beta,

Journal of Financial Economics, Vol. 111 (1), pp. 1-25.

29. Frazzini, A, and O. A Lamont, 2008, Dumb Money:Mutual Fund Flows and the Cross-section of Stock Returns,

Journal of Financial Economics, Vol. 88 (2), pp. 299-322.

30. Hur, C. S, H. C Kang, and K. S Eom, 2012, Price Efficiency of Exchange-Traded Funds in Korea, Journal of Money and Finance, Vol. 26 (1), pp. 42-76.

31. Israeli, D, C. M Lee, and S. A Sridharan, 2017, Is There a Dark Side to Exchange Traded Funds?An Information Perspective,

Review of Accounting Studies, Vol. 22, pp. 1048-1083.

32. Kang, J. K, K. Y Kwon, and M. H Sim, 2013, Retail Investor Sentiment and Stock Returns, The Korean Journal of Financial Management, Vol. 30 (3), pp. 35-68.

33. Kim, D. H, and T. K Park, 2017, A Study on the Investor Sentiment and the Irrational Investors'Behavior Based on the Commodity ETF Market,

The Korean Association of Financial Engineering, Vol. 16 (2), pp. 87-106.

34. Kim, D. W, 2018, Liquidity Provider and Pricing Error in KOSPI200 ETF,

Korean Journal of Financial Studies, Vol. 47 (4), pp. 579-605.

35. Kim, D. W, 2020, Institutional Constraints on the Rate of Derivatives in Leveraged Exchange-Traded Fund,

Korean Journal of Financial Studies, Vol. 49 (2), pp. 217-248.

36. Kim, K. R, D. J Ryu, and H. J Yang, 2018, Investor Sentiment Indices and the Cross-section of Stock Returns of Individual Firms,

Korean Management Review, Vol. 47 (5), pp. 1231-1260.

38. Ko, K. S, and K. S Kim, 2004, Portfolio Performance and Characteristics of Each Investor Type:Individuals, Institutions, and Foreigners, Korean Journal of Financial Studies, Vol. 33 (4), pp. 35-62.

39. Kim, S. J, and H. S Choi, 2018, The Effect of Portfolio Composition on the Pricing Efficiency of Exchange Traded Funds,

Korean Journal of Financial Studies, Vol. 47 (1), pp. 1-25.

40. Kumar, A, 2009, Who Gambles in the Stock Market?,

The Journal of finance, Vol. 64 (4), pp. 1889-1933.

41. Kumar, A, and C. M Lee, 2006, Retail Investor Sentiment and Return Comovements,

The Journal of Finance, Vol. 61 (5), pp. 2451-2486.

42. Lee, C. M, A Shleifer, and R. H Thaler, 1991, Investor Sentiment and the Closed-end Fund Puzzle,

The Journal of finance, Vol. 46 (1), pp. 75-109.

43. Lee, M. H, 2020, Measuring the Vulnerability of Korean Stock Markets in the event of Global Financial Instability,

Journal of Money and Finance, Vol. 34 (4), pp. 61-98.

44. Lee, M. H, and S. J Yoon, 2017, Investor Sentiment in Derivatives Market and Forecasting Stock Returns,

Journal of Money and Finance, Vol. 31 (2), pp. 1-40.

45. Lemmon, M, and E Portniaguina, 2006, Consumer Confidence and Asset Prices:Some Empirical Evidence,

The Review of Financial Studies, Vol. 19 (4), pp. 1499-1529.

47. Odean, T, 1999, Do Investors Trade Too Much?,

American Economic Review, Vol. 89 (5), pp. 1279-1298.

48. Ohk, K. Y, and J. S Kim, 2012, An Empirical Study between Consumer Sentiment Index and KOSPI's Return:Negativity Effect,

The Korean Journal of Financial Engineering, Vol. 11 (1), pp. 17-37.

49. Scheinkman, J. A, and W Xiong, Overconfidence and Speculative Bubbles,

Journal of Political Economy, Vol. 111 (6), pp. 1183-1220.

50. Shleifer, A, and L. H Summers, 1990, The Noise Trader Approach to Finance,

Journal of Economic Perspectives, Vol. 4 (2), pp. 19-33.

51. Smales, L. A, The Importance of Fear:Investor Sentiment and Stock Market Returns,

Applied Economics, Vol. 49 (34), pp. 3395-3421.

52. Stambaugh, R. F, Predictive Regressions,

Journal of financial economics, Vol. 54 (3), pp. 375-421.

53. Yi, J. S, K. B Binh, and G. I Jang, 2010, The Causal Relationship between Stock Price and Short Sales:Evidence from the Korean Stock Market, Korean Journal of Financial Studies, Vol. 39 (3), pp. 449-489.