|

|

- Search

| Korean J Financ Stud > Volume 52(3); 2023 > Article |

|

Abstract

ņÜöņĢĮ

Notes

1) ŌĆśĻĖ░Ļ┤ĆĒł¼ņ×Éņ×ÉņØś ņØśĻ▓░ĻČīĒ¢ēņé¼ ļ░Å ESG Ļ┤ĆļĀ© Engagement ļÅÖĒ¢źŌĆÖ, ļīĆņŗĀņ¦Ćļ░░ĻĄ¼ņĪ░ņŚ░ĻĄ¼ņåī, 20210707.

2) ŌĆśĻĄŁļ»╝ņŚ░ĻĖł, ņ×æļģä ļīĆĻĖ░ņŚģ ņŻ╝ņ┤Øņä£ ņĢłĻ▒┤ ļ░śļīĆņ£© 10% ļäśņ¢┤ŌĆÖ, ļÅÖņĢäņØ╝ļ│┤ 2022ļģä 2ņøö 24ņØ╝ņ×É.

3) ĻĄŁļé┤ņŚÉņä£ ņŖżĒŖ£ņ¢┤ļō£ņŗŁ ņĮöļō£ļŖö ĻĖ░Ļ┤ĆĒł¼ņ×Éņ×ÉļōżņØ┤ ņłśĒāüņ×ÉļĪ£ņä£ņØś ņ▒ģņ×äņØä ņāüļŗ╣Ē׳ ļ░®ĻĖ░ĒĢśĻ│Ā ņ׳ļŗżļŖö ņ¦ĆņĀüņŚÉ ļö░ļØ╝ ļÅäņ×ģļÉśņŚłļŗż. ņŚ░ĻĖ░ĻĖłļōżņØĆ ņĀĢņ▒ģ ļ¬®ņĀüņŚÉ ņØśĒĢ┤ ņ¦ĆļČä ļ│┤ņ£Ā ĻĖ░ņŚģņŚÉ ļīĆĒĢ£ ņØśĻ▓░ĻČīņØä Ē¢ēņé¼ĒĢśĻ│Ā ņ¦æĒĢ®Ēł¼ņ×ÉņŚģņ×ÉļŖö ļīĆĻĖ░ņŚģ Ļ┤ĆļĀ© ļ¬©ĒÜīņé¼Ļ░Ć ļŗżņłś ņĪ┤ņ×¼ĒĢ©ņŚÉ ļö░ļØ╝ ņØśĻ▓░ĻČī Ē¢ēņé¼ņØś ļÅģļ”Įņä▒ņŚÉ ļ¼ĖņĀ£Ļ░Ć ņĀ£ĻĖ░ļÉ£ ļ░ö ņ׳ļŗż. ņŖżĒŖ£ņ¢┤ļō£ņŗŁ ņĮöļō£ņØś ļ│┤ļŗż ņāüņäĖĒĢ£ ļÅäņ×ģ ļ░░Ļ▓ĮņŚÉ ļīĆĒĢ┤ņä£ļŖö Yi(2019)ļź╝ ņ░ĖņĪ░ĒĢśļØ╝.

5) ņāüļ▓Ģ ņĀ£363ņĪ░ņØś2 ņĀ£1ĒĢŁ, ņĀ£542ņĪ░ņØś6 ņĀ£2ĒĢŁ, ņāüļ▓Ģ ņŗ£Ē¢ēļĀ╣ ņĀ£32ņĪ░ņŚÉ ļö░ļź┤ļ®┤ ļ╣äņāüņןĒÜīņé¼ņŚÉņä£ļŖö ņØśĻ▓░ĻČī ņ׳ļŖö ļ░£Ē¢ēņŻ╝ņŗØ ņ┤ØņłśņØś 3% ņØ┤ņāüņØä ņåīņ£ĀĒĢ£ ņŻ╝ņŻ╝, ņāüņןĒÜīņé¼ņŚÉņä£ļŖö ņØśĻ▓░ĻČī ņ׳ļŖö ļ░£Ē¢ēņŻ╝ņŗØ ņ┤ØņłśņØś 1% ņØ┤ņāüņØä 6Ļ░£ņøö ņØ┤ņāü ļ│┤ņ£ĀĒĢ£ ņŻ╝ņŻ╝, ņ×Éļ│ĖĻĖł 1ņ▓£ņ¢Ą ņøÉ ņØ┤ņāüņØś ņāüņןĒÜīņé¼ņŚÉņä£ļŖö ņØśĻ▓░ĻČī ņ׳ļŖö ļ░£Ē¢ēņŻ╝ņŗØ ņ┤ØņåīņØś 0.5% ņØ┤ņāüņØä 6Ļ░£ņøö ņØ┤ņāü ļ│┤ņ£ĀĒĢ£ ņŻ╝ņŻ╝Ļ░Ć ņŻ╝ņŻ╝ņĀ£ņĢłņØä ĒĢĀ ņłś ņ׳ļŗż.

6) ņ×Éļ│Ėņŗ£ņןļ▓Ģ ņŗ£Ē¢ēļĀ╣ ņĀ£154ņĪ░ 1ĒĢŁņŚÉ ļö░ļź┤ļ®┤ Ļ▓ĮņśüĻČīņŚÉ ņśüĒ¢źņØä ņŻ╝ĻĖ░ ņ£äĒĢ£ Ē¢ēņ£äņØś ņ£ĀĒśĢņØä 10Ļ░Ćņ¦ĆļĪ£ ņĀ£ņŗ£ĒĢśĻ│Ā ņ׳ļŗż.

7) ŌĆś2019ļģä ņĀĢĻĖ░ņŻ╝ņŻ╝ņ┤ØĒÜī ņŻ╝ņŻ╝ņĀ£ņĢł ļČäņäØŌĆÖ ļīĆņŗĀņ¦Ćļ░░ĻĄ¼ņĪ░ņŚ░ĻĄ¼ņåī, 20190611, 2017ļģäĻ│╝ 2018ļģäņØś ņŻ╝ņŻ╝ņĀ£ņĢł ņŖ╣ņØĖļ╣äņ£©ņØĆ Ļ░üĻ░ü 10%ņÖĆ 12.5%.

8) ņĄ£Ļ│ĀĻ▓Įņśüņ×ÉļōżņØ┤ ņØ┤ņé¼ĒÜīļź╝ ņ×ÉņŗĀļōżĻ│╝ ņ╣£ĒĢ£ ņé¼ņÖĖņØ┤ņé¼ļōżļĪ£ ĻĄ¼ņä▒ĒĢ┤ ņŚ░ņ×äņŚÉ ņ£Āļ”¼ĒĢ£ ĻĄ¼ļÅäļź╝ ĻĄ¼ņČĢĒĢ£ļŗżļŖö ņØ┤ļĪĀņØ┤ļŗż.

9) ņŻ╝ņŻ╝ņĀ£ņĢłņØĆ ņĀ£ĻĖ░ļÉ£ ņØ┤Ēøä ĻĖ░ņŚģ ņĖĪĻ│╝ņØś ĒśæņØśļź╝ ĒåĄĒĢ┤ ņé¼ņĀäņ▓ĀĒÜīļÉśĻ▒░ļéś ĻĖ░ņŚģņØ┤ ņŻ╝ņŻ╝ņ┤ØĒÜī ņāüņĀĢņØä Ļ▒░ļČĆĒĢśļŖö Ļ▓ĮņÜ░ļÅä ņ׳ļŗż. ļśÉĒĢ£ ņŻ╝ņŻ╝ņ┤ØĒÜī ņåīņ¦æĻ▓░ņØśļéś Ļ│ĄĻ│Āļź╝ ĒåĄĒĢ┤ ņŻ╝ņŻ╝ņĀ£ņĢł ņŚ¼ļČĆļŖö ĒÖĢņØĖņØ┤ ļÉśņ¦Ćļ¦ī Ļ░ĆĻ▓░ņØ┤ļéś ļČĆĻ▓░ ņŚ¼ļČĆĻ░Ć ĒīīņĢģļÉśņ¦Ć ņĢŖļŖö ļ»ĖĻ│Ąņŗ£ Ļ▓ĮņÜ░ļÅä ņ׳ļŗż. ņØ┤ņŚÉ ļö░ļØ╝ ņ¦æĻ│ä ĻĖ░Ļ┤Ćļ│äļĪ£ ņŻ╝ņŻ╝ņĀ£ņĢłņØä ņĀĢņØśĒĢśļŖö ļ▓öņ£äĻ░Ć ņāüņØ┤ĒĢśņŚ¼ ņ¦æĻ│ä ĻĖ░Ļ┤ĆņŚÉ ļö░ļØ╝ ņŻ╝ņŻ╝ņĀ£ņĢł Ļ▒┤ņłśļŖö ņ░©ņØ┤Ļ░Ć ļ░£ņāØĒĢ£ļŗż.

10) VIP ņ×ÉļŻīļŖö ĻĖ░ļ│ĖņĀüņ£╝ļĪ£ ņŻ╝ņŻ╝ņ┤ØĒÜīņŚÉ ņāüņĀĢļÉ£ ņŻ╝ņŻ╝ņĀ£ņĢłņØä ļīĆņāüņ£╝ļĪ£ ĒĢ£ļŗż. ņ”ē ņŻ╝ņŻ╝ņĀ£ņĢł ņĀ£ĻĖ░ Ēøä ņé¼ņĀäņ▓ĀĒÜīļÉśĻ▒░ļéś ĻĖ░ņŚģņØ┤ ņŻ╝ņ┤Ø ņāüņĀĢņØä Ļ▒░ļČĆĒĢ£ ņĢłĻ▒┤ņØĆ ņĀ£ņÖĖļÉ£ļŗż. ļ░śļ®┤ ņŻ╝ņ┤ØņŚÉņä£ ņ░¼ņä▒ņØ┤ļéś ļ░śļīĆ, ņżæļ”Į ņØśĻ▓░ĻČīņØä Ē¢ēņé¼ĒĢśĻ▒░ļéś ņØśĻ▓░ĻČīņØä Ē¢ēņé¼ĒĢśņ¦Ć ņĢŖņØĆ ņĢłĻ▒┤, ĻĘĖļ”¼Ļ│Ā Ļ░ĆĻ▓░ņŚ¼ļČĆļź╝ Ļ│Ąņŗ£ĒĢśņ¦Ć ņĢŖņØĆ ļ»ĖĻ│Ąņŗ£ ļō▒ņØĆ ĒżĒĢ©ļÉ£ļŗż. ļŗżļ¦ī ņØ╝ļČĆ ņĢłĻ▒┤ņØś Ļ▓ĮņÜ░ ņ░¼ņä▒, ļ░śļīĆ, ņżæļ”Į, ļČłĒ¢ēņé¼, ļ»ĖĻ│Ąņŗ£ ņżæ ņ¢┤ļŖÉ ĒĢśļéśņŚÉļÅä ĒĢ┤ļŗ╣ĒĢśņ¦Ć ņĢŖņØĆ ņĢłĻ▒┤ņØ┤ ņĪ┤ņ×¼ĒĢ£ļŗż.

11) ļÅÖņØ╝ĻĖ░ņŚģņŚÉ ļīĆĒĢ┤ ņŚ¼ļ¤¼ ņ░©ļĪĆ ņŻ╝ņŻ╝ņĀ£ņĢłņØ┤ ņØ┤ļŻ©ņ¢┤ņ¦ä Ļ▓ĮņÜ░ļź╝ Ļ░£ļ│äņĀüņ£╝ļĪ£ Ļ│äņé░ĒĢśļ®┤ ĻĖ░ņŚģ ņłśļŖö 133Ļ░£Ļ░Ć ļÉ£ļŗż.

13) ņ¦Ćļ░░ĻĄ¼ņĪ░ ļō▒ĻĖē A+, A, B+, B, C, DņŚÉ ļīĆĒĢ┤ Ļ░üĻ░ü 6ņĀÉļČĆĒä░ 1ņĀÉĻ╣īņ¦Ć ņĀÉņłśļź╝ ļČĆņŚ¼ĒĢ£ ņłśņ╣śņØ┤ļŗż

14) ņāüļ▓Ģ ņĀ£363ņĪ░ņØś2 ņĀ£1ĒĢŁņŚÉņä£ļŖö ņŻ╝ņŻ╝ņĀ£ņĢłņØä ņŻ╝ņŻ╝ņ┤ØĒÜīņØ╝ņØś 6ņŻ╝ ņĀäņŚÉ ņŻ╝ņ┤Ø ļ¬®ņĀüņé¼ĒĢŁņ£╝ļĪ£ ņĀ£ņĢłĒĢśĻ▓ī ļÉśņ¢┤ņ׳Ļ│Ā ņĀ£2ĒĢŁņŚÉņä£ļŖö ņŻ╝ņ┤Ø ņåīņ¦æ ĒåĄņ¦Ć ņŗ£ ņŻ╝ņŻ╝ņĀ£ņĢłņØś ĒåĄņ¦Ć ĻĖ░ņ×¼ļź╝ ņ▓ŁĻĄ¼ĒĢĀ ņłś ņ׳Ļ▓ī ļÉśņ¢┤ ņ׳ļŗż. ļö░ļØ╝ņä£ Ēł¼ņ×Éņ×ÉļōżņØ┤ ņŻ╝ņŻ╝ņĀ£ņĢł ņŚ¼ļČĆļź╝ ņØĖņ¦ĆĒĢĀ ņłś ņ׳ļŖö ņŗ£ĻĖ░ļŖö ņŻ╝ņ┤Ø 2ņŻ╝ņĀäņØś ņåīņ¦æĒåĄņ¦Ć ņŗ£ņĀÉņØ┤ļŗż.

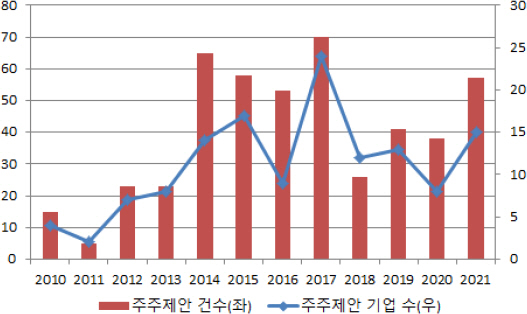

15) ņ¦æĒĢ®Ēł¼ņ×ÉņŚģņ×ÉņØś ņØśĻ▓░ĻČī Ļ│Ąņŗ£ ĻĘ£ņĀĢņØĆ ņ¦ĆņåŹņĀüņ£╝ļĪ£ ļ│ĆĻ▓ĮļÉśņ¢┤ ņÖöļŗż. 2013ļģä 2ņøö ņØ┤ņĀäņŚÉļŖö ņŻ╝ņŻ╝ņ┤ØĒÜī 5ņØ╝ ņĀäņŚÉ ņØśĻ▓░ĻČī Ē¢ēņé¼ņŚ¼ļČĆ ļ░Å ĻĘĖ ļé┤ņÜ®ņØä Ļ│Ąņŗ£ĒĢśĻ▓ī ļÉśņ¢┤ ņ׳ņŚłņ£╝ļéś ņØ┤ĒøäņŚÉļŖö ĻĘ£ņĀĢņØ┤ Ļ░£ņĀĢļÉśļ®┤ņä£ ņŻ╝ņ┤Ø Ļ░£ņĄ£ Ēøä 5ņØ╝ ņØ┤ļé┤ Ļ│Ąņŗ£ļĪ£ ļ│ĆĻ▓ĮļÉśņŚłļŗż. ĒĢśņ¦Ćļ¦ī 2015ļģä 10ņøö ņ×Éļ│Ėņŗ£ņןļ▓ĢņØ┤ Ļ░£ņĀĢļÉśļ®┤ņä£ ņ¦æĒĢ®Ēł¼ņ×ÉņŚģņ×ÉņØśņØśĻ▓░ĻČī Ē¢ēņé¼ ļé┤ņŚŁ Ļ│Ąņŗ£Ļ░Ć ņŚ░ 1ĒÜīļĪ£ ļŗżņŗ£ ļ│ĆĻ▓ĮļÉśņŚłļŗż.

16) ņ×äņøÉĒĢ┤ņ×ä ņĢłĻ▒┤ņØś Ļ▓ĮņÜ░ ļÅäļĀłņØ┤ņ╝Ćļ»Ėņ╣╝(2015, 1Ļ▒┤), ņŗĀņØ╝ņé░ņŚģ(2014, 4Ļ▒┤) 2Ļ░£ņé¼ņŚÉ Ļ┤ĆĒĢ£ Ļ▒┤ņ£╝ļĪ£ ņŗĀņØ╝ņé░ņŚģņØś ņ×äņøÉĒĢ┤ņ×ä 4Ļ░£ ņĢłĻ▒┤ņŚÉ ļīĆĒĢ┤ ņØśĻ▓░ĻČī Ē¢ēņé¼ļź╝ ĒĢśņ¦Ć ņĢŖņĢśļŗż.

17) ņŻ╝ņäØ(9)ņŚÉņä£ļÅä ņ¦ĆņĀüĒ¢łļŗżņŗ£Ēö╝ ņ×äņøÉĒĢ┤ņ×äņŚÉ ĒĢ┤ļŗ╣ĒĢśļŖö ĻĖ░ņŚģņØĆ ļÅäļĀłņØ┤ņ╝Ćļ»Ėņ╣╝Ļ│╝ ņŗĀņØ╝ņé░ņŚģļ┐Éņ£╝ļĪ£ ļČäņäØ Ļ▓░Ļ│╝ņŚÉ ļīĆĒĢ£ ĒÖĢļīĆĒĢ┤ņäØņØĆ ņ£ĀņØśĒĢ┤ņĢ╝ ĒĢ£ļŗż.

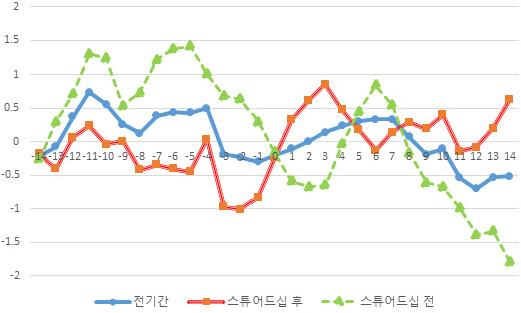

19) Ļ░üņŻ╝ 13)ņŚÉņä£ ņäżļ¬ģĒĢ£ ļ░öņÖĆ Ļ░ÖņØ┤ ņŻ╝ņŻ╝ņĀ£ņĢł ņĀĢļ│┤ Ļ│Ąņŗ£ļŖö ņŻ╝ņ┤Ø 2ņŻ╝ ņØ┤ņĀä ņØ┤ņ¦Ćļ¦ī ņŻ╝ņŻ╝ņĀ£ņĢłņØä ņŻ╝ņ┤ØņØś ļ¬®ņĀüņé¼ĒĢŁņ£╝ļĪ£ ņÜöņ▓ŁĒĢśļŖö Ļ▓āņØĆ ņŻ╝ņ┤Øņåīņ¦æ 6ņŻ╝ ņØ┤ņĀä ņØ┤ļ»ĆļĪ£ ņØśĻ▓░ĻČī Ē¢ēņé¼ ņĀäĒøä 30ņØ╝(-30,30)ņØś ļłäņĀüņ┤łĻ│╝ņłśņØĄļźĀļÅä ņé░ņČ£ĒĢśņśĆļŗż. Ļ▓░Ļ│╝ļŖö ņØśĻ▓░ĻČī Ē¢ēņé¼ ņĀäĒøä 14ņØ╝(-14,14)Ļ│╝ ņ£Āņé¼ĒĢśņśĆļŗż. ļśÉĒĢ£ ĻĄŁļ»╝ņŚ░ĻĖłņØś Ļ▓ĮņÜ░ ĻĄŁļé┤ ņŗ£ņןņŚÉņä£ Ļ░Ćņן Ēü░ ĻĖ░Ļ┤ĆĒł¼ņ×Éņ×ÉļĪ£ ņŗ£ņןņŚÉ ļ»Ėņ╣śļŖö ņśüĒ¢źņØ┤ ņ¦ĆļīĆĒĢśļŗż. ļö░ļØ╝ņä£ ĻĄŁļ»╝ņŚ░ĻĖłņØ┤ ņØśĻ▓░ĻČīņØä Ē¢ēņé¼ĒĢ£ 63Ļ░£ ĻĖ░ņŚģņØä ļīĆņāüņ£╝ļĪ£ ļČäņäØņØä ņŗżņŗ£Ē¢łņ£╝ļéś ļČäņäØĻ▓░Ļ│╝ļŖö ņĀäņ▓┤ Ēæ£ļ│ĖņØä ļīĆņāüņ£╝ļĪ£ ĒĢ£ <Ēæ£ 9>ņÖĆ ņ£Āņé¼ĒĢśļŗż.

20) ņ×äņøÉĒĢ┤ņ×äņØś Ļ▓ĮņÜ░ ņŖżĒŖ£ņ¢┤ļō£ņŗŁ ņĮöļō£ ļÅäņ×ģ ņØ┤ņĀäņŚÉļ¦ī ņĢłĻ▒┤ņØ┤ ņĪ┤ņ×¼ĒĢśņŚ¼ ļÅäņ×ģ ņØ┤ņĀäĻ│╝ ņĀäņ▓┤ĻĖ░Ļ░äņØś ĒåĄĻ│ä Ļ░ÆņØ┤ ļÅÖņØ╝ĒĢśļŗż.

21) ņŚ░ĻĄ¼ļ¬©ĒśĢņØś ļé┤ņāØņä▒ Ļ░ĆļŖźņä▒ņØ┤ ņĪ┤ņ×¼ĒĢ£ļŗż. ļČĆņ▒äļ╣äņ£©, ņןļČĆĻ░Ć ļīĆļ╣ä ņŗ£Ļ░Ćļ╣äņ£©, ņ×Éļ│ĖņØ┤ņØĄļźĀ, ļ¦żņČ£ņĢĪņ”ØĻ░Ćņ£© ļō▒ņØä ĒåĄņĀ£ļ│ĆņłśļĪ£ Ļ│ĀļĀżĒ¢łĻ│Ā ĒĢśņÜ░ņŖżļ¦īĒģīņŖżĒŖĖļź╝ ĒåĄĒĢ┤ ļé┤ņāØņä▒ņØä Ļ▓Ćņ”ØĒ¢łņØīņŚÉļÅä ļŗżļźĖ ņé¼Ļ▒┤ ņŚ░ĻĄ¼ņÖĆ ļ¦łņ░¼Ļ░Ćņ¦ĆļĪ£ ļ│Ė ņŚ░ĻĄ¼Ļ▓░Ļ│╝Ļ░Ć ņŻ╝ņŻ╝ņĀ£ņĢł ņ░¼ņä▒ņ£©ņØ┤ ļłäņĀüņ┤łĻ│╝ņłśņØĄļźĀņŚÉ ņ¦üņĀæ ņśüĒ¢źņØä ļ»Ėņ╣£ ņĀĢļÅäļź╝ ĒīīņĢģĒ¢łļŗżĻ│Ā ļ│┤ĻĖ░ļŖö ņ¢┤ļĀĄļŗż. ņŻ╝ņŻ╝ņĀ£ņĢł Ē¢ēņé¼ņØ╝ņØ┤ ņŻ╝ņŻ╝ņ┤ØĒÜīņØ╝ņØ┤ļ»ĆļĪ£ ņŻ╝ņ┤ØĻ│╝ Ļ┤ĆļĀ©ļÉ£ ļŗżņ¢æĒĢ£ ņØ┤ļ▓żĒŖĖ ņżæ ņł£ņłśĒĢ£ ņŻ╝ņŻ╝ņĀ£ņĢłņØś ĒÜ©Ļ│╝ļ¦īņØä ļ░£ņĘīĒĢśĻĖ░ļŖö ņ¢┤ļĀĄļŗż. ņØ┤ ļ¼ĖņĀ£ļŖö ļ│Ė ļģ╝ļ¼ĖņØś ĒĢ£Ļ│äņĀÉņ£╝ļĪ£ ņČöĒøä ņŚ░ĻĄ¼Ļ│╝ņĀ£ļĪ£ ļé©Ļ▓©ļæöļŗż.

References

- TOOLS

-

METRICS

-

- 1 Crossref

- 734 View

- 92 Download

- Related articles in Korean J Financ Stud